Andhra Pradesh BIEAP AP Inter 1st Year Accountancy Study Material 4th Lesson Journal Textbook Questions and Answers.

AP Inter 1st Year Accountancy Study Material 4th Lesson Journal

Very Short Answer Questions

Question 1.

What is Journal ?

Answer:

The word ‘Journal, is derived from the Latin word Journ’ which means a day. Therefore journal means a day book where in day-to-day business transactions are recorded in chronological order. This is also known as ‘Book of original entry’ or ‘Book of primary entry’.

Question 2.

What is Journalizing ?

Answer:

The process of recording the transaction in the Journal is called “Journalizing”.

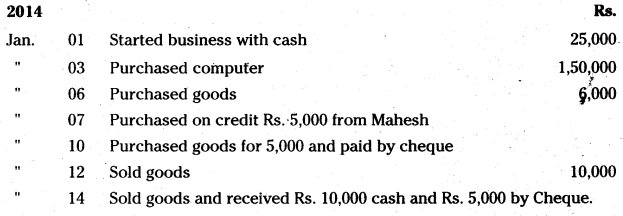

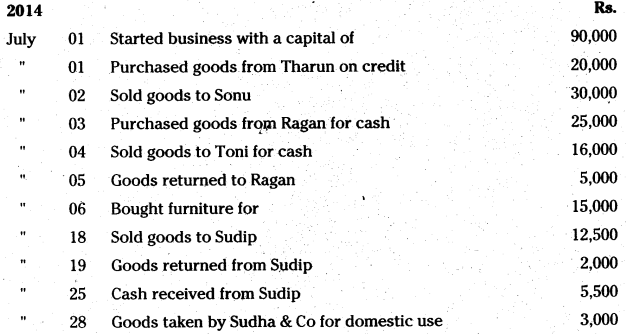

![]()

Question 3.

What is Journal Entry ?

Answer:

The entry made in the Journal is called “Journal entry”.

Question 4.

What is Narration ?

Answer:

Narration means a brief explanation of the transaction for which the entry is recorded is written within the brackets known as ’narration’.

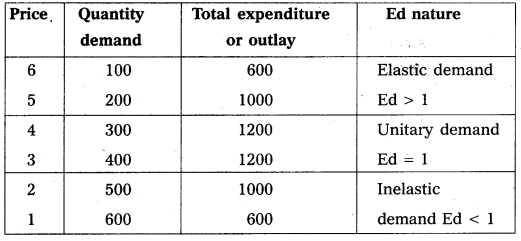

Problems

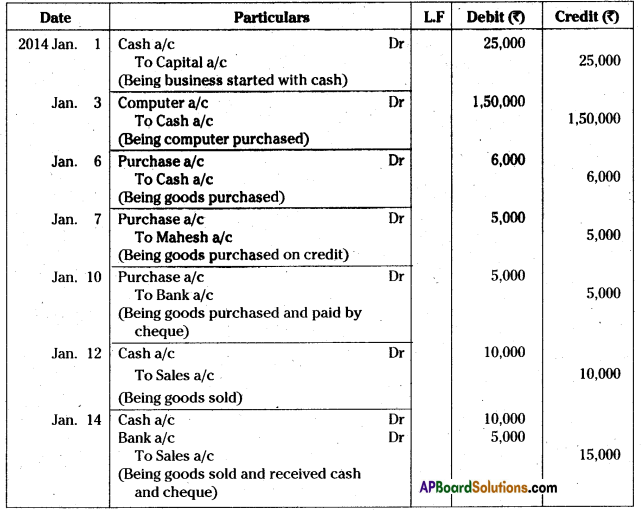

Question 1.

Mr. Anil started business with cash Rs. 75,000 on 1st January 2014. The details of business transactions for the month of January are as follows.

