Andhra Pradesh BIEAP AP Inter 1st Year Economics Study Material 8th Lesson Macro Economic Aspects Textbook Questions and Answers.

AP Inter 1st Year Economics Study Material 8th Lesson Macro Economic Aspects

Essay Questions

Question 1.

Discuss the implications of the classical theory of employment

Answer:

The theory of output and employment developed by economists such as Adam Smith, David Ricardo, Malthus is known as classical theory. lt is based on the famous “Law of markets” advocated by J.B. Say. According to this law “supply creates its own demand”. The classical theory of employment assumes that there is always full employment of labour and other resources. The classical economists ruled out any general unemployment in the long run. These views are known as the classical theory of output and employment.

The classical theory of employment can be three dimensions.

A. Goods market equilibrium → Say’s market law

B. Money market equilibrium → Say’s market law

C. Equilibrium of the labour market (Pigou wage cut policy)

A) Goods market equilibrium: The 1st part of Say’s law of markets explains the goods market equilibrium. According to Say “supply creates its own demand”. Say’s law states that supply always equals demand. Whenever additional output is produced in the economy, the factors of production which participate in the process of production. The total income generated is equivalent to the total value of the output produced. Such income creates additional demand for the sale of the additional output. Thus there could be no deficiency in the aggregate demand in the economy for the total output. Here every thing is automatically adjusting without need of government intervention.

![]()

The classical economists believe that economy attains equilibrium in the long run at the level of full employment. Any disequilibrium between aggregate demand and aggregate supply equilibrium adjusted automatically. This changes in the general price level is known as price flexibility.

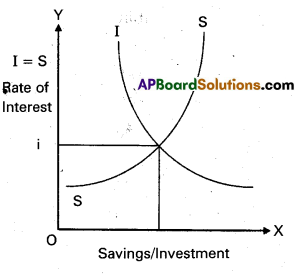

B) Money market equilibrium : The goods market equilibrium leads to bring equilibrium of both money and labour markets. In goods market, it is assumed that total income spent the classical economists agree that part of the income may be saved. But the savings is gradually spent on capital goods. The expenditure on capital goods is called investment. It is assumed that equality between savings and investment is brought by the flexible rate of interest. This can be explained by the following diagram.

In the diagram savings and investment are measured on the ‘X’ axis and rate of interest on Y axis. Savings and investments are equal at ‘Oi’ rate of interest. So money market equilibrium can be automatically brought through the rate of interest flexibility.

C) Labour market equilibrium : According to the classical economists, unemployment may occur in the short run. This is not because the demand is not sufficient but due to increase in the wages forced by the trade unions. A.C. Pigou suggests that reduction in the wages will remove,unemployment. This is called wage – cut policy. A reduction in the wage rate results in the increase in employment.

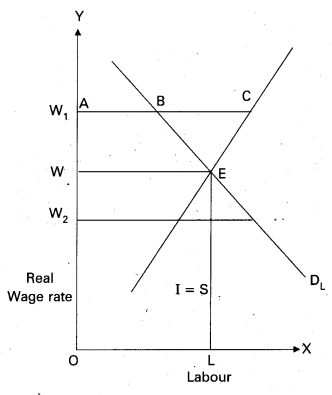

According to the classical theory supply of and demand for labour are determined by real wage rate. Demand for labour is the inverse function of the real wage rate. The supply of labour is the direct function of real wage rate. At a particular point real wage rate the supply of and the demand for labour in the economy become equal and thus equilibrium attained in the labour market. Thus there is full employment of labour. This can be ex-plained with the help of diagram.

In the above diagram supply of and demand for labour is measured on the X – axis. The real wage rate is measured on the Y axis. If the wage rate is OW1, the supply of labour more than the demand for labour. Hence the wage rate falls. If the real wage rate is OW2, the demand for labour is more than supply of labour. Hence the wage rate rises. At OW, real wage rate the supply and demand are equal. This is equilibrium.

Assumptions:

- There is no interference of government of the economy.

- Perfect competition in commodity and labour market.

- Full employment.

- Wage flexibility.

- Money does not matter.

- Savings and investment depends on the rate of interest.

- Supply of and demand for labour depends on real wage rate.

Question 2.

Explain the Keynesian theory of employment. [March 18, 17, 16]

Answer:

Keynes theory of employment is the principle of effective demand. He called his theory, general theory because it deals with all levels of employment. Keynes explains that lack of aggregate demand is the cause of unemployment. He used the terms aggregate demand, aggregate supply. It means total. The term effective demand is used to denote that level of aggregate demand which is equal to aggrerate supply.

