Telangana & Andhra Pradesh BIEAP TS AP Intermediate Inter 2nd Year Maths 2B Textbook Solutions Study Material Guide PDF Free Download, Inter 2nd Year Maths 2B Blue Print Weightage 2022-2023, Maths 2B Chapter Wise with Solutions Pdf in English Medium and Telugu Medium are part of AP Inter 2nd Year Study Material Pdf.

Students can also go through Inter 2nd Year Maths 2B Formulas PDF to understand and remember the concepts easily. Students can also read Inter 2nd Year Maths 2B Syllabus & Inter 2nd Year Maths 2B Important Questions Chapter Wise with Solutions Pdf 2022-2023 for exam preparation.

Inter 2nd Year Maths 2B Textbook Solutions PDF | Intermediate 2nd Year Maths 2B Study Material

Inter 2nd Year Maths 2B Solutions in English Medium

Inter 2nd Year Maths 2B Circle Solutions

- Chapter 1 Circle Ex 1(a)

- Chapter 1 Circle Ex 1(b)

- Chapter 1 Circle Ex 1(c)

- Chapter 1 Circle Ex 1(d)

- Chapter 1 Circle Ex 1(e)

Inter 2nd Year Maths 2B System of Circles Solutions

Inter 2nd Year Maths 2B Parabola Solutions

Inter 2nd Year Maths 2B Ellipse Solutions

Inter 2nd Year Maths 2B Hyperbola Solutions

Inter 2nd Year Maths 2B Integration Solutions

- Chapter 6 Integration Ex 6(a)

- Chapter 6 Integration Ex 6(b)

- Chapter 6 Integration Ex 6(c)

- Chapter 6 Integration Ex 6(d)

- Chapter 6 Integration Ex 6(e)

- Chapter 6 Integration Ex 6(f)

Inter 2nd Year Maths 2B Definite Integrals Solutions

- Chapter 7 Definite Integrals Ex 7(a)

- Chapter 7 Definite Integrals Ex 7(b)

- Chapter 7 Definite Integrals Ex 7(c)

- Chapter 7 Definite Integrals Ex 7(d)

Inter 2nd Year Maths 2B Differential Equations Solutions

- Chapter 8 Differential Equations Ex 8(a)

- Chapter 8 Differential Equations Ex 8(b)

- Chapter 8 Differential Equations Ex 8(c)

- Chapter 8 Differential Equations Ex 8(d)

- Chapter 8 Differential Equations Ex 8(e)

Inter 2nd Year Maths 2B Circle Solutions

- Chapter 1 Circle Ex 1(a)

- Chapter 1 Circle Ex 1(b)

- Chapter 1 Circle Ex 1(c)

- Chapter 1 Circle Ex 1(d)

- Chapter 1 Circle Ex 1(e)

Inter 2nd Year Maths 2B System of Circles Solutions

Inter 2nd Year Maths 2B Parabola Solutions

Inter 2nd Year Maths 2B Ellipse Solutions

Inter 2nd Year Maths 2B Hyperbola Solutions

Inter 2nd Year Maths 2B Integration Solutions

- Chapter 6 Integration Ex 6(a)

- Chapter 6 Integration Ex 6(b)

- Chapter 6 Integration Ex 6(c)

- Chapter 6 Integration Ex 6(d)

- Chapter 6 Integration Ex 6(e)

- Chapter 6 Integration Ex 6(f)

Inter 2nd Year Maths 2B Definite Integrals Solutions

- Chapter 7 Definite Integrals Ex 7(a)

- Chapter 7 Definite Integrals Ex 7(b)

- Chapter 7 Definite Integrals Ex 7(c)

- Chapter 7 Definite Integrals Ex 7(d)

Inter 2nd Year Maths 2B Differential Equations Solutions

- Chapter 8 Differential Equations Ex 8(a)

- Chapter 8 Differential Equations Ex 8(b)

- Chapter 8 Differential Equations Ex 8(c)

- Chapter 8 Differential Equations Ex 8(d)

- Chapter 8 Differential Equations Ex 8(e)