Answer:

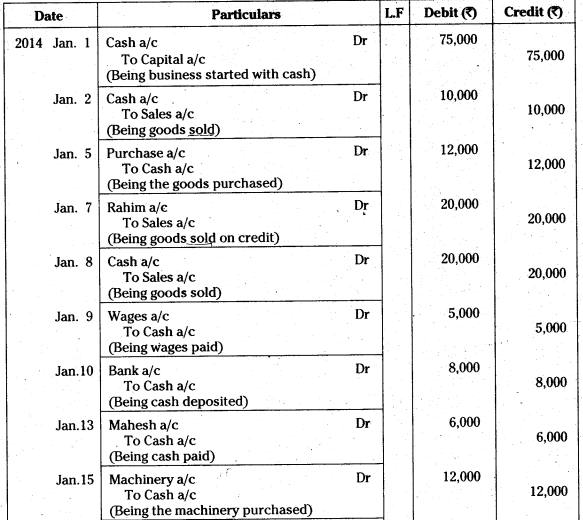

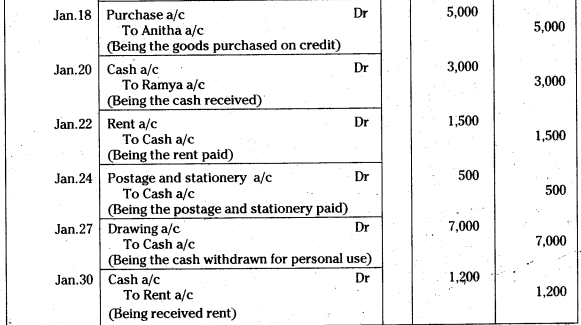

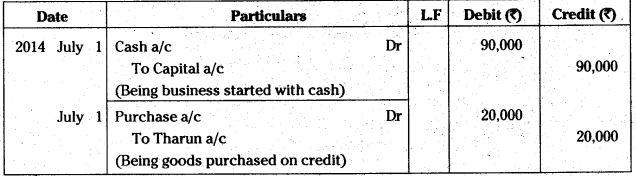

![]()

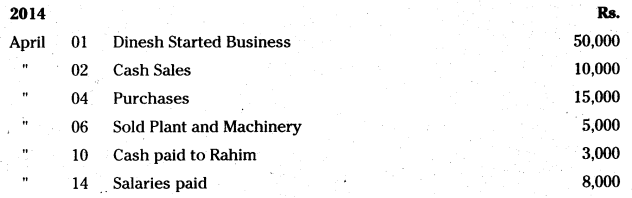

Question 2.