According to Keynes where, aggregate demand and aggregate supply are intersected at that point effective demand is determined. This effective demand will determine the level of employment.

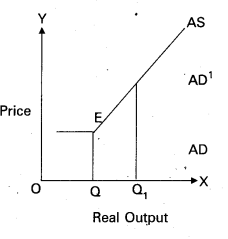

Aggregate supply schedule : The aggregate supply schedule shows the various amounts of the commodity that will be offered for sale at a series of price. As the level of output increases with the level of employment. The aggregate supply price also increases with every increase in the level of employment. The aggregate supply curve slopes upwards from left to right. But when the economy reaches the level of the full employment, the aggregate supply curve becomes vertical.

Aggregate demand schedule: The various aggregate demand prices at different level of employment is called aggregate demand price schedule. As the level of employment rises, the total income of the community also rises and therefore the aggregate demand price also increases. The aggregate demand curve slopes upward from left to right.

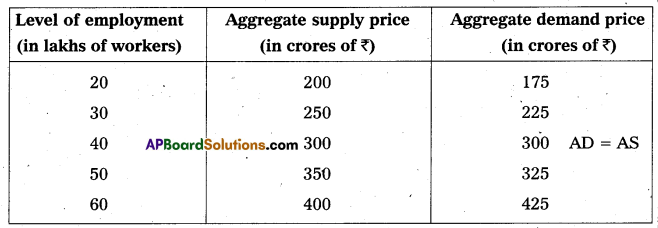

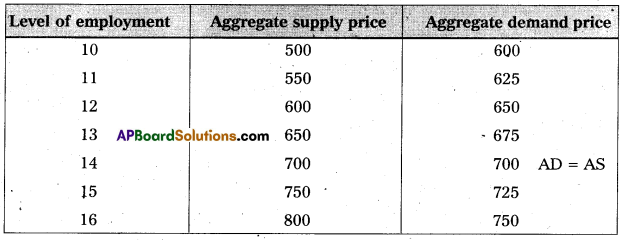

Equilibrium level of income : The two determinants of effective demand aggregate supply and aggregate demand prices combined schedule is shown in the following table.

The table shows that so long as the demand price is higher than the aggregate supply price. The level of employment 40 lakh workers aggregate demand price is equal to aggregate supply price i.e., 300 crores. So effective demand in the above table is ₹ 300 crores. This can be shown in the following diagrams.

In the diagram X’ axis represents the employment and Y axis represents price. A.S is aggregate supply curve A.D is aggregate demand curve. The point of intersection between the two ‘E1‘ point. This is effective demand where all workers are employed at this point the entrepreneur’s expectation of profits are maximised. At any other points the entrepreneurs will either incur losses or earn sub-normal profits.

![]()

Question 3.

How does Keynes advocate government expenditure to reduce unemployment ? Explain.

Answer:

The role of the state has become almost all pervasive in the economic organisation of the country. Whether it may be developed or underdeveloped country.

The activities undertaken by the modem State in the economic organisation of a country may be discussed under the following heads.

1) The State and Industry: The activities of the State in the industrial sphere may be considered under three groups namely, the regulatory functions, control of monopolies and lastly nationalisation or public ownership.

The state is taking an increasing role in regulating the manner of forming and operating industrial undertakings. The undertakings will probably have to take out licenses from the government before they can start operation. To check the growth of few giant concerns, the state has been forced to adopt measures for fixing prices and other terms of sale of the monopolised products. All the methods of controlling monopolies have ineffective, then the State take over the ownership of the monopolistic concerns.

2) State and Labour : The modem state has also been forced to take a number of steps for protecting the interests of labour. In this respect the state has passed factory laws prohibiting the employment of children and women under certain circumstances, fixing of reasonable hours of work etc.

3) The State and the Social Services : State has adopted schemes of social insurance according tp which all persons get free medical treatment and cash payments during periods of sickness, receive unemployment benefits if they are out of work, enjoy pensions in their oldage or in case of disablement. The widows and orphans also receive pensions from the State. The purpose behind these schemes is to relieve the poverty of the citizens and to provide security against the various risks of life.

4) The State and Foreign Trade : The state interferes with the course of foreign trade for the protection of home industries and for curing deficits in the balance of payments. The deficits in balance of payments will be cured by the State through the system of import control and exchange restrictions.

