Andhra Pradesh BIEAP AP Inter 1st Year Economics Study Material 7th Lesson National Income Textbook Questions and Answers.

AP Inter 1st Year Economics Study Material 7th Lesson National Income

Essay Questions

Question 1.

Define National Income and explain the various concepts of National Income.

Answer:

National Income means the aggregate value of all the final goods and services produced in the economy in one year.

Concepts of National Income :

1) Gross National Product (GNP) : It is the total value of all final goods and services produced in the economy in one year.

The main components of GNP are :

a) The goods and services purchased by consumers – C.

b) Investments made by public and private sectors – I.

c) Government expenditure on public utility services – G.

d) Incomes earned through International Trade (x – m).

e) Net factor incomes from abroad.

GNP at market prices = C + I – G + (x – m) + Net factor income from abroad.

2) Gross Domestic Product (GDP) : The market value of the total goods and services produced in a country in one particular period usually in a year is the GDP

GDP = C + I + G

3) Net National Product (NNP) : Firms use continuously machines and tools for the production of goods and services. This result in a loss of value due to wear and tear of fixed capital. The loss suffered by fixed capital is called depreciation. When we substract depreciation from GNP we get NNP

NNP = GNP – depreciation.

4) National Income at factor cost: The cost of production of a good is equal to the rewards paid to the factors which participated in the production process. So the cost of production of a firm is the rent paid land, wages paid labour, interest paid on capital and profits of the entrepreneur.

National Income at factor cost = NNP + Subsidies – Indirect Taxes – Profits of Govt, owned firms.

5) Personal Income: It is the total of incomes received by all persons from all sources in a specific time period. Personal income is not equal to National Income. Because social security payments. Corporate taxes, undistributed profits are deducted from national income and only the remaining is received by persons.

Personal Income = National Income at factor cost – Undistributed profits – Corporate taxes – Social security contributions + Transfer payments.

6) Disposable income : Personal income totally is not available for spending income tax is a payment which must be, deducted to obtain disposable income.

Disposable income = Personal income – Personal taxes

D.I = Consumption + Savings

7) Per capita income : National Income when divided by country’s population. We get per capita income.

Per capita Income = \(\frac{\text { National Income }}{\text { Total Population }}\)

The average standard of living of a country is indicated by per Capita income.

![]()

Question 2.

Explain the various methods of calculating National Income. [March 18, 17, 16]

Answer:

There are three methods of measuring National Income.

- Output method or Product method

- Expenditure method

- Income method

‘Carin cross’ says National Income can be looked in any one of the three ways. As the national income measured by adding up everybody’s income by adding up everybody’s output and by adding up the value of all things that people buy and adding in their savings.

1) Output method (Product method) : The market value of total goods and services produced in an economy in a year is considered for estimating National Income. In order to arrive at the value of the product services, the total goods and services produced are multiplied with their market prices. .

Then National Income = (P1Q1 + P2Q2 + ……….. PnQn) – Depreciation – Indirect taxes + Net income from abroad.

Where P = Price

Q = Quantity

1, 2, 3 n = Commodities & services

There is a possibility of double counting. Care must be taken to avoid this. Only final goods and services are taken to compute National Income but not the raw materials or intermediary goods. Estimation of the National Income through this method will indicate the contribution of different sectors, the growth trends in each sector and the sectors which are lagging behind.

2) Expenditure method : In this method we add the personal consumption expenditure of households, expenditure of the firms, government purchase of goods and services net exports plus net income from abroad.

NI – EH + EF + EG + Net exports + Net income from abroad.

Here National Income = Private final consumption expenditure + Government final consumption expenditure + Net domestic capital formation + Net exports + Net income from abroad

EH = Expenditure of households

EF = Expenditure of firms

EG = Expenditure of Government

Care should be taken to include spending or expenditure made on final goods and services only.

3) Income method : In this method, the incomes earned by all factors of production are aggregated to arrive at the National Income of a country. The four factors of production receive incomes in the form of wages, rent, interest and profits. This is also national income at factor cost.

NI = W + I + R + P + Net income from abroad

NI = National income

W = Wages I = Interest

R = Rent

P = Profits

This method gives us National Income according to distribute shares.

![]()

Question 3.

Describe the components of National Income.

Answer:

The total quantity of goods and services produced in the economy in a year is the National Income. The various components of the National Income are :

- Consumption (C)

- Gross Domestic Investment (I)

- Government Expenditure (G)

- Net foreign Investment (x – m) ‘

1) Consumption : By consumption, we mean the expenditure’ made on goods and services which directly satisfy our wants. Ex : Cloth, food products, education and health services etc. A major portion of the National Income comprises Only consumption goods and services.

Consumption expenditure depends on the level of income. Consumption and savings are the two parts of disposable income. Income which is left after consumption is the saving.

Consumption goods can be perishable or durable. Perishable goods are single use goods. Ex : Food. Durable goods can be used more than once for a longer time.

Ex : Vehicles, fans etc.

2) Gross Domestic Investment : The expenditure made on producer goods by the firms to produce goods and services is the investment expenditure. Ex : Machinery and tools etc. They satisfy wants indirectly. For instance, the plough used for producing rice cannot give us satisfaction directly. Producer goods are most essential for the growth in National Income.

3) Government expenditure : The expenditure incurred on various goods and services by the government is the public expenditure. This is what is meant by government consumption. Government provides roads, schools, medical facilities, irrigation, electricity, infrastructure facilities etc., to the society.

It also provides administrative services, defence services etc. The public expenditure is determined by the nature of economic system.

4) Net foreign Investment: Some goods produced in the economy are exported to other countries. In the same way, some goods which are required in the economy are imported into the country. If the value of exports is more than the value of imports, other countries are indebted to our country. So, it must be added to National Income. If the value of imports is more than exports, that difference must be deducted from National Income.

