Andhra Pradesh BIEAP AP Inter 2nd Year Accountancy Study Material 5th Lesson Partnership Accounts Textbook Questions and Answers.

AP Inter 2nd Year Accountancy Study Material 5th Lesson Partnership Accounts

Very Short Answer Questions

Question 1.

Define Partnership.

Answer:

Section 4 of the Indian Partnership Act, of 1932 defines partnership as “The relation between persons who have agreed to share the profits of a business carried on by all or any one of them acting for all”.

Question 2.

What are the features of a Partnership firm?

Answer:

The essential features of a partnership are

- There must be atleast two persons to form a partnership.

- The partnership is the result of an agreement.

- The agreement should be to carry on some business.

- The partnership may be carried on by all partners or any one of them acting for all.

- The partner should share the profits and losses of the business.

- The liability of partners is joint, several, and unlimited.

Question 3.

What is meant by a partnership deed?

Answer:

The document which contains the terms and conditions of the agreement is called the partnership deed.

![]()

Question 4.

Why it is important to have a partnership deed in writing?

Answer:

The partnership comes into existence as a result of an agreement. The agreement or partnership deed may be oral or written. A written agreement is safe to settle disputes between the partners that may arise in the future.

Question 5.

In the absence of a partnership deed, what are the rules applicable to a partnership firm?

Answer:

When there is no agreement among the partners, the following rules will be applicable as per section 13 of the partnership Act.

- Profits and Losses are shared equally by the partners.

- Interest on capital will not be allowed.

- No interest will be charged on the drawings of partners.

- No salary or commission will be allowed to any partner.

- If any partner has given a loan to the firm, he is entitled to get interest @ 6% per annum.

Question 6.

Why is the Profit and Loss Appropriation Account prepared? Explain.

Answer:

The profit and Loss Appropriation Account is merely an extension of the Profit and Loss Account. It shows how the profits are appropriated or distributed among the partners. All adjustments in respect of partners are made through this account. It starts with the profit/loss as per P & L a/c transferred to this account.

Question 7.

What do you understand by the fixed capital of the partners?

Answer:

Under the fixed capital method, the capitals of the partners shall remain fixed unless additional capital is introduced or a part of the capital is withdrawn as per agreement among the partners. Items like a share of profit/ loss, interest on capital, drawings, interest on drawings, etc., are recorded in a separate account called partner current account.

Question 8.

How do you understand by fluctuating capital of partners?

Answer:

Under the fluctuating capital method, only one account i.e., the capital account is maintained for each partner. All the adjustments such as share of profit/loss, interest on capital, drawings, interest on drawings, salary etc., are recorded directly in this account. This makes the balance in the capital account fluctuate from time to time which is why it is called as fluctuating capital method.

![]()

Question 9.

How will you deal with the following terms while preparing partnership accounts?

(i) Interest on Capital

(ii) Interest on Drawings

(iii) Interest on Loan

Answer:

(i) Interest on Capital: The interest on partner capital is not allowed unless it is specifically mentioned in the partnership deed. It should be calculated on a time basis after considering additional capital or withdrawal of capital.

(ii) Interest on Drawings: Interest on drawings is charged by the firm only when it is clearly mentioned in the partnership deed. It is calculated with reference to the period of time for which the money was withdrawn.

(iii) Interest on Loan: When the partner gives a loan to the firm, it should be credited to a separate loan account and calculated interest as per the interest rate in the agreement. In the absence of an agreement, the partnership Act provides that interest @ 6% p.a. shall be allowed on such loan irrespective of the profit.

Textual Exercise

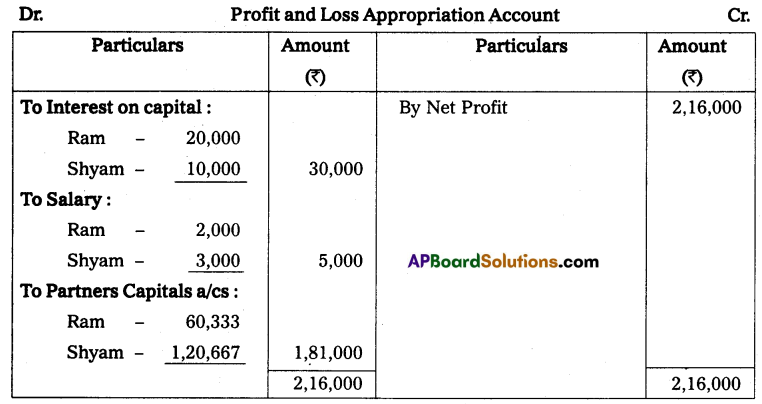

Question 1.

Ram and Shyam started a partnership firm on 1st January 2014. Their capital contributions were ₹ 2,00,000 and ₹ 1,00,000 respectively. The partnership deed provided:

(i) Interest on capitals @10% p.a.

(ii) Ram to get a salary of ₹ 2,000 p.a. and Shyam ₹ 3,000 p.a.

(iii) Profits are to be shared in the ratio of 1 : 2.

The profits for the year ended 31st December 2014 before making the above appropriations were ₹ 2,16,000. Prepare Profit and Loss Appropriation Account.