5) State and Inequalities of Income : It is the duty of the state to take all reasonable steps for the reduction of inequalities of income. Therefore, the state has adopting the system of progressive taxation of incomes, imposing levy of death duties or inherited proper ties at progressive rates and distributing the proceeds of the taxes among the poorer sections of the community.

6) The State and War : The expenses of modem war have forced the state to assume a good deal of control over the economic lifd of a country. If the economic system is to be organised fully for the successful prosecution of the war, it may be necessary for the state to exercise an all – round control over the economy of the country.

7) The State and the Trade Cycles : Both monetary policy and budgetary policy can be utilised by the State to check the course of the trade cycle.

8) The State and Economic Planning : An economic plan is a method of organising and utilising .the available resources of a country for the purpose of fulfilling certain desirable end. The modem state is expected to formulate such an economic plan or plans. It is necessary or desirable for the state to formulate a plan for rapid economic development especially in underdeveloped economies, to secure a better distribution of the national income among all classes of people, for the development of resources of the community so on to ensure full employment for everybody etc. All these activities of the state will increase the public expenditure.

![]()

Question 4.

Discuss how the Keynesian theory is an improvement over the classical theory of employment ?

Answer:

Classical theory of employment was stated by Adam Smith, David Ricardo, Robert Malthus etc. It is based on the Say’s law of market. According to this law “Supply creates its own demand”. The classical theory of employment assumed that there is always full employment of labour and other resources.

Infact full – employment is considered to be the normal situation and any lapses from full employment are considered to be abnormal. Even if at any time there is not actual full employment. The classical theory asserts that there is always a tendency towards full employment.

The free play of economic resources itself bring about the fuller utilization of economic resources including labour. Any interference of government in economic activities shall fail to bring about full employment.

Criticism on classical theory: J. M Keynes criticized the basic assumptions of classical theory. According to him the assumptions of classical theory are far from reality.

1) Full employment: According to classicals full employment is a general condition in the economy but for Keynes full employment is a special situation and not a general situation. The 1930’s economic depression proved that the classical assumption of full employment equilibrium was wrong.

2) Automatic adjustment: Classicals believed that the economic forces automatically adjust by them self without interference of the government. But automatic adjustment mecha-nism faild to restore. Full employment during the period of economic depression.

3) Money is neutral: J.M Keynes denounced the classical assumption that money is neutral. He integrated monetary variables with real variable through rate of interest and successfully demonstrated the effect of changes in money supply on real variables.

4) Wage-cut-policy : Classicals suggested the wage cut policy to solve the problem of involuntary unemployment. But according to Keynes it is impossible to cut money wage. The unions always fight for a hike in money wage and never accept a cut in money wage.

5) Savings and investment: According to classicals the saving and investment are the function of interest rate. But Keynes argued that savings is a function of level of income rather than that the rate of interest.

6) Labour supply: The supply of labour depends upon the money wage rate and not on real wage rate because workers suffer from money illusion i.e., they are interested in the amount of money they receive rather than its purchasing power.-

7) Long run analysis : Keynes also criticized the long run analysis of classical by saying that we are all dead in the long run. He emphasised the need for the analysis of short run problems and providing solution for them.

8) According to Keynes existence of perfect competition is also wrong.

Having made such a frontal attract on the classical theory. Keynes offered his own theory in its place. So his theory is treated as an improvement over the classical theory of employment.

Question 5.

Explain the concept of under – employment equilibrium with the help of a diagram.

Answer:

Under employment equilibrium is a situation when all resources are not fully used and same resources are lying idle or under utilised.

In case of under employment, equilibrium increase in aggregate demand brought about by expansionary fiscal and monetary policies will lead to increase in aggregate supply.

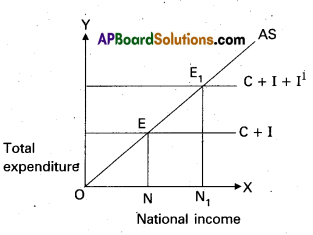

Keynesian employment theory states that in general there is unemployment in the economy in the short run that is caused by deficiency of aggregate demand. This can be shown in the side diagram.

Output is shown on X-axis as national income on the Y- axis consumption expenditure (Q and investment I are measured. AS is the aggregate supply curve. E represents the equilibrium point. ON output represents low level employment and to ensure full employment. The output should reach ON1 level. The aggregate demand helps determine output in the Keynesian approach. AS is upward sloping curve. AD and AS intersects at point A. It implies that a modem market economy can get trapped in an under employment equilibrium. Thus Keynes’s analysis created a revolution in macro economics.