Exports – Imports = Net foreign investment National Income = C + I + G + (x – m)

Short Answer Questions

Question 1.

What are the factors that determine National Income ? [March 17]

Answer:

National Income is the total market value of all goods and services produced in a country during a given period of time. There are many factors that influence and determine the size of national income country.

a) Natural resources : The availability of natural resources in a country, its climatic conditions, geographical features, fertility of soil, mines and fuel resources etc., influence the size of National Income.

b) Quality and Quantity of factors of production : The national income of a country is largely influenced by the quality and quantity of a country’s stock of factors of production.

c) State of technology : Output and national income are influenced by the level of technical progress achieved by the country. Advanced techniques of production help in optimum utilization of a country’s national resources.

d) Political will and stability: Political will and stability in a country helps in planned economic development and for a faster growth of National Income.

![]()

Question 2.

What is National Income at factor cost ? [March 18, 16]

Answer:

The cost of production of good is equal to the rewards paid to the factors which participated in the production process. So the cost of production of a firm is the rent paid to land, wages paid to labour, interest paid on capital and profits of the entrepreneur. These are received by suppliers of factors of production. There is a difference between net National Income at market prices and National Income at factor of cost. Imposition of tax increases the market prices. When these taxes deducted from net National Income, remaining income gets distributed among the factors of production.

Sometimes, the government may offer subsidies to encourage production of certain goods. The market prices of such goods will decrease to that extent. The value of subsidies is not included in net national product. So, it is to be added.

National Income at factor cost = NNP + Subsidies – Indirect taxes.

Question 3.

Mention any three definitions of National Income.

Answer:

National Income is the total market value of all goods and services produced in a country during a given period of time. ,

Several economists have defined National Incomes as follows :

Pigou’s definition : According to Pigou “National Income is that part of the objective income of the community including of course income derived from abroad which can be measured in money”.

Fisher’s definition : “The National dividend or income consists solely of services as received by ultimate consumers, whether from their material or from their human environment.

Marshall’s definition : “The labour and capital of country acting on its natural resources, produce annually a certain net aggregate of commodities, material and immaterial including services of all kinds. This is the net annual income or revenue of a country”.

Kuznet definition : According to Kuznets, National Income is the net output of commodities and services flowing during the year from the country’s productive system into the hands of the ultimate consumers or into the net additional to country’s capital goods”.

![]()

Question 4.

What is the relationship between per capita income and population ?

Answer:

There is a close relationship between national income and population. These two together determine the per capita income. If rate of growth of national income is 6% and rate of growth of population is 3% the rate of growth of per capita income will be 3% and it can be expressed as follows.

QPC = Q – QP

QPC = Rate of growth of per capita income

Q = Rate of growth of national income

QP = Rate of growth of population

A rise in the per capita income indicates a rise in standard of living. The rise in per capita income is possible only when the rate of growth of population is less than the rate of growth of that national income.

Additional Questions

Question 5.

Importance of National Income estimates.

Answer:

The importance of national income studies is growing because of several reasons.

- The national income estimates are very important for preparing economic plans.

- It is a very important tool for framing economic policies. .

- It is very useful in making budgetary allocations.

- It helps us to compare economic growth with other countries.

- It is essential to calculate per capita incomes in a country and income inequalities.

- It helps the government in macroeconomic policy making.

Question 6.

Explain circular flow of goods, services and incomes.

Answer:

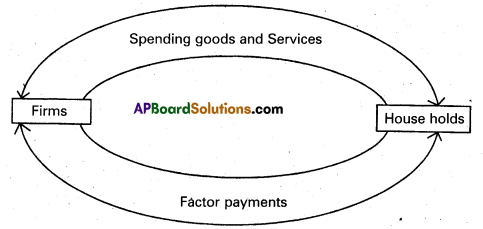

Income is flow from wealth where as wealth is a stock. In every economy income flows from households to firms and vice versa. Thus the factor market and the product market are closely related to each other.

The process of circular flow of income of income makes to understand that income flows from households, firms and firms to households. The same can be understood from the following diagram.

In this diagram from households to firms shows the spending of households on goods and services produced by firms. The second arrow from firm to households shows the flow of goods and services from firm to households. These two arrows show the goods and services market. The other two arrows in second half of the diagram (lower part) represents the factors of production market.

Very Short Answer Questions

Question 1.

GNP (Gross National Product)

Answer:

It is the total value of all final goods and services produced in the economy in one year.

GNP = C + I + G + (x – m) where

C = Consumption

I = Gross National Investment

G = Government Expenditure

X = Exports

M = Imports

x – m = Net foreign trade.

![]()

Question 2.

Per capita Income [March 18, 17, 16]

Answer:

National Income when divided by country’s population, percapita income is obtained.

Per capita Income = \(\frac{\text { National Income }}{\text { Total Population }}\)

The average standard of living of country is indicated by per capita income.

Question 3.

Depreciation

Answer:

Firms use continuously machines and tools for the production of goods and services. This results in a loss of value due to wear and tear of fixed capital. This loss suffered by fixed capital is called depreciation.

Question 4.

Disposable Income

Answer:

Personal income totally is not available for spending. Income tax is payment which must be deducted to obtain disposable income.

Disposable Income = Personal income – Personal taxes

DI = Consumption + savings

Additional Questions

Question 5.

Circular flow of income

Answer:

Flow of income from firms to households and from households to firms.

![]()

Question 6.

Subsidies

Answer:

Share of government in price of a commodity.

Ex : Agriculture products.

Question 7.

National Income

Answer:

The total value of all final goods and services produced in the economy in a year.