Andhra Pradesh BIEAP AP Inter 1st Year Accountancy Study Material 10th Lesson Trail Balance Textbook Questions and Answers.

AP Inter 1st Year Accountancy Study Material 10th Lesson Trail Balance

Short Answer Questions

Question 1.

Define ‘TrialBalance’.

Answer:

“Trial Balance is a statement, prepared with the debit and credit balances of ledger accounts to test the arithmetical accuracy of the books.” – J.R. Batliboi

“A Trial Balance is a list of all the balances standing on the ledger accounts and cash book of a concern at any given date.” – Spicer and Peglar

Question 2.

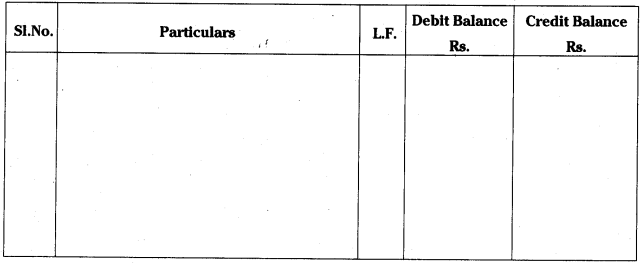

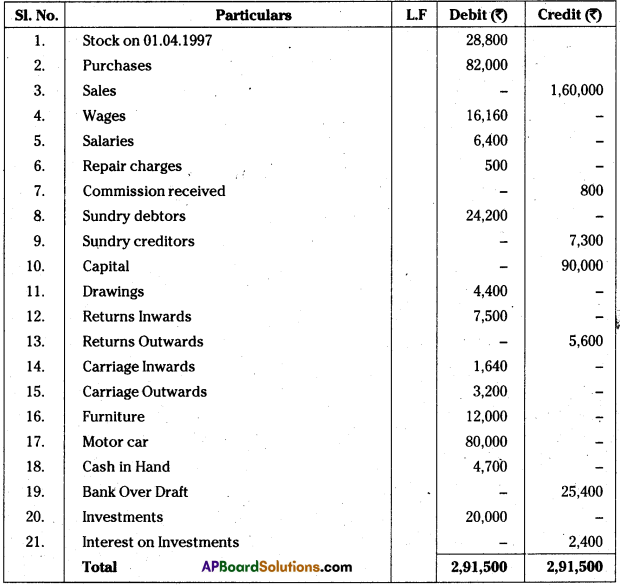

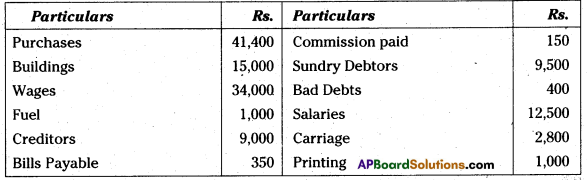

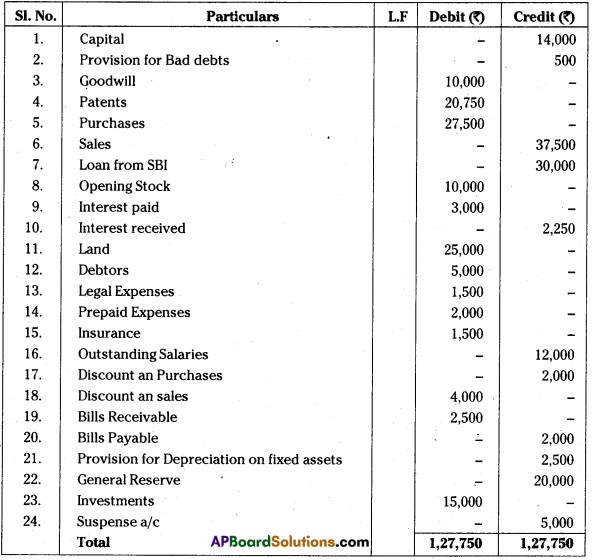

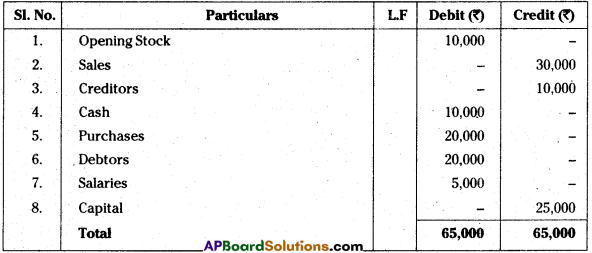

Give the format of Trial Balance.