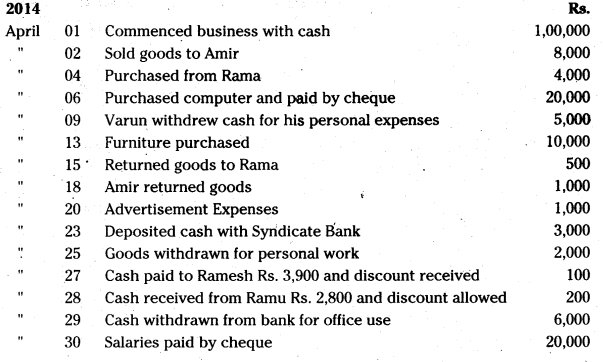

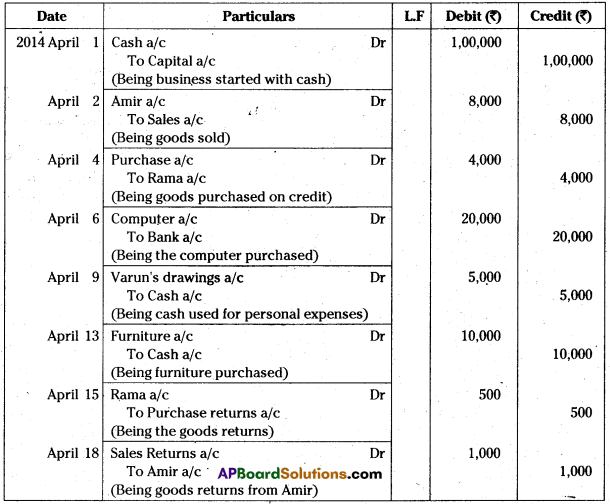

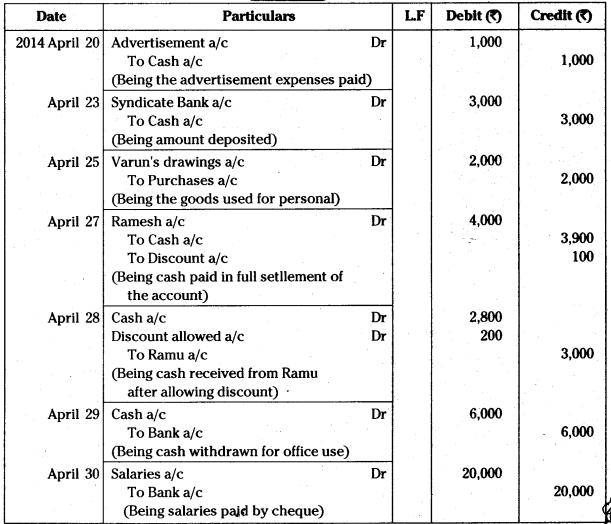

Pass journal entries in the books of Mr. Varan.

Answer:

Question 3.

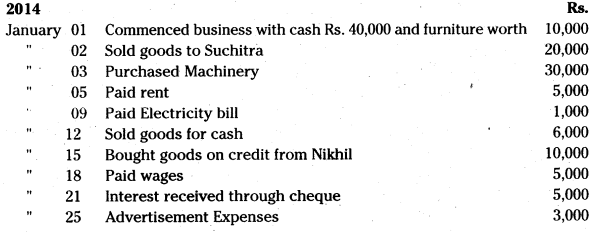

Journalize the following transactions.

Answer:

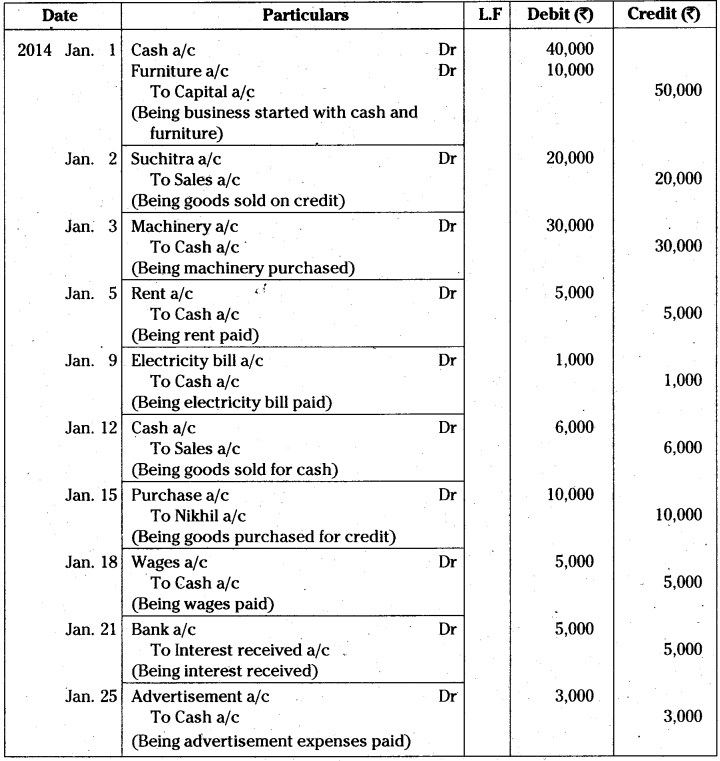

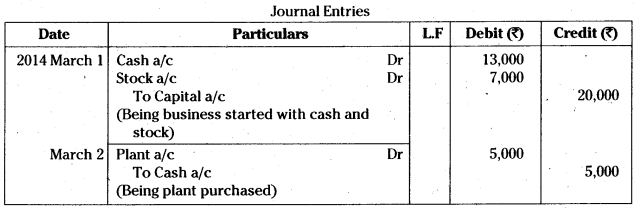

Question 4.