Solution:

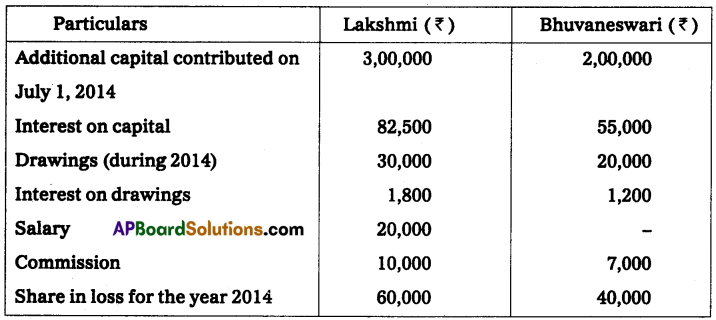

Question 2.

Lakshmi and Bhuvaneswari are partners with capitals of ₹ 15,00,000 and ₹ 10,00,000 respectively. They agree to share profits in the ratio of 3 : 2. Show how the following transactions will be recorded in the capital accounts of the partners in case the capitals are fixed. The books are closed on March 31, every year.

Solution:

![]()

Question 3.

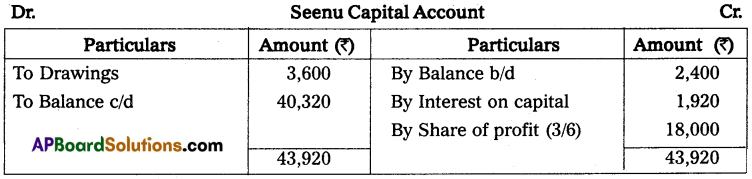

On March 31, 2013, after the close of books of accounts, the capital accounts of Seenu, Prasad, and Sudarsan showed balances of ₹ 24,000, ₹ 18,000, and ₹ 12,000 respectively. After all adjustments profit for the year ended March 31, 2014, amounted to ₹ 36,000 and the partner’s drawings had been Seenu, ₹ 3,600; Prasad, ₹ 4,500 and Sudarsan, ₹ 2,700. The interest on capital @ 8% and the profit sharing ratio of Seenu, Prasad, and Sudarsan was 3 : 2 : 1. Prepare Partners’ Capital Accounts.

Solution:

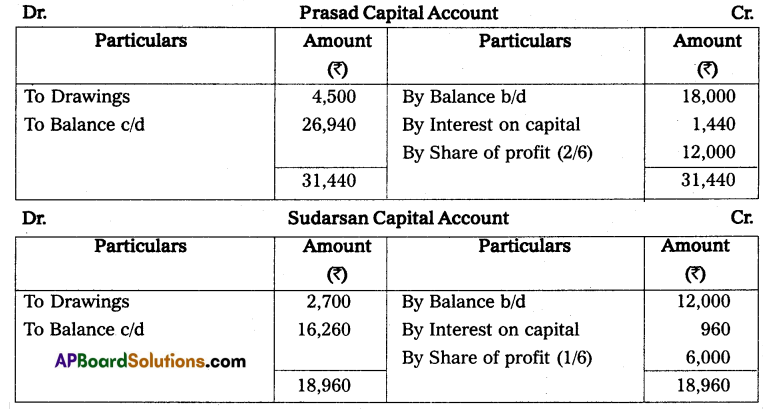

Question 4.

Venu and Subbu are partners sharing profits in the ratio of 3 : 2, with capitals of ₹ 1,00,000 and ₹ 60,000 respectively. Interest on capital is agreed @ 10% p.a. Subbu is to be allowed an annual salary of ₹ 2,500. During the year 2014-15, the profits prior to the calculation of interest on capital but after charging Subbu’s salary amounted to ₹ 22,500.

Prepare the Profit and Loss Appropriation Account and the partners’ capital account for the year ending March 31, 2015.

Solution:

Question 5.

A and B are partners sharing profits in the ratio of 3 : 2, with capitals of ₹ 50,000 and ₹ 30,000 respectively. Interest on capital is agreed to be paid @ 6% p.a. Calculate interest on capital.

Solution:

Calculation of Interest on Capital:

A: 50,000 × \(\frac{6}{100}\) = ₹ 3,000

B: 30,000 × \(\frac{6}{100}\) = ₹ 1,800

Question 6.

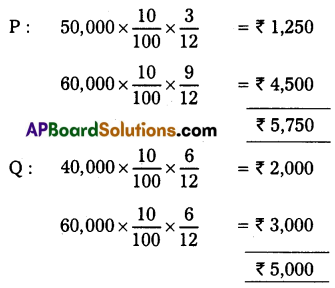

P and Q are partners sharing profits and losses in the ratio of 3 : 2. On 1st April 2014 their capital balances was ₹ 50,000 and ₹ 40,000 respectively. On 1st July 2014, P brought ₹ 10,000 as his additional capital, whereas Q brought ₹ 20,000 as additional capital on 1st October 2014. Interest on capital was provided @ 10% p.a. Calculate the interest on capital of P and Q on 31st March 2015.