Answer:

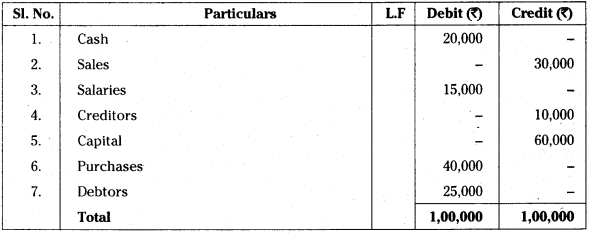

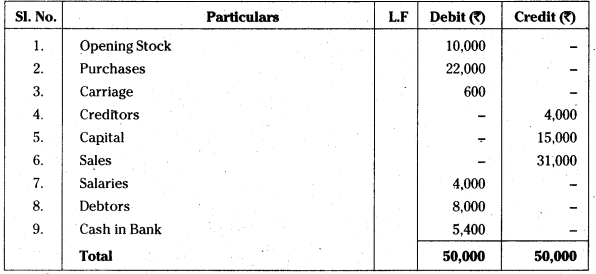

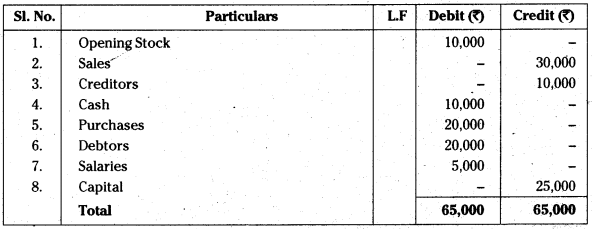

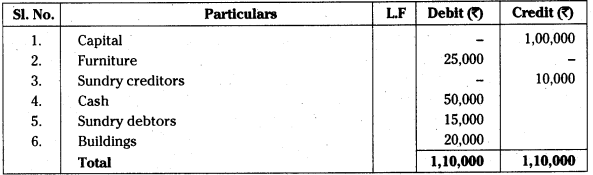

Trial Balance of ……. as on ……

![]()

Question 3.

What are the objectives of the Trial Balance ?

Answer:

Objectives of trial balance are :

- To verify the arithmetical accuracy of ledger accounts.

- To know the balances of various ledger accounts.

- Final accounts can be prepared on the basis of trial balance.

- Trial balances of various years are useful for comparison and get conclusions.

Question 4.

What are the methods of preparation of Trial Balance ?

Answer:

There are two methods to prepare trial balance.

- Total Balances Method : Under this method total of debit side and total of credit side of each individual a/c is taken into trial balance. This method is not in use now.

- Net Balances Method : Under this method, balance in each ledger a/c is taken into trial balance. All the ledger a/cs showing debit balances are put on the debit side of the trial balance and the accounts showing credit balances are put on the credit side.

Essay Type Questions

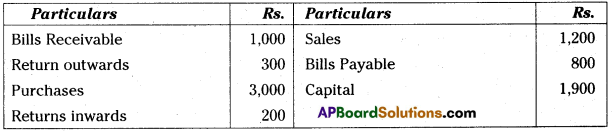

Question 1.

What is Trial Balance ? How it is prepared ?

Answer:

Trial balance is a statement of balances/totals of accounts of a business concern and prepared to check the arithmetical accuracy of the books.

Preparation of Trial balance : The following points are to be kept in the mind while preparing the Trial Balances.

- Draw the pro forma of trial balance with the title.

- Trial balance is a statement; hence we need not use the words ‘to’ or ‘by’.

- Show all types of assets in debit column.

- Show all types of liabilities in credit column.

- Show all types of expenses in debit column,

- Show all types of incomes in credit column.

- Show reserves and surpluses / reserve funds / provisions in credit columns.

- Show intangible assets in debit column E.g. good will, patents, royalties

- Show purchases and sales returns in debit column.

- Show sales, purchase returns in credit column.

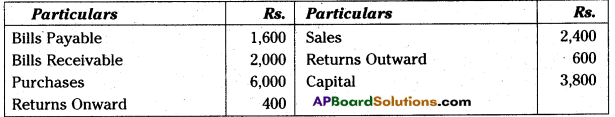

![]()

Question 2.