Journalize the following transactions in the books of Bhagat.

Answer:

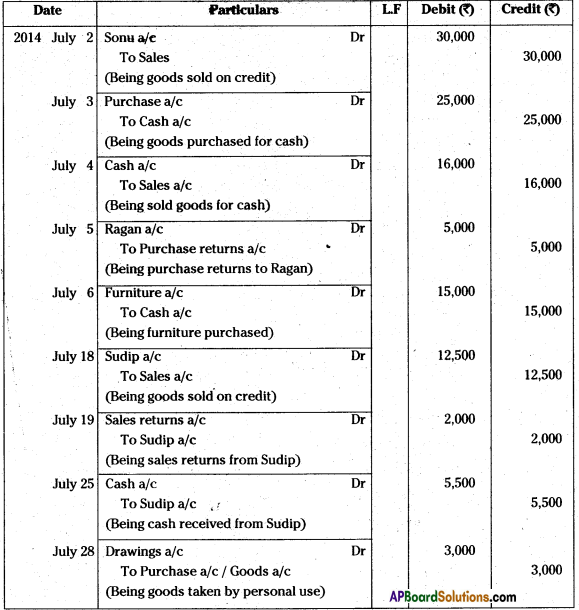

![]()

Question 5.

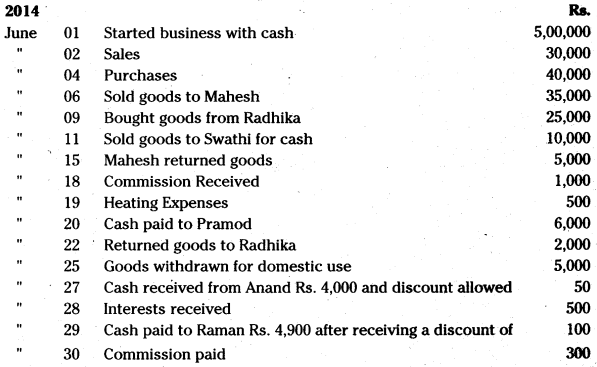

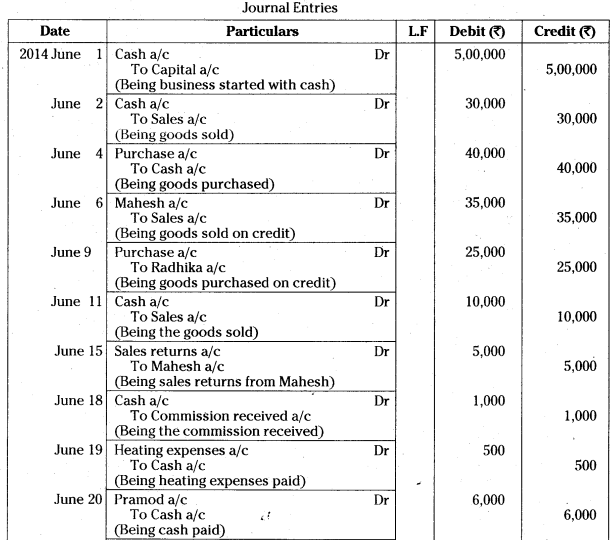

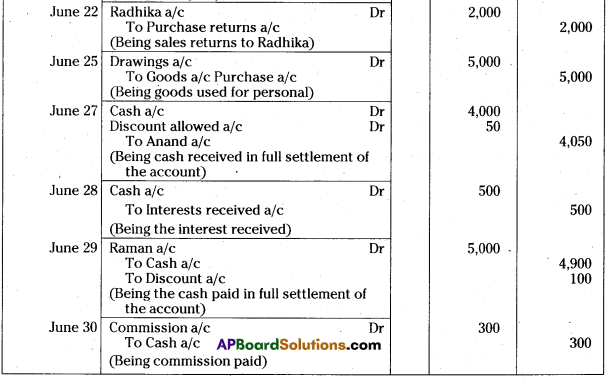

Journalize the following transactions.