Solution:

Calculation of Interest on Capital:

![]()

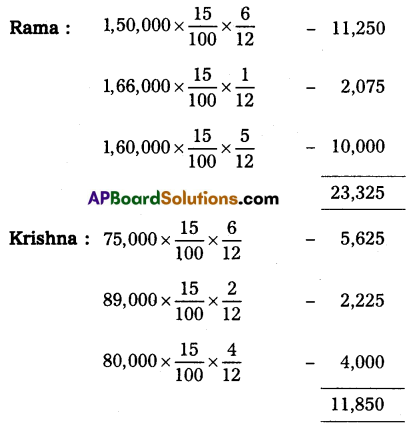

Question 7.

Rama and Krishna are partners sharing profits and losses in the ratio of 5 : 1. Their capitals at the end of the financial year 2013-14 were ₹ 1,50,000 and ₹ 75,000. On October 1st, 2014 Rama and Krishna brought additional capitals of ₹ 16,000 and ₹ 14,000 respectively. On November 1st, 2014 Rama withdrew ₹ 6,000 and on December 1st, 2014 Krishna withdrew ₹ 9,000 from their capitals. Calculate interest on capital @ 15% p.a. for the year 2014-15.

Solution:

Calculation of Interest on Capital:

Question 8.

Priya and Mani are partners, sharing profits and losses in the ratio of 5 : 3. The balances in their capital accounts as on April 1, 2013, were; Priya, ₹ 6,00,000, and Mani, ₹ 8,00,000. Calculate interest on capital;

(a) when there is no agreement in respect of interest on capital, and

(b) when there is an agreement that the interest on capital will be allowed @ 7% p.a.

Solution:

(a) No interest on capital.

(b) Priya: 6,00,000 × \(\frac{7}{100}\) = ₹ 42,000

Mani: 8,00,000 × \(\frac{7}{100}\) = ₹ 56,000

Question 9.

Mohith is a partner, who withdrew ₹ 5,500 at the end of June 2014. The Partnership deed provides for charging the interest on drawings @ 12% p.a. Calculate interest on Mohith’s drawings for the year ending 31st December 2014.

Solution:

Mohit interest on drawings = 5,500 × \(\frac{12}{100} \times \frac{6}{12}\) = ₹ 330

Question 10.

Amar and Gul are partners in a firm. They share profits in the ratio of 3 : 2. As per their partnership agreement, interest on drawings is to be charged @10% p.a. Their drawings during 2014 were ₹ 24,000 and ₹ 16,000, respectively. Calculate interest in drawings.

(Hint: If the date of Drawings is not given in the question, interest on drawings will be charged an average period of 6 months.)

Solution:

Calculation of interest on drawings:

Amar: 24,000 × \(\frac{10}{100} \times \frac{6}{12}\) = ₹ 1,200

Gul’s: 16,000 × \(\frac{10}{100} \times \frac{6}{12}\) = ₹ 800

Note: In the absence of the date of withdrawal, it is assumed that withdrawals are made evenly throughout the year. Hence, interest is charged for the average period of the year i.e., 6 months.

Question 11.

Bose is a partner in a firm. He withdraws ₹ 3,000 at the start of each month for 12 months. The books of the firm close on March 31 every year. Calculate interest on drawings if the rate of interest is 10% p.a.

Solution:

When the amount is withdrawn at the beginning of every month:

Total drawings = 3,000 × 12 = ₹ 36,000

Interest on drawings = 36,000 × \(\frac{10}{100} \times \frac{6.5}{12}\) = ₹ 1,950

Question 12.

Vishnu and Thomas are partners in a firm. They share profits equally. Vishnu’s monthly drawings are ₹ 2,000. Interest on drawings is to be charged @ 10% p.a. Calculate interest on Vishnu’s drawings for the year 2014, assuming that money is withdrawn:

(i) at the beginning of every month

(ii) in the middle of every month

(iii) at the end of every month.

Solution:

(i) When the amount is withdrawn at the beginning of every month:

Total drawings = 2,000 × 12 = ₹ 24,000

Interest on drawings = 24,000 × \(\frac{10}{100} \times \frac{6.5}{12}\) = ₹ 1,300

(ii) When the amount is withdrawn in the middle of every month:

Interest on drawings = 24,000 × \(\frac{10}{100} \times \frac{6}{12}\) = ₹ 1,200

(iii) When the amount is withdrawn at the end of every month:

Interest on drawings = 24,000 × \(\frac{10}{100} \times \frac{5.5}{12}\) = ₹ 1,100

![]()

Question 13.

A and B are partners sharing profits and losses in the ratio of 4 : 1. A withdraws ₹ 2,500 at the beginning of each month and B withdrew ₹ 1,500 at the end of each month for 12 months period. Interest on drawings was charged @ 8% p.a. Calculate the interest on drawings of A and B for the year ended 31st December 2014.