![]()

Question 6.

Describe the various methods of redemption of public debt.

Answer:

Redemption of public debt means repayment of public debt. All government debts should be rapid promptly. There are various methods of repayment which may be discussed under the following heads.

- Surplus budget: Surplus budget means having public revenue in excess of public expenditure. If the government plans for a surplus budget, the excess revenue may be utilized to repay public debt.

- Refunding : Refunding implies the issue of fresh bands and securities by government so that the matured loans can be used for repayment of public debt.

- Annuities : By this method, the government repays past of the public debt every year. Such annual payments are made regularly till the debt is completely cleared.

- Sinking fund: By this method, the government creates a separate fund called ’Sinking fund’ for the purpose of repaying public debt. This is considered as the best method of redemption.

- Conversion: Conversion means that the existing loans are changed into new loans before the date of their maturity.

- Additional taxation : Government may resort to additional taxation so as to raise necessary funds to repay public debt under this method new taxes are imposed.

- Capital levy: Capital levy is a heavy one time tax on the capital assets and estates.

- Surplus Balance of payments : This is useful to repay external debt for which foreign exchange is required surplus balance of payment implies exports in excess of imports by which reserves of foreign exchange can be created.

Short Answer Questions

Question 1.

“Supply creates its own demand” comment on the statement. [March 18, 17]

Answer:

Classical theory of employment or the theory of output and employment developed by economists such as Adam Smith, David Ricardo, Robert Malthus etc., it is based on the J.B Say’s law of market’. According to this law “supply creates its own demand”. The classical theory of employment assumes that there is always full employment of labour and other resources.

According to this law the supply always equals to demand it can be expressed as S = D. Whenever additional output is produced in the economy. The factors of production which participate in the process of production. Earn income in the form of rent, wages, interest and profits.

The total income so generated is equivalent to the total value of the additional output produced. Such income creates addition demand necessary for the sale of the additional output. Therefore the question of addition output not being sold does not arise.

![]()

Question 2.

Enumerate the assumptions of Classical theory of employment.

Answer:

The classical theory of employment is based on the Say’s law of markets. The famous law of markets, propounded by the J.B Say states that “Supply creates its own demand”.

Assumptions : The Say’s law is based on the following assumptions.

- There is a free enterprise economy.

- There is perfect competition in the economy.

- There is no government interference in the functioning of the economy.

- The equilibrium process is considered from the long term point of view.

- All savings are automatically invested.

- The interest rate is flexible.

- The wage rate is flexible.

- There are no limits to the expansion of the market.

- Money acts as medium of exchange.

Question 3.

Explain the criticism against the classical theory of employment.

Answer:

The classical theory of employment came in for severe criticism from J.M. Keynes. The main points of criticism are as follows :

- The assumption of full employment is unrealistic. It is rare phenomenon and not a normal features.

- The wage cut policy is not a practical policy in modem times. The supply of labour is a function of money wage and not real wage. Trade unions would never accept any reduction in the money wage rate.

- Equilibrium between savings and investment is not brought about by a flexible rate of interest. Infact, saving is a function of income and not interest.

- The process of equilibrium between supply and demand is not realistic. Keynes commented the self adjusting mechanism doesn’t always operate.

- Long run approach to the problem of unemployment is also not realistic. Keynes commented, “we are all dead in the long run”. He considered unemployment as a short- run problem and offered immediate solution through his employment theory.

- It is not correct to say that money is neutral. Money acts not only as a medium of exchange but also as a store of value. Money influences variables like consumption, investment and output.

![]()

Question 4.

Explain the wage cut policy.

Answer:

Wage cut policy is one of the assumption of classical theory of employment which was started by “AC Pigou” who defended the classical theory and its full employment assumption. To Pigou and others the wage fund is given. The wage rate determined by dividing the wage fund with the number of workers. Pigou advocated a general cut in money wages in times of depression to restore full employment.

If there is a problem of unemployment in the economy. It is possible to solve this problem by reducing the money wages of the workers. This is known as “wage cut policy”. The given wage fund can offer more employment at a lower wage rate. The classicals believe that involuntary unemployment all involuntary unemployment would disappear.

According to classical theory of the labour supply and its demand depends on real wage rate. Real wage rate indicates the purchasing power of labourers. Because of existence of perfect competition in labour market real wage rate always equals to marginal productivity of labour. Labour supply is positively related to real wage rate and the demand for labour is inversely related to real Wage rate.