Inter 2nd Year Maths 2B Solutions in Telugu Medium

Inter 2nd Year Maths 2B వృత్తం Solutions

- Chapter 1 వృత్తం Ex 1(a)

- Chapter 1 వృత్తం Ex 1(b)

- Chapter 1 వృత్తం Ex 1(c)

- Chapter 1 వృత్తం Ex 1(d)

- Chapter 1 వృత్తం Ex 1(e)

Inter 2nd Year Maths 2B వృత్త సరణులు Solutions

Inter 2nd Year Maths 2B పరావలయం Solutions

Inter 2nd Year Maths 2B దీర్ఘవృత్తం Solutions

Inter 2nd Year Maths 2B అతిపరావలయం Solutions

Inter 2nd Year Maths 2B సమాకలనం Solutions

- Chapter 6 సమాకలనం Ex 6(a)

- Chapter 6 సమాకలనం Ex 6(b)

- Chapter 6 సమాకలనం Ex 6(c)

- Chapter 6 సమాకలనం Ex 6(d)

- Chapter 6 సమాకలనం Ex 6(e)

- Chapter 6 సమాకలనం Ex 6(f)

Inter 2nd Year Maths 2B నిశ్చిత సమాకలనులు Solutions

- Chapter 7 నిశ్చిత సమాకలనులు Ex 7(a)

- Chapter 7 నిశ్చిత సమాకలనులు Ex 7(b)

- Chapter 7 నిశ్చిత సమాకలనులు Ex 7(c)

- Chapter 7 నిశ్చిత సమాకలనులు Ex 7(d)

Inter 2nd Year Maths 2B అవకలన సమీకరణాలు Solutions

- Chapter 8 అవకలన సమీకరణాలు Ex 8(a)

- Chapter 8 అవకలన సమీకరణాలు Ex 8(b)

- Chapter 8 అవకలన సమీకరణాలు Ex 8(c)

- Chapter 8 అవకలన సమీకరణాలు Ex 8(d)

- Chapter 8 అవకలన సమీకరణాలు Ex 8(e)

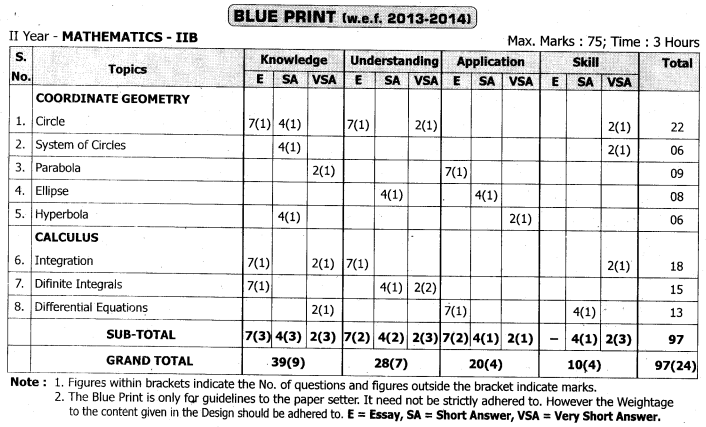

Inter 2nd Year Maths 2B Blue Print Weightage 2022-2023 | Blueprint of Intermediate 2nd Year Maths 2B

AP Inter 2nd Year Maths 2B Blue Print | Inter 2nd Year Maths 2B Weightage 2022-2023

Inter 2nd Year Maths 2B Syllabus | Intermediate Second Year Maths 2B Syllabus

Inter 2nd Year Maths 2B Syllabus Coordinate Geometry

1. Circle

- 1.1 Equation of circle – standard form-center and radius of a circle with a given line segment as diameter & equation of a circle through three noncollinear points – parametric equations of a circle.

- 1.2 Position of a point in the plane of a circle – the power of a point-definition of tangent-length of tangent

- 1.3 Position of a straight line in the plane of a circle-conditions for a line to be tangent – chord joining two points on a circle – equation of the tangent at a point on the circle – point of contact-equation of normal.

- 1.4 Chord of contact – pole and polar-conjugate points and conjugate lines equation of chord with given middle point.