Explain the merits and demerits of Trial Balance.

Answer:

Merits:

- It helps in ascertaining the arithmetical accuracy of ledger accounts.

- It helps in detecting errors.

- It helps to get a summary of the ledger accounts.

- It helps in the preparation of final accounts.

Limitations:

- Certain type of errors remain even when the trial balance tallies.

- It is possible to prepare trial balance in which double entry book-keeping system is followed which is very expensive.

- Even if some transactions are omitted the trial balance tallies.

Problems

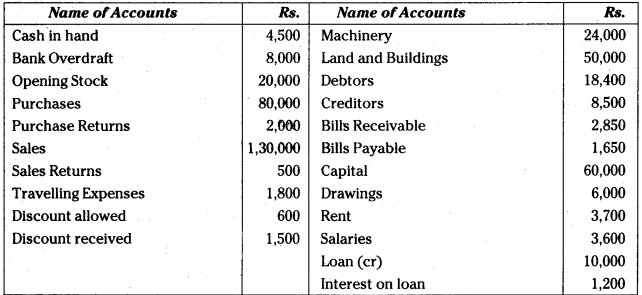

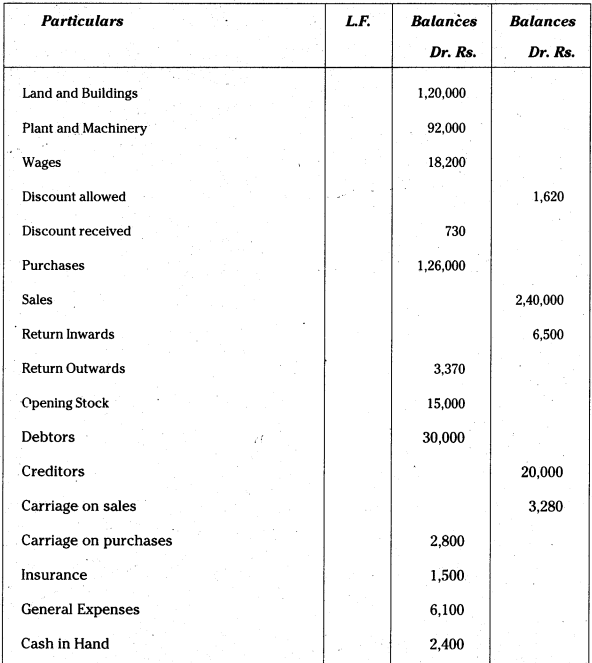

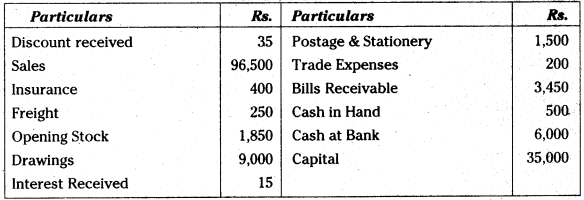

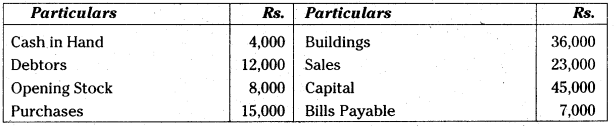

Question 1.

From the following balances taken from the books of Naveena as on December 2013, prepare a trial balance in proper form :

Answer:

Trial Balance of Naveena as on December 2013

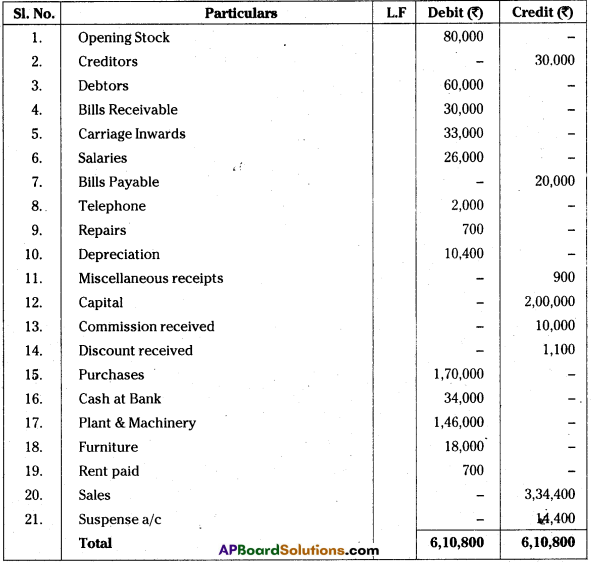

![]()

