Andhra Pradesh BIEAP AP Inter 1st Year Accountancy Study Material 7th Lesson Journal Proper Textbook Questions and Answers.

AP Inter 1st Year Accountancy Study Material 7th Lesson Journal Proper

Questions

Question 1.

What is Journal Proper?

Answer:

There are some transactions which cannot be recorded in any of the remaining seven subsidiary books, are entered in special book known as “Journal proper”.

Question 2.

Explain various kinds of transactions that are recorded in Journal Proper.

Answer:

The following are the transactions recorded in journal proper.

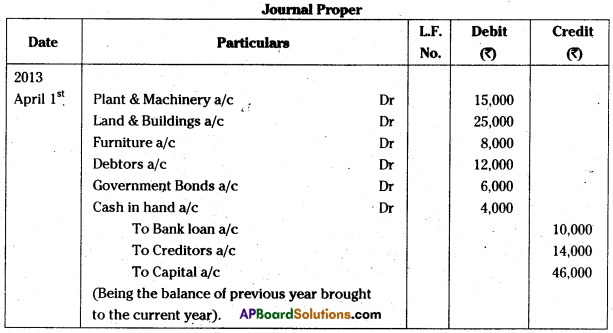

1) Opening entries : Opening entries are passed at the commencement of the new year, to record the balances of assets and liabilities brought forward from the previous year.

The rule to be applied as

Assets A/C

To Liabilities a/c

To Capital a/c

(Being last year balance brought forward).

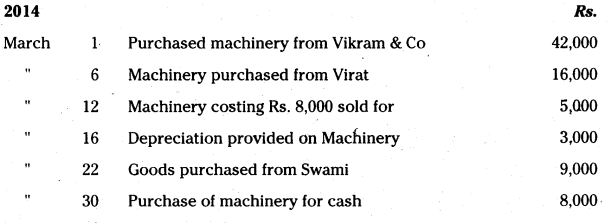

2) Purchase and sale of fixed assets: Business organisations either purchase or sell the assets for cash and sometimes on credit. If it is purchased on credit, then the entry should be recorded in the journal proper.

Example : Purchased machinery from Godrej Company 40,000.

3) Rectification entries : Sometimes errors may occur while recording transactions, posting them into the ledger or while balancing the ledger accounts. In such cases certain entries should be passed in order to rectify the errors. Such entries are called “Rectification entries”.

Example : Rama paid Rs. 1000. This was credited to Bheema’s A/c.

4) Adjustment entries: At the time of preparation of final accounts of the business firm some adjustments are to be made. The journal entries relating to these adjustments are known as “Adjustment entries”.

Example: Outstanding expenses, prepaid expenses, incomes receivable, income received in advance, depreciation, etc.

5) Closing entries: At the end of every financial year the balances of all the Nominal accounts are transferred to the Trading and Profit & Loss accounts. These transferred entries are known as Closing entries. All expenses and losses are debited and incomes and gains are credited to Trading, Profit & Loss account.

6) Transfer entries: Sometimes the trader transfers the amount from one account to another account. This type of journal entries are known as ‘Transferred journal entries’.

Example : Transfer of Profit to Reserve Fund.

7) Other entries : It is not possible to enter same transactions in journal and hence they are recorded in Journal Proper.

Example: Interest on drawings, interest on capital, goods lost due to fire & theft, goods sent on consignment, etc.

![]()

Question 3.

Explain the following in not more than 5 lines.

a) Opening Entries

b) Rectification Entries

c) Adjustment Entries

d) Closing Entries

Answer:

a) Opening Entries : Opening entries are passed at the commencement of the new year, to record the balances of assets and liabilities brought forward from the previous year.

The rule to be applied as

Assets a/c Dr

To Liabilities a/c

To Capital a/c

(Being the last year balance brought forward).

b) Rectification Entries : Sometimes errors may occur while recording transactions, posting them into the ledger or while balancing the ledger accounts. In such cases certain entries should be passed in order to rectify the errors. Such entries are called “Rectification entries”.

Example : Rama paid Rs. 100. This was credited to Somu’s A/c.

c) Adjustment Entries: At the time of preparation of final accounts of the business firm some adjustments are to be made. The journal entries relating to these adjustments are known as “Adjustment entries”.

Example: Outstanding expenses, prepaid expenses.

d) Closing Entries: At the end of every financial year the balances of all the Nominal accounts are transferred to the Trading and Profit & Loss accounts. These transferred entries are known as Closing entries. All expenses and losses are debited and incomes and gains are credited to Trading, Profit & Loss account.