Solution:

A’s total drawings = 2,500 × 12 = ₹ 30,000

Interest on drawings = 30,000 × \(\frac{8}{100} \times \frac{6.5}{12}\) = ₹ 1,300

B’s total drawings = 1,500 × 12 = ₹ 18,000

Interest on drawings = 18,000 × \(\frac{8}{100} \times \frac{5.5}{12}\) = ₹ 660

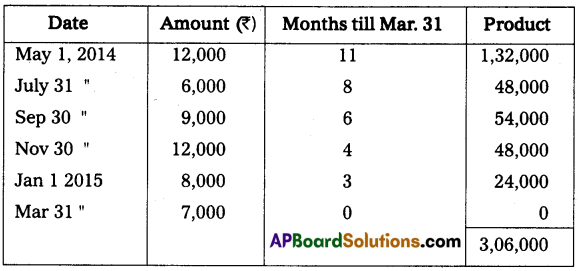

Question 14.

Apama is a partner in a firm. She withdrew the following amounts during the year ended March 31, 2015.

May 01, 2014 – ₹ 12,000

July 31, 2014 – ₹ 6,000

September 30, 2014 – ₹ 9,000

November 30, 2014 – ₹ 12,000

January 01, 2015 – ₹ 8,000

March 31, 2015 – ₹ 7,000

Interest on drawings is charged @ 9% p.a. Calculate interest on drawings.

Solution:

Statement showing the calculation of interest on drawings

Interest on drawings = Sum of products × \(\frac{\text { Rate }}{100} \times \frac{1}{12}\)

= 3,06,000 × \(\frac{9}{100} \times \frac{1}{12}\)

= ₹ 2,295

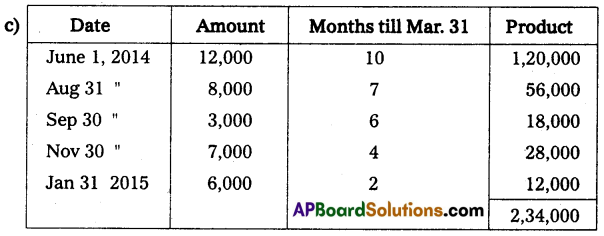

Question 15.

John, a partner in Kaveri Tours and Travels withdrew money for his personal use from his capital account during the year ending March 31, 2015. Calculate interest on drawings in each of the following alternative situations, if the rate of interest is 9 percent per annum.

(a) If they withdrew ₹ 3,000 at beginning of each month.

(b) If an amount of ₹ 3,000 per month was withdrawn by him at the end of each month.

(c) If the amounts withdrawn were:

₹ 12,000 on June 01, 2014

₹ 8,000 on August 31, 2014

₹ 3,000 on September 30, 2014

₹ 7,000 on November 30, 2014, and

₹ 6,000 on January 3, 2015.

Solution:

(a) When the amount is withdrawn at the beginning of every month:

Total drawings = 3,000 × 12 = ₹ 36,000

Interest on drawings = 36,000 × \(\frac{9}{100} \times \frac{6.5}{12}\) = ₹ 1,755

(b) When the amount is withdrawn at the end of each month:

Interest on drawings = 36,000 × \(\frac{9}{100} \times \frac{5.5}{12}\) = ₹ 1,485

Interest on drawings = Sum of product × rate × \(\frac{1}{12}\)

= 2,34,000 × \(\frac{9}{100} \times \frac{1}{12}\)

= ₹ 1,755

Textual Examples

Question 1.

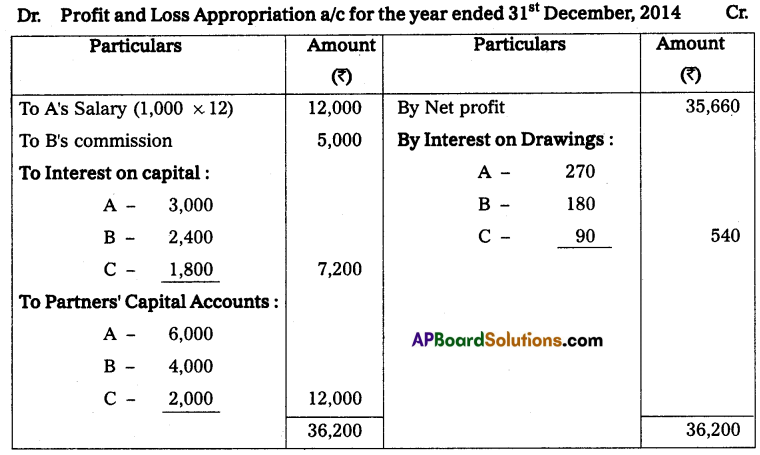

A, B and C set up a partnership firm on January 1, 2014. They contributed ₹ 50,000, ₹ 40,000 and ₹ 30,000 respectively as their capitals and agreed to share profits and losses in the ratio of 3 : 2 : 1. A is to be paid a salary of ₹ 1,000 per month and a Commission for B of ₹ 5,000. It is also provided that interest be allowed on capital at 6% p.a. The drawings for the year were A – ₹ 6,000, B – ₹ 4,000, and C – ₹ 2,000. Interest on drawings was charged ₹ 270 on A’s drawings, ₹ 180 on B’s drawings, and ₹ 90 on C’s drawings. The net profit as per the Profit and Loss Account for the year ending December 31, 2014, was ₹ 35,660. Prepare the Profit and Loss Appropriation Account to show the distribution of profit among the partners.