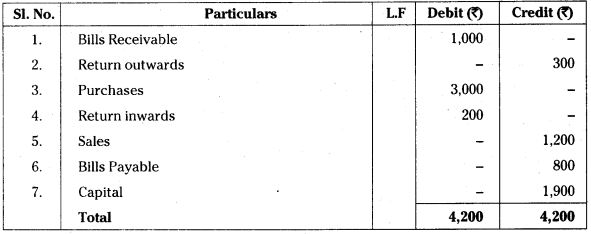

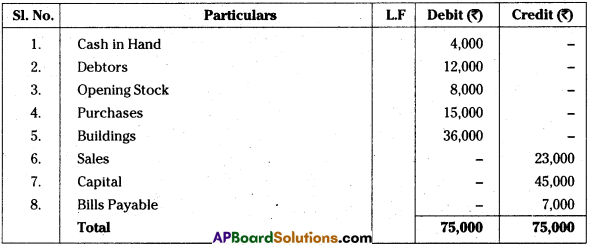

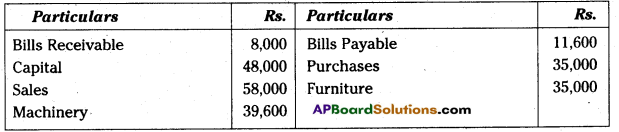

Question 2.

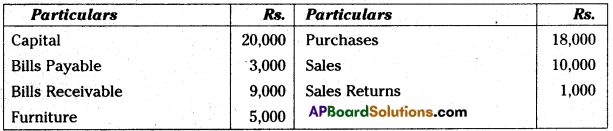

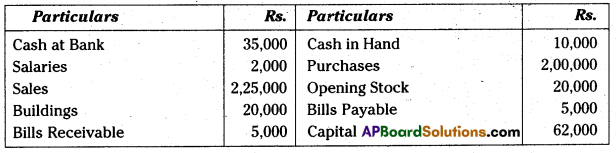

Prepare a Trial Balance from the following balances of Swathi as on 31st March 2013:

Answer:

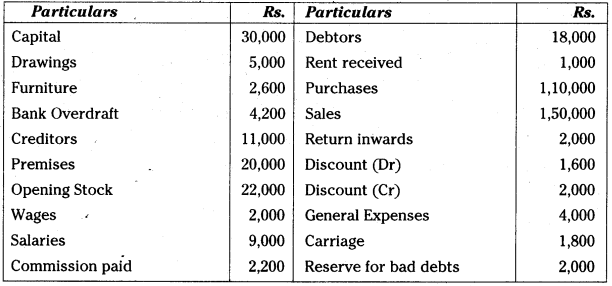

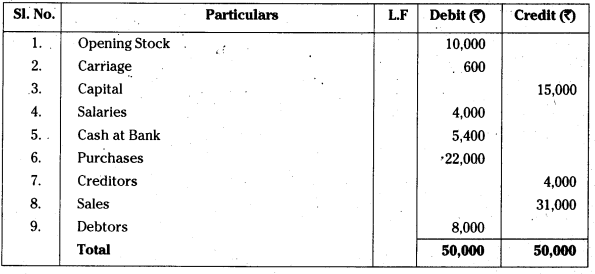

Trial Balance of Swathi as on 31st March 2013

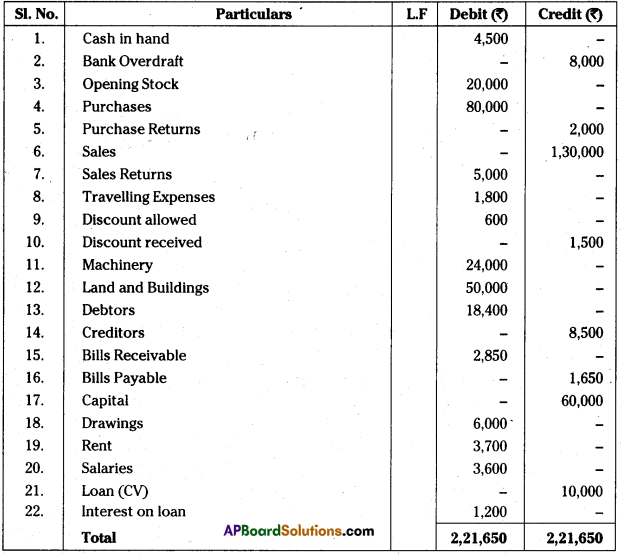

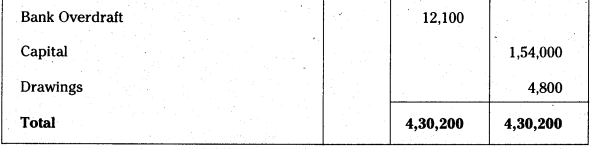

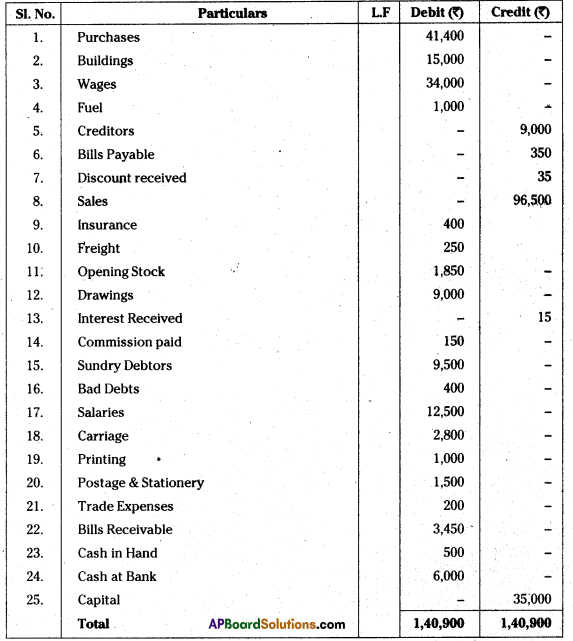

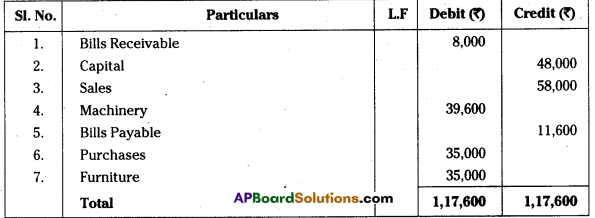

Question 3.

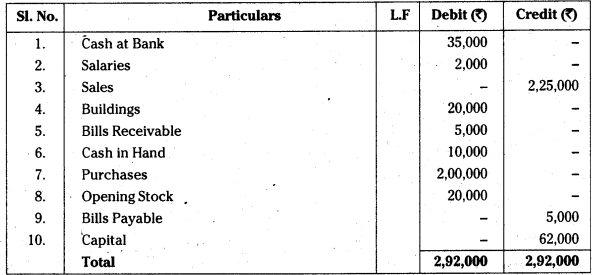

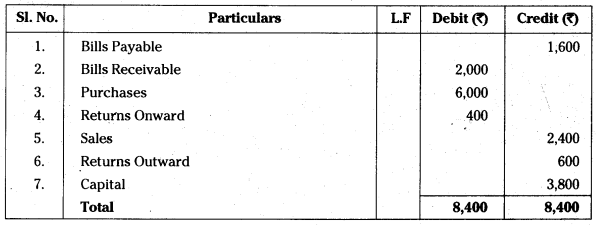

The following Trial Balance has been prepared by an inexperienced accountant. Redraft it in a correct form :

Answer:

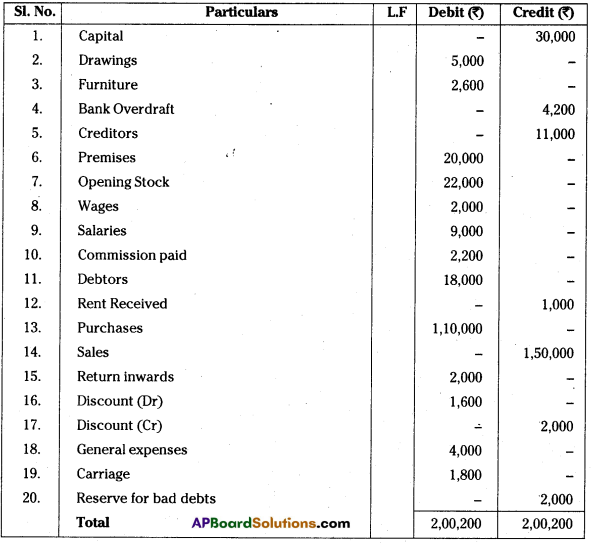

Correct Trial Balance

![]()

Question 4.

The following are the Balances extracted from the books ofRuthwik, prepare a Trial Balance as on 31-03-2013.

Answer:

Trial Balance of Ruthwik as on 31.03.2013

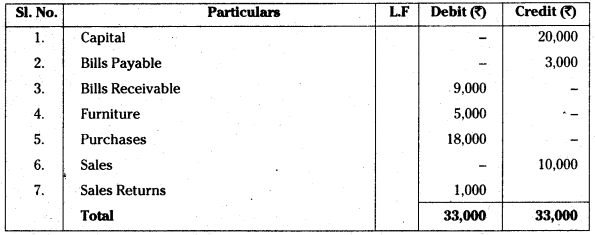

Question 5.

From the following balances, prepare Trial Balance of Harshini as at 31-12-2013.

Answer:

Trial Balance of Harshini as at 31.12.2013

![]()

Question 6.

The following are the balances extracted from the books ofSarayu on 31-08-2013 Prepare the Trial Balance.

Answer:

Trial Balance of Sarayu as on 31.8.2013

Question 7.

The following are the balances extracted from the books of Paddu as on 31 -01 – 2014. Prepare Trial Balance.

Answer:

Trial Balance of Paddu as on 31.1.2014

Question 8.

Prepare the Trial Balance of Renish as on 31.12.2013. (Mar. 2018 – A.P. ; May ’17 – A.P.)

Answer:

Trial Balance of Renish as on 31.12.2013

Question 9.

From the following balances prepare Trial Balance of Manas as on 31.12.2013.

Answer:

Trial Balance of Manas as on 31.12.2013

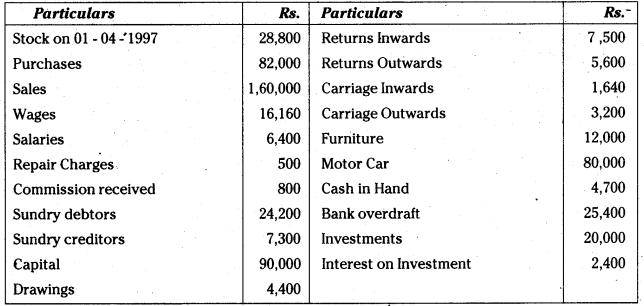

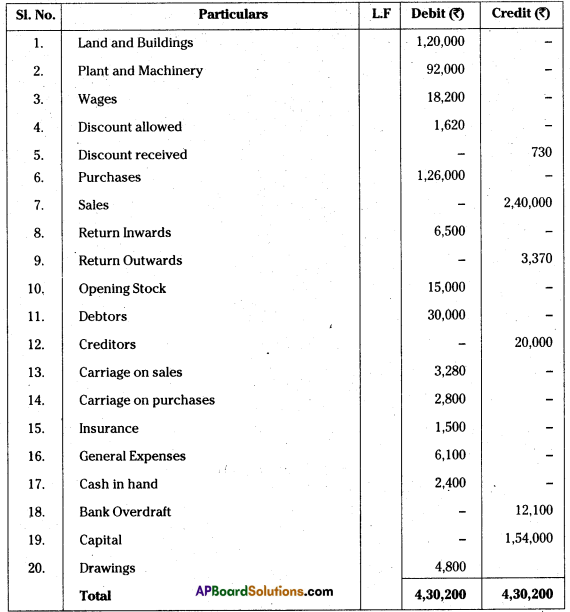

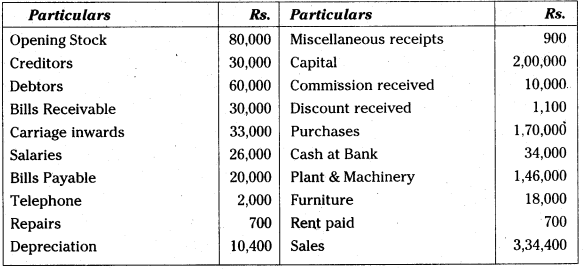

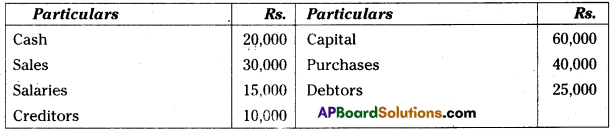

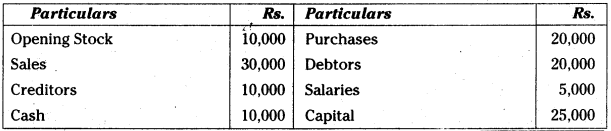

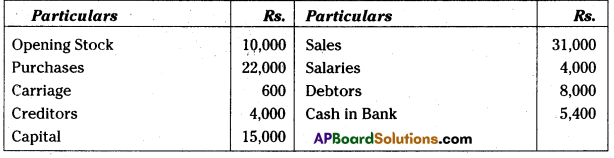

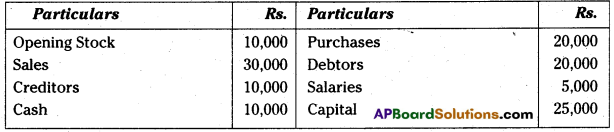

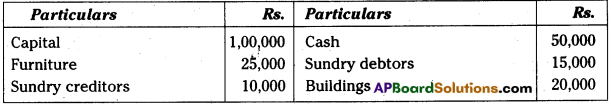

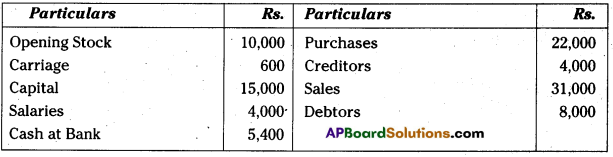

Question 10.

From the following balances prepare Trial Balance of Mridula as on 31.12.2013. (Mar. ’17 – A.P.)

Answer:

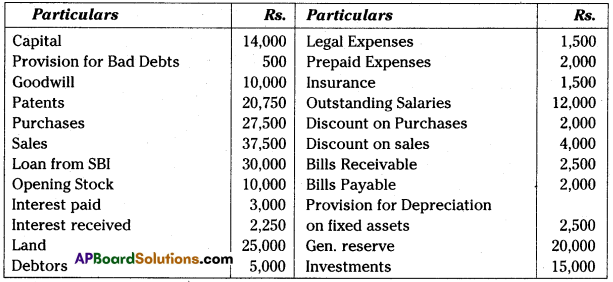

Trial Balance of Mridula as on 31.12.2013

![]()

Question 11.

Prepare Trial Balance of Prafulla from the following balances as on 31.12.2013. (Mar. 2019 – T.S.)

Answer:

Question 12.

Prepare Trial Balance of Suchitra as on 31.12.2013 from the following balances:

Answer:

Trial Balance of Suchitra as on 31.12.2013

Question 13.

Prepare trial Balance of Radha from the following balances:

Answer:

Trial Balance of Radha

Question 14.

Prepare Trial Balance of Snigdha form the following balances:

Answer:

Trial Balance of Snigdha

Question 15.

Prepare Trial Balance of Supreeth from the following balances as on 31-12-2010. [May – ’17 – T.S.]

Answer:

Trial Balance of Supreeth as on 31.12.2010

![]()

Question 16.

Prepare Trial Balance of Rohitha : (Mar. 2018 – T.S.)

Answer:

Trial Balance of Rohitha

Question 17.

Prepare Trial Balance ofSusmitha from the following balances as on 31.03.2013.

Answer:

Trial Balance of Smith as on 31.12.2013

Question 18.

Prepare Trial Balance of Sudha from the following particulars:

Answer:

Trial Balance of Sudha as on 31.12.2013

Question 19.

Prepare Trial Balance from the following balances.

Answer:

Trial Balance as on 31.12.2013

Student Activity

Visit any organisation and prepare a trial balance by extracting balances of accounts from its ledger.