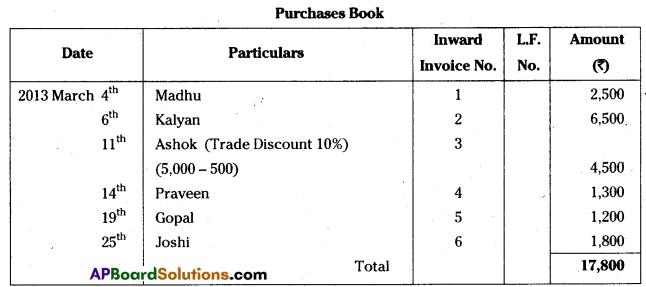

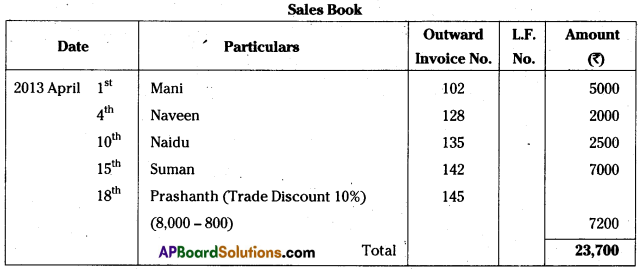

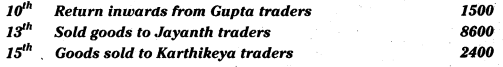

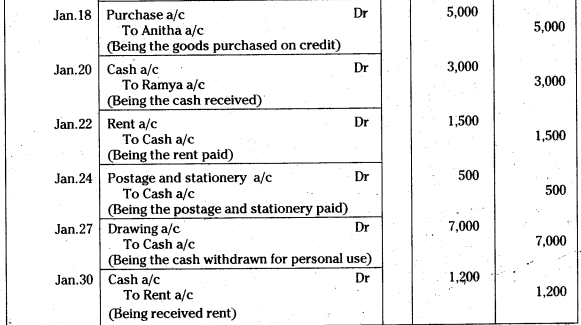

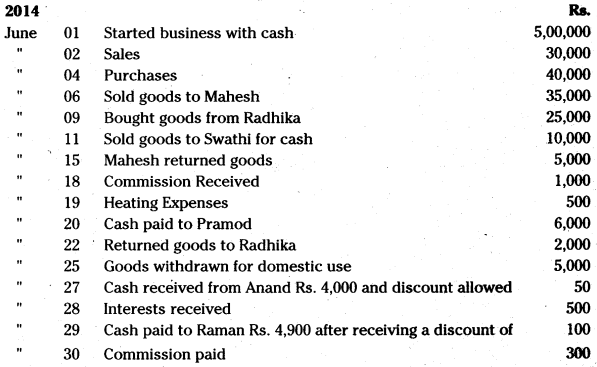

Problems

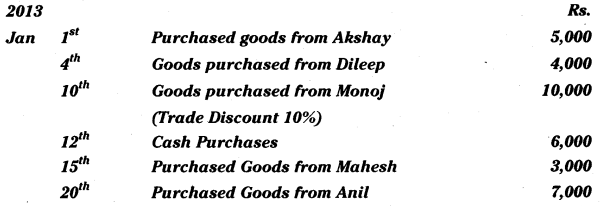

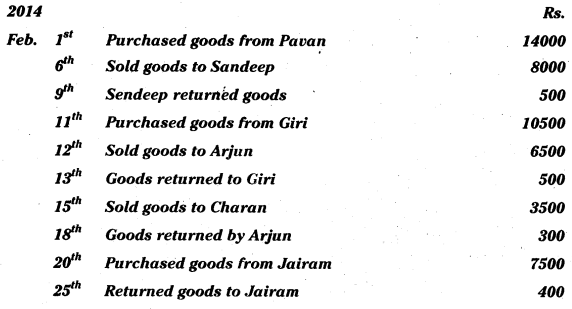