Solution:

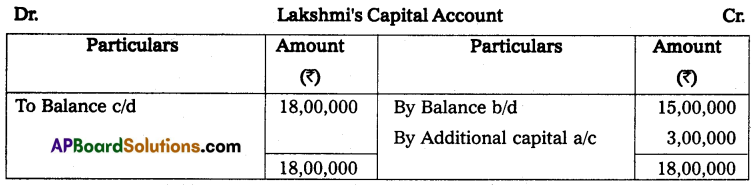

Question 2.

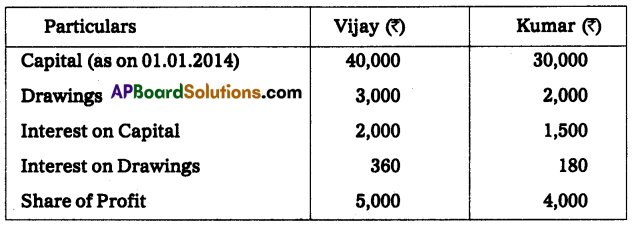

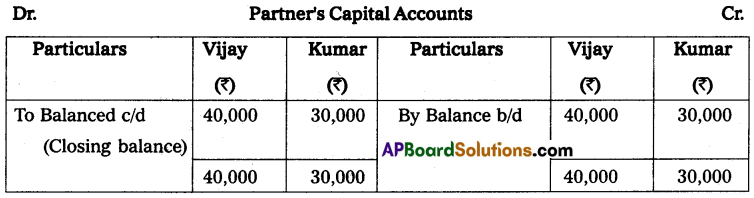

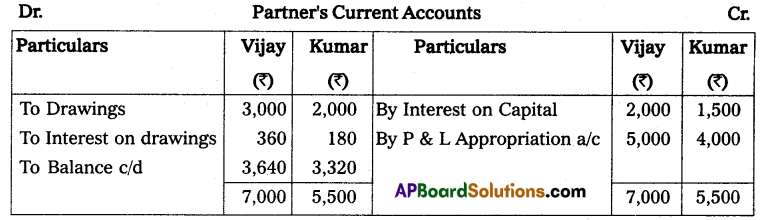

Vijay and Kumar are partners in a firm. The following information is provided as of 31st December 2014:

Solution:

![]()

Question 3.

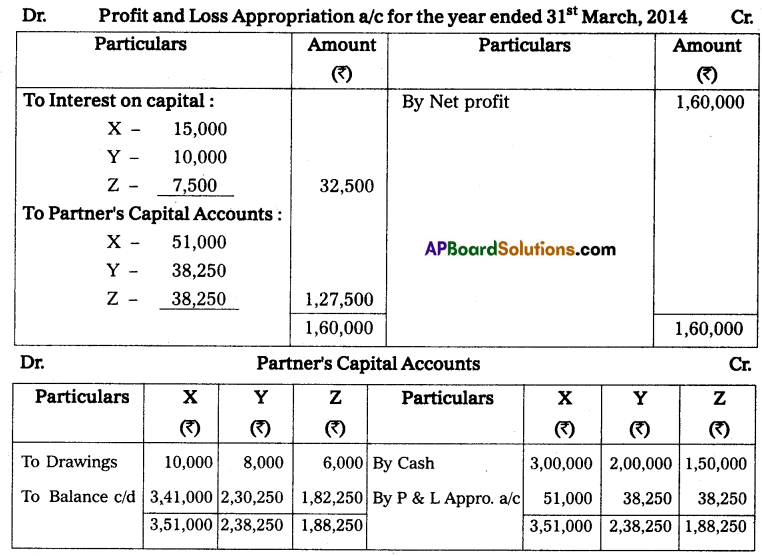

X, Y, and Z entered into a partnership on 1st April 2013 to share profits & losses in the ratio of 4 : 3 : 3. Interest on Capital @ 5% p.a. The Capital contributions were: X – ₹ 3,00,000; Y – ₹ 2,00,000 and Z – ₹ 1,50,000 and drawings were: X – ₹ 10,000, Y – ₹ 8,000, and Z – ₹ 6,000 in this year. The profit for the year ended 31st March 2014 amounted to ₹ 1,60,000. Show the necessary Accounts.

Solution:

Question 4.