Question 5.

Distinguish between aggregate supply price and aggregate demand price.

Answer:

Aggregate supply price : When an entrepreneur gives employment to certain amount of labour. It requires the use of other factors of production or inputs. All these inputs have to be paid remunerations. When all these are added what we get is the value of the output produced or the expenditure incurred to supply employment for a specific number of labourers. By selling the output the entrepreneurs must expect to receive atleast what they have spent. This is known as the “Aggregate supply price” of the output or level of employment. As the level of output increases with the level of employment, aggregate supply price also increases with every increase in the level of employment.

Aggregate demand price : In Keynes theory the aggregate demand determines the level of employment. The aggregate demand price for a given output is the amount of money which the firms expect to receive from the sale of that output. Then aggregate demand will be equal to the sum of consumption (C) investment (I) and Government expenditure (G) for goods and services.

Therefore, Aggregate demand (AD) = C + I + G.

As the level of employment rises, the total income of the community also rises and therefore the aggregate demand, price also increases.

![]()

Question 6.

Explain the concept of effective demand.

Answer:

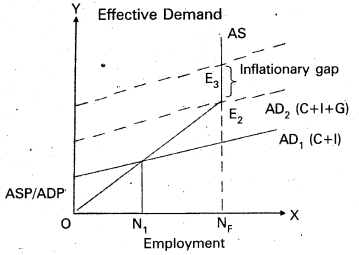

Effective demand means where aggregate demand equals the aggregate supply. When aggregate demand is equal to aggregate supply the economy is in equilibrium. This can be shown in the table.

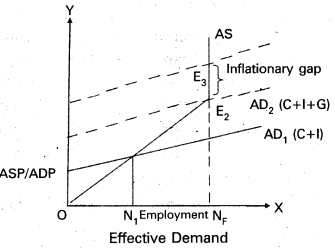

In the table when the level of employment is 14 lakh workers, aggregate demand price is equal to aggregate supply price i.e ₹ 700 crores. This can be shown in the following diagram.

In the above diagram aggregate demand price curve (AD) and the aggregate supply price curve (AS) interest each other at point E1. It shows the equilibrium point. The equilibrium has been attained at ON1 level of employment. It is assumed that ON1 in the above diagram does not indicate full employment as the economy is having idle factors of production. So it is considered as under-employment equilibrium.

According to Keynes, to achieve full employment an upward shift of aggregate demand curve is required. This can be possible through government expenditure on goods and services supplied in the economy, whenever private entrepreneurs may not show interest to invest. With this the AD1 curve (C + I) shift as AD2 (C + I + G) at new point of effective demand E2, where the economy reaches full employment level i.e., ONE

Question 7.

What are the sources of public Revenue. [March 18, 17, 16]

Answer:

Revenue received by the government from different sources is called public revenue.

Public revenue is classified into two kinds.

- Tax revenue

- Non-Tax revenue.

1) Tax Revenue : Revenue received through collection of taxes from the public is called tax revenue. Both the state and central government collect taxes as per their allocation in the constitution.

Taxes are two types.

a) Direct taxes:

- Taxes on income and expenditure. Ex : Income tax, Corporate tax etc.

- Taxes on property and capital assests. Ex : Wealth tax, Gift tax etc.

b) Indirect taxes : Taxes levied on goods and services. Ex : Excise duty, Service tax.

2) Non – tax revenue: Government receives revenue from sources other than taxes and such revenue is called non-tax revenue. They are

a) Administrative revenue : Government receives money for certain administrative services. Ex : License fee, Tution fee etc.

b) Commercial revenue : Modern governments establish public sector units to manufacture certain goods and offer certain services. The goods and services are exchanged for the price. So such units earn revenue by way of selling their products. Ex : Indian Oil Corporation, Bharath Sanchar Nigam Ltd, Bharath Heavy Electricals, Indian Railways, State Road Transport Corporations, Indian Air lines etc.,

c) Loans and advances : When the revenue received by the government from taxes and from the above non-tax sources is not sufficient to meet the needs of government expenditure, it may receive loans from the financial institutions operating within the country and also from the public. Modem government also taken loans from international financial institutions.

d) Grants-in-aid : Grants are amount received without any condition of repayment. They are not repaid.

These are two types.

- General grant,

- Specific grant.

![]()

Question 8.

List out various items of public expenditure. [March 16]

Answer:

Public expenditure is an important constituent of public finance. Modem governments spend money from various welfare activities. The expenditure incurred by the government on various economic activities is called public expenditure.