Answer:

Question 6.

Journalize the following transactions in the books of Atma Ram.

Answer:

Journal Entries in the books of Atma Ram

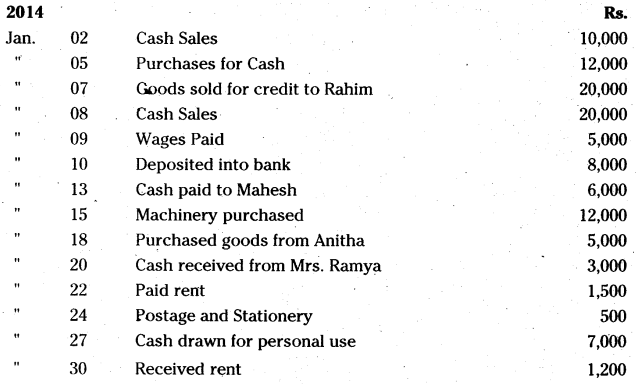

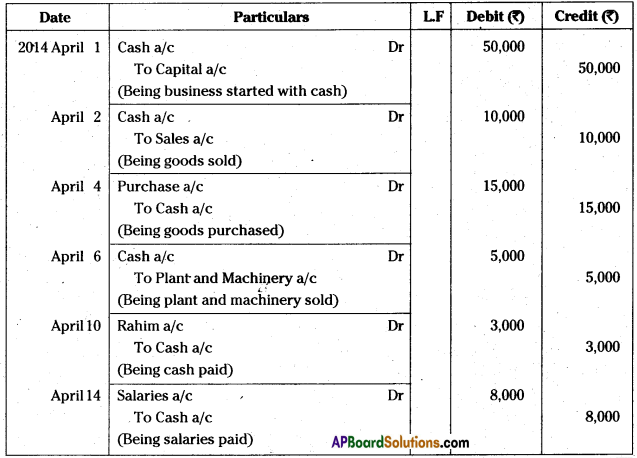

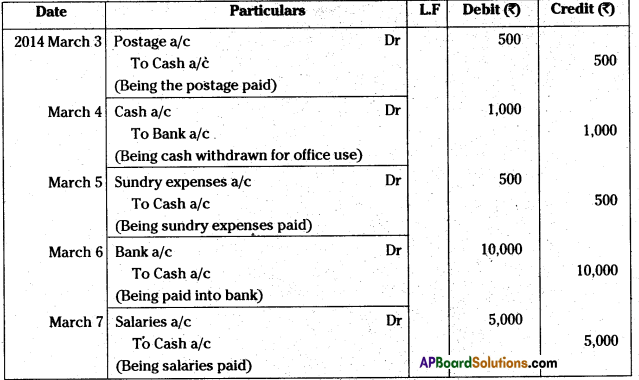

Question 7.

Journalize the following transactions.

March 01 Commenced business with cash Rs. 13,000 and stock 7,000

March 02 Bought plant Rs. 5,000

March 03 Paid for postage Rs. 500

March 04 Withdrew cash for office use Rs. 1000

March 05 Paid for Sundry Expenses Rs. 500

March 06 Paid into bank Rs. 10,000

March 07 Paid salaries Rs 5,000

Answer:

![]()

Question 8.

Write journal entries in the books of Sudha & Co.

Answer:

Journal Entries in the book of Sudha & Co

Student Activity

Visit any organisation and find journal entries from its journal.