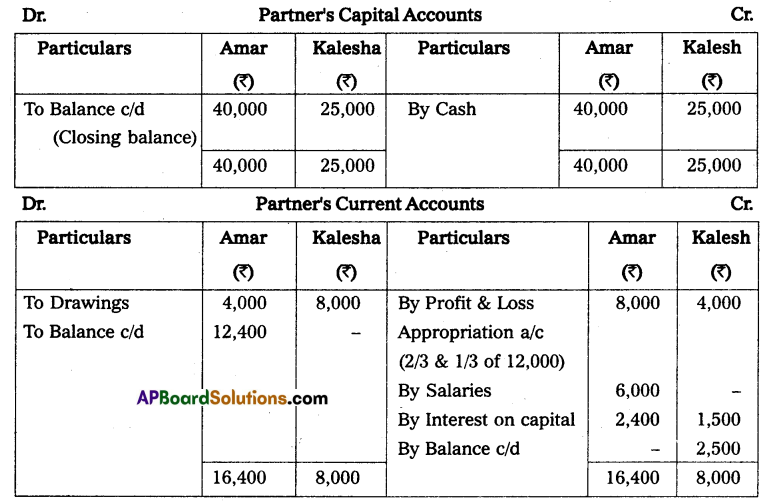

Amar and Kalesha commenced business as partners on April 1, 2013. Amar ₹ 40,000 and Kalesha ₹ 25,000 contributed as their capital. The partners decided to share their profits ¡n the ratio of 2 : 1. Amar was entitled to a salary of ₹ 6,000 p.a. Interest on capital was to be provided @ 6% p.a. The drawings of Amar and Kalesha for the year ending March 31, 2014, were ₹ 4,000 and ₹ 8,000 respectively. The profits of the firm after providing Amar’s salary and interest on capital were ₹ 12,000.

Draw up the Capital Accounts of the partners; (i) When capitals are fixed, and (ii) When capitals are fluctuating.

Solution:

(i) When capitals are fixed:

(ii) When capitals are fluctuating:

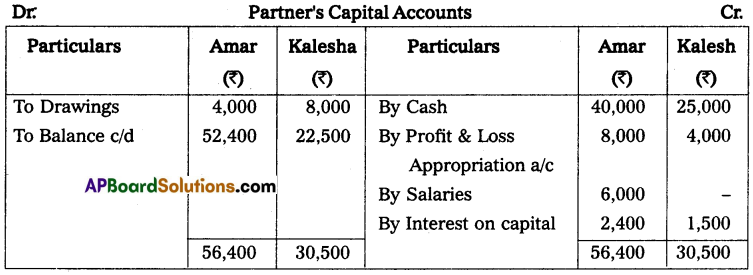

Question 5.

A and B are partners sharing profits in the ratio of 3 : 2 with capitals of ₹ 5,00,000 and ₹ 3,00,000 respectively. Interest on capital is agreed @ 6% p.a. B is be allowed an annual salary of ₹ 25,000. During the year 2014, the profit prior to the calculation of interest on capital but after charging B’s salary amounted to ₹ 1,25,000. A provision of 5% of the profits is to be made in respect of the Manager’s commission.

Prepare an account showing the allocation of profits and partner’s capital accounts.

Solution:

Question 6.

P, Q, and R entered into a partnership, bringing capital in ₹ 3,00,000, ₹ 2,00,000, and ₹ 1,00,000 respectively into the business. They decided to share profits and losses equally and agreed that interest on capital will be provided to the partners @ 10 percent per annum.

Solution:

The interest on capital:

For P = ₹ 30,000 (10% on 3,00,000)

For Q = ₹ 20,000 (10% on 2,00,000)

For R = ₹ 10,000 (10% on 1,00,000)

Question 7.

M and N who are partners in a firm and their capital accounts showed a balance of ₹ 4,00,000 and ₹ 2,50,000 respectively on April 1, 2014. M introduced additional capital of ₹ 1,00,000 on August 1, 2014, and N brought in further capital of ₹ 1,50,000 on October 1, 2014. Interest is to be allowed @ 6% p.a. on the capital.

Solution:

Interest on capital shall be worked as follows:

For M = \(\left[4,00,000 \times \frac{6}{1,000}\right]+\left[1,00,000 \times \frac{6}{1,000} \times \frac{8}{12}\right]\)

= 24,000 + 4,000

= ₹ 28,000

For N = \(\left[2,50,000 \times \frac{6}{1,000}\right]+\left[1,50,000 \times \frac{6}{1,000} \times \frac{6}{12}\right]\)

= 15,000 + 4,500

= ₹ 19,500

![]()

Question 8.

Lal and Pal are partners in a firm. Their capital accounts as on April 01, 2013, showed a balance of ₹ 4,00,000 and ₹ 6,00,000 respectively. On July 01, 2013, Lal introduced additional capital of ₹ 1,00,000 and Pal, ₹ 60,000. On October 01, 2013, Lal withdrew ₹ 50,000, and on January 01, 2014, Pal withdrew, ₹ 25,000 from their capitals. Interest is allowed @ 8% p.a. Calculate interest payable on capital to both partners during the financial year 2013-2014.

Solution:

Calculation of Interest on Capital:

For Lal = \(\left[4,00,000 \times \frac{8}{100}\right]+\left[1,00,000 \times \frac{8}{100} \times \frac{9}{12}\right]-\left[50,000 \times \frac{8}{100} \times \frac{6}{12}\right]\)

= 32,000 + 6,000 – 2,000

= ₹ 36,000

For Pal = \(\left[6,00,000 \times \frac{8}{100}\right]+\left[25,000 \times \frac{9}{12}\right]-\left[50,000 \times \frac{8}{100} \times \frac{3}{12}\right]\)

= 48,000 + 3,600 – 500

= ₹ 51,100

Question 9.