Governments incur expenditure on the following heads of accounts.

- Defence

- Internal security

- Economic services

- Social services

- Other general services

- Pensions

- Subsidies

- Grants to state governments

- Grants to foreign governments

- Loans to state governments

- Loans to public enterprises

- Loans to foreign governments

- Repayment of loans

- Assistance to states on natural calamities etc.

Very Short Answer Questions

Question 1.

Classical economics.

Answer:

The term classical economics refers to the body of economic group which held their influence from the letter half of the 18th century to the early part of the 20th century. The most important principle of classicism are personal liberty Private property and freedom of private enterprise.

![]()

Question 2.

Laissezf aire

Answer:

According to classicals the role of government in economic activities should be nominal or very less. The free play of economic forces it self bring about the fuller utilization of economic resources including labour. Any interference with the free play of market forces under such circumstances the state shall not interfere in economic matter. It should pursue a policy of laissez fair-a policy of, non-intervention in economic matters.

Question 3.

Say’s law of market [March 16]

Answer:

J.B Say a french economist advocated the famous ‘Law of markets’ on which the classical theory of employment is based. According to this law “supply creates its own demand”. According to this law whenever additional output is created. The factors of production which participate in that production receive incomes equal to that value of that output. This income would be spent either on consumption goods or on capital goods. Thus additional demand is created matching the additional supply.

Question 4.

Market mechanism

Answer:

Market mechanism is the method of solving the central problems of an economy viz., what to produce, how to produce, whom to produce use through the forces of demand and supply. This mechanisms used by a free enterprise capitalist economy.

Question 5.

Full employment [March 17]

Answer:

Full employment is a situation in which all those who are willing to work at the existing wage rate are engaged in work.

Question 6.

Aggregate demand function

Answer:

The schedule showing aggregate demand prices at different levels of employment in the economy is called as aggregate demand function.

![]()

Question 7.

Aggregate supply function

Answer:

The schedule showing the aggregate supply price at different levels of employment is called the aggregate supply function.

Question 8.

Effective demand [March 16]

Answer:

Effective demand is that aggregate demand which becomes equal to the aggregate supply. This refers to the aggregate demand at equilibrium.

Question 9.

Difference between revenue account and capital account

Answer:

Revenue account consists of the current transactions and includes value of transactions relating to export import travel expenses, insurance, investment, income etc. The capital account refers to the transactions of capital nature such as borrowing and lending of capital repayment of capital sale and purchase of shares and securities etc.

Question 10.

Difference between internal debt and external debt

Answer:

Internal debt is the debt which is borrowed by a government from the people and institutions with in the country is called internal debt.

External debt is amount borrowed by a government from institutions and government of other countries is called external debt.

Question 11.

Structure of budget

Answer:

Budget is the annual statement showing the estimated receipts and expenditure of the government for a financial year in the budget. The budget estimates and revised estimates of the current financial year and actual expenditure of the preceding financial year are shown.

![]()

Question 12.

Deficit budget [March 18]

Answer:

Deficit budget arises when the total expenditure in the budget exceeds the total receipts in the budget technically there are four types of deficit budgets.

- Revenue deficit

- Budget deficit

- Fiscal defict

- Primary defict

Question 13.

Fiscal deficit

Answer:

Fiscal deficit is the difference between total revenue and total expenditure plus the market borrowings.

Fiscal deficit = (Total revenue – total expenditure) + Other borrowing and other liabilities.

Question 14.

Primary deficit

Answer:

Primary deficit is the fiscal deficit minus the interest payments.

Additional Questions

Question 15.

Wage – cut policy

Answer:

This is the policy advocated by A.C Pigou to reduce unemployment in the economy. It suggests that the wages of the labour should be reduced so that the unemployed can be employed.

Question 16.

Vote on account

Answer:

Vote on account is an interium budget presented for a few months pending presentation of the regular budget.

Question 17.

Surplus budget

Answer:

It refers to the budget in which the total receipts exceed the total expenditure.

Question 18.

Balanced Budget

Answer:

It is the budget in which the total receipts and total expenditure are equal.

![]()

Question 19.

Revenue deficit

Answer:

Revenue deficit is the difference between the revenue receipts and the revenue ex-penditure.

Question 20.

Redemption of debt

Answer:

Redemption of public debt means repayment of public debt.

Question 21.

Budget.

Answer:

Budget is the annual statement of the estimated receipts and estimated expenditure of the government for the ensuing financial year.