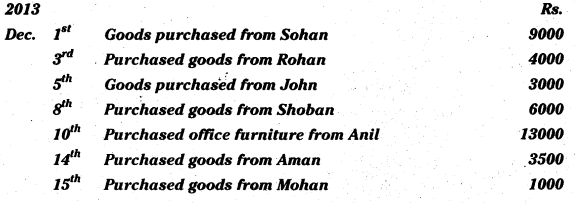

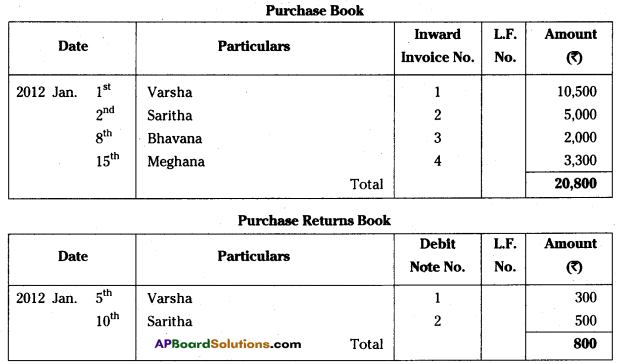

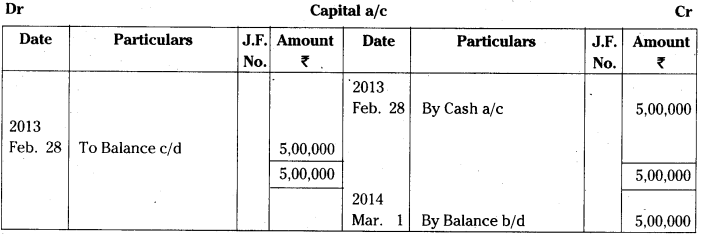

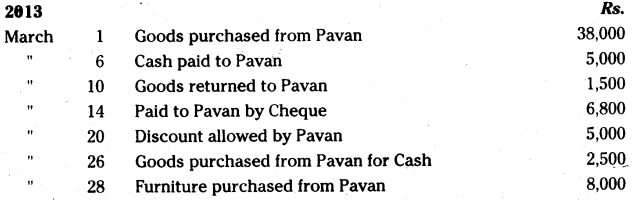

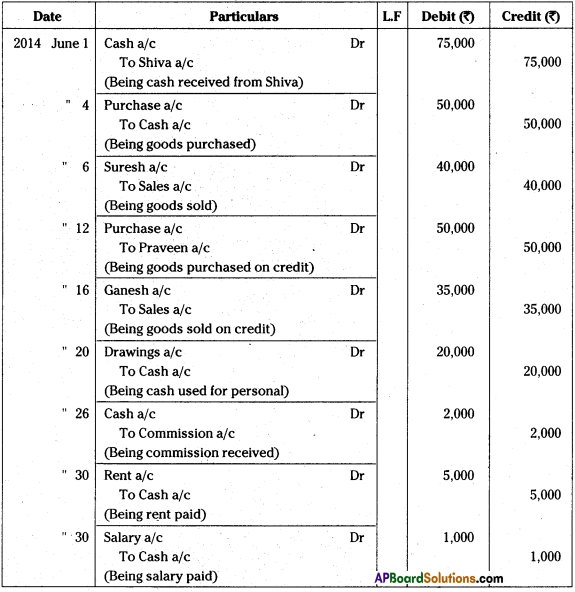

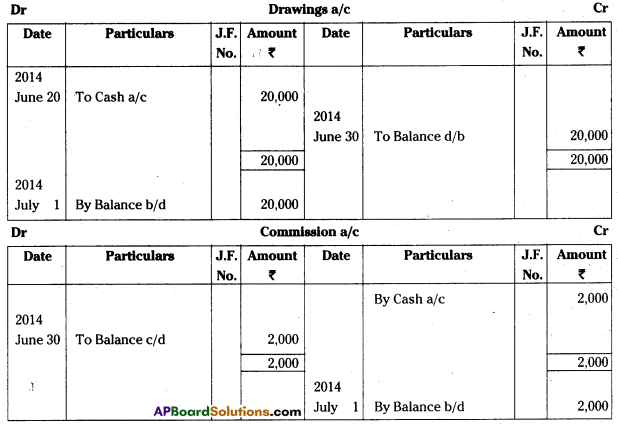

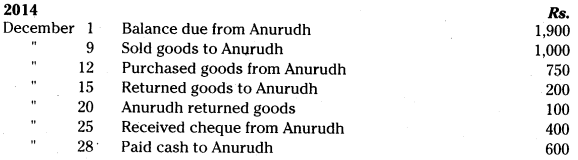

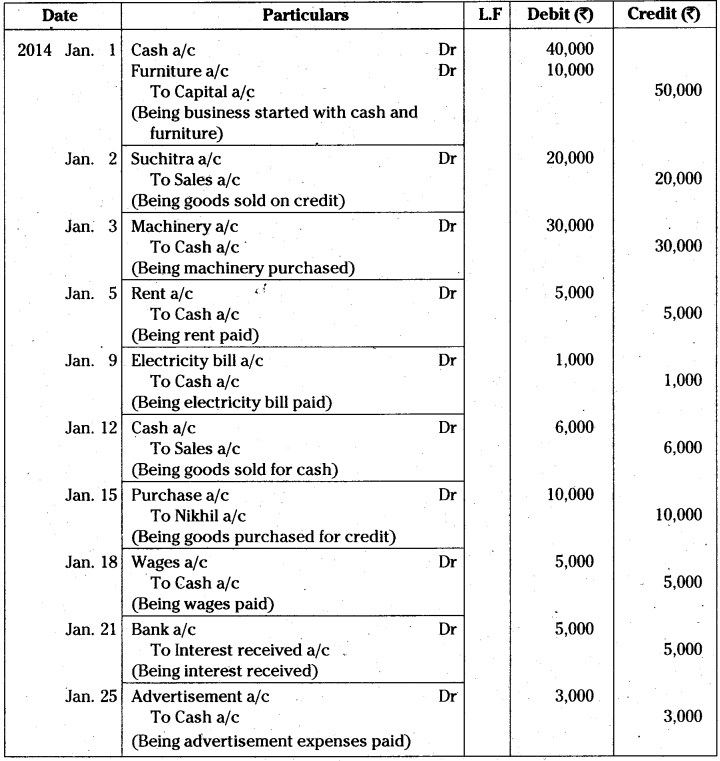