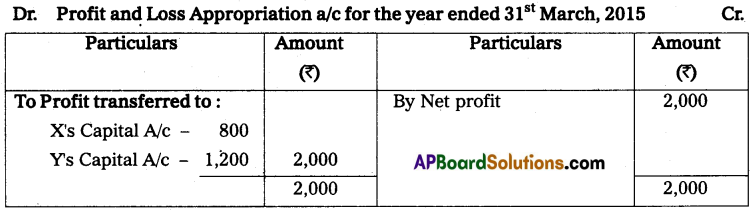

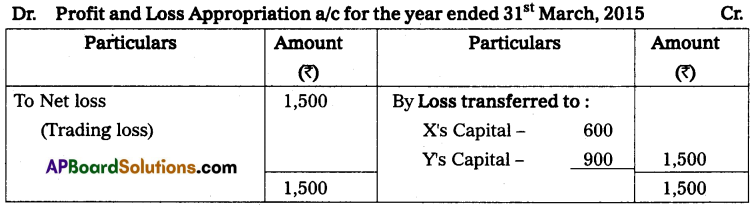

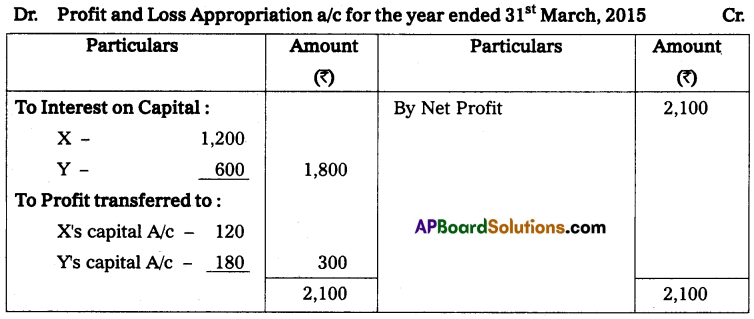

X and Y are Partners sharing Profit and Loss in the ratio of 2 : 3 with a capital of ₹ 20,000 and ₹ 10,000 respectively. Show distribution of Profit/Losses for the year ended 31st March 2015 by preparing P & L Appropriation a/c in each of the alternative cases.

Case 1: If the Partnership deed is silent as to the interest on capital and the profit for the year ended is ₹ 2,000.

Case 2: If the Partnership deed provides for the interest on capital @ 6% p.a. and the loss for the year is ₹ 1,500.

Case 3: If the Partnership deed provides for interest on capital @ 6% p.a. and trading profit is ₹ 2,100.

Solution:

Case 1:

Case 2:

Note: No interest on capital will be allowed if the firm has a net loss, even though they have an agreement.

Case 3:

Question 10.

Johnson is a partner who withdrew ₹ 20,000 on October 1, 2014. Interest on drawings is charged @ 10% per annum and the accounts were closed every year on December 31. Calculate interest on drawings.

Solution:

Interest on Drawings = 20,000 × \(\frac{10}{100} \times \frac{3}{12}\) = ₹ 500

Question 11.

Amount and rate of interest are given but the date of withdrawal is not specified:

Ahmed is a partner who withdraws ₹ 30,000 and interest on drawings is charged @ 15% per annum. Calculate interest on drawings:

Solution:

Interest on Drawings = 30,000 × \(\frac{15}{100} \times \frac{6}{12}\) = ₹ 2,250

Here, it is noted that in the absence of any particular date of withdrawal, it is assumed that withdrawals are made evenly throughout the year. Hence, interest is charged for the average of the period of the year, i.e., six months.

![]()

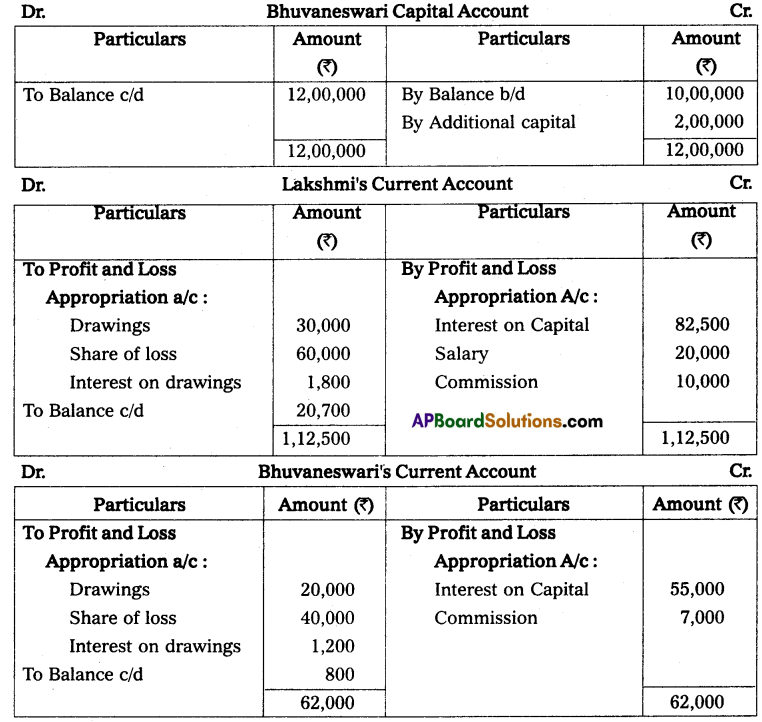

Question 12.