- 1.5 The relative position of two circles-circles touching each other externally, internally common tangents – centers of similitude- equation of pair of tangents from an external point.

2. System of circles

- 2.1 The angle between two intersecting circles.

- 2.2 Radical axis of two circles – properties – Common chord and common tangent of two circles – radical centre. The intersection of a line and a Circle.

3. Parabola

- 3.1 Conic sections – Parabola – equation of parabola in standard form-different forms of parabola – parametric equations.

- 3.2 Equations of tangent and normal at a point on the parabola (Cartesian and parametric) – conditions for a straight line to be a tangent.

4. Ellipse

- 4.1 Equation of ellipse in standard form- Parametric equations.

- 4.2 Equation of tangent and normal at a point on the ellipse (Cartesian and parametric) – condition for a straight line to be a tangent.

5. Hyperbola

- 5.1 Equation of hyperbola in standard form – Parametric equations.

- 5.2 Equations of tangent and normal at a point on the hyperbola (Cartesian and parametric) – conditions for a straight line to be a tangent – Asymptotes.

Intermediate 2nd Year Maths 2B Syllabus Calculus

6. Integration

- 6.1 Integration as the inverse process of differentiation- Standard forms – properties of integrals.

- 6.2 Method of substitution-integration of Algebraic, exponential, logarithmic, trigonometric, and inverse trigonometric functions. Integration by parts.

- 6.3 Integration – Partial fractions method.

- 6.4 Reduction formulae.

7. Definite Integrals

- 7.1 Definite Integral as the limit of a sum

- 7.2 Interpretation of Definite Integral as an area.

- 7.3 Fundamental theorem of Integral Calculus.

- 7.4 Properties

- 7.5 Reduction formulae

- 7.6 Application of Definite integral to areas

8. Differential Equations

- 8.1 Formation of differential equation-Degree and order of an ordinary differential equation.

- 8.2 Solving differential equations by

- Variables separable method

- Homogeneous differential equation

- Non-Homogeneous differential equation

- Linear differential equations

Maths taught in Cass 12 is a bit analytical and practicing Maths daily will become one of the most interesting and favourite subjects for the students. These Maths 2B Chapter Wise with Solutions Pdf is a fruitful resource for the students as there is a sudden advancement in the level of difficulty in the subject.

The Board of Intermediate Education swung into action with the task of evolving a revised syllabus on par with the main intention being enabling the students from our state to prepare for the national level common entrance tests, like NEET, ISEET, etc. This Intermediate 2nd Year Maths 2B Study Material will prove to be a useful study tool during exam preparation. keeping this task in view a committee of subject experts along with authorities in the department of BIE, strongly decided to adopt the NCERT textbooks from the academic year 2012-2013 on words.

This Intermediate 2nd Year Maths 2B Textbook Solutions PDF Download is brought up in accordance with the New Telugu Academy Inter 2nd Year Maths 2B Textbook PDF Download. The subject is presented in a lucid way. So that each and every student understands the subject easily. All Problems have been solved for the benefit of students. These Inter 2nd Year Maths 2B Textbook Solutions PDF is given will help the students to get an idea of the different types of questions that can be framed in an examination.

A lot of care and attention has gone into the Inter Maths 2B Study Material problems and clear illustrations have been provided where necessary. The alternative method is also discussed for some problems, to understand the students and solve them easily. With the help of this Intermediate Maths 2B Study Material, the student gets the style of answering and scope of the answer which helps him in getting the highest marks in the Public Examinations.

Intermediate 2nd Year Maths 2B Textbook Solutions

- All textual problems are solved.

- Diagrams are drawn wherever necessary.

- To solve Questions, a formula relating to that problem is also given to understand the students easily.

- The newly introduced problems are solved in a better way.

We hope that this Intermediate 2nd Year Maths 2B Textbook Solutions PDF Download helps the student to come out successful with flying colors in this examination. We wish that this Inter 2nd Year Maths 2B Textbook Solutions PDF will win the hearts of the students and teaching faculty. These Inter 2nd Year Maths 2B Study material will help students to gain the right knowledge to tackle any type of questions that can be asked during the exams.