Shanu withdrew ₹ 10,000 per month from the firm for her personal use during the year 2014. Find out the interest on drawings, in different situations @ 8% p.a

Solution:

(a) When the amount is withdrawn at the beginning of every month:

Total drawings = 10,000 × 12 = ₹ 1,20,000

Interest on drawings = 1,20,000 × \(\frac{8}{100} \times \frac{6.5}{12}\) = ₹ 5,200

(b) When the amount is withdrawn at the end of every month:

Interest on drawings = 1,20,000 × \(\frac{8}{100} \times \frac{5.5}{12}\) = ₹ 4,400

(c) When money is withdrawn in the middle of every month/date of Drawings is not given:

Interest on drawings = 1,20,000 × \(\frac{8}{100} \times \frac{6}{12}\) = ₹ 4,800

Question 13.

Ratna and Manikyam are partners in a firm, sharing profits and losses equally. During the financial year 2014 – 2015, Ratna withdrew ₹ 50,000 quarterly. If interest is to be charged on drawings @ 10% per annum, calculate interest on drawings in different situations.

Solution:

(a) If the amount is withdrawn at the beginning of each quarter:

Total drawings = 50,000 × 4 = ₹ 2,00,000

Interest on drawings = 2,00,000 × \(\frac{10}{100} \times \frac{7.5}{12}\) = ₹ 12,500

(b) If the amount is withdrawn at the end of every quarter:

Interest on drawings = 2,00,000 × \(\frac{10}{100} \times \frac{4.5}{12}\) = ₹ 7,500

When different amounts are withdrawn on different dates:

The following are the two methods to calculate the amount of Interest on Drawings:

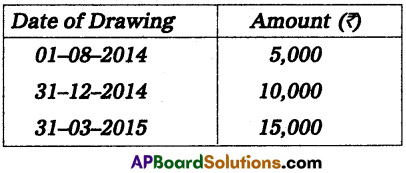

Question 14.

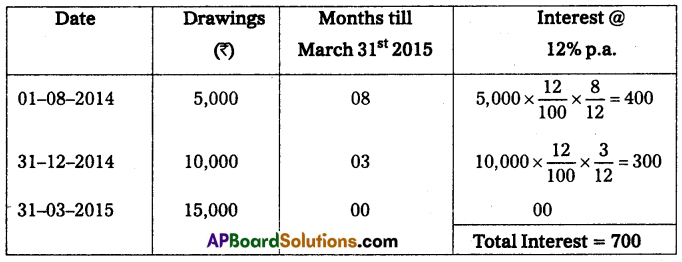

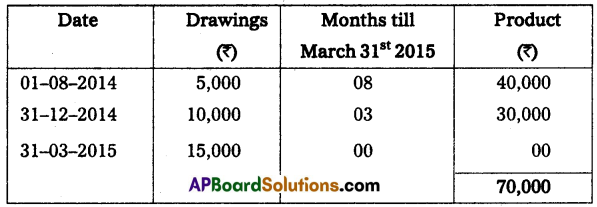

Vamshi and Krishna are partners in a firm. During the year ended 31st March 2015, Vamshi makes the drawings as under:

Partnership Deed provided that partners are to be charged interest on drawings @ 12% p.a. Calculate the interest on Vamshi’s drawings by using Simple Interest Method and Product Method.

Solution:

1. Simple Interest Method:

2. Product Method:

Interest on Drawings = Sum of Products × \(\frac{\text { Rate }}{100} \times \frac{1}{12}\)

= 70,000 × \(\frac{12}{100} \times \frac{1}{12}\)

= ₹ 700

![]()

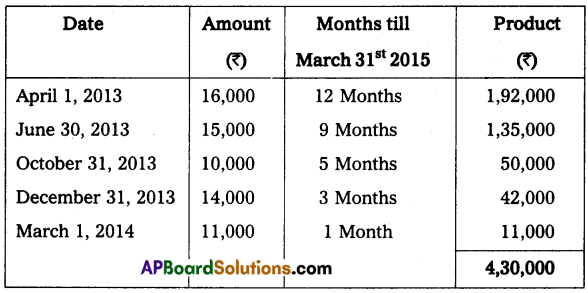

Question 15.

Thanvika withdrew the following amounts for her personal use from her firm during the year ending March 31, 2014. Calculate interest on drawings with the product method, if the rate of interest to be charged is 7% per annum.

April 1, 2013, ₹ 16,000

June 30, 2013, ₹ 15,000

October 31, 2013, ₹ 10,000

December 31, 2013, ₹ 14,000, and

March 1, 2014, ₹ 11,000.

Solution:

Statement Showing Calculation of Interest on Drawings

Interest on Drawings = Sum of Products × \(\frac{\text { Rate }}{100} \times \frac{1}{12}\)

= 4,30,000 × \(\frac{7}{100} \times \frac{1}{12}\)

= ₹ 2,508 (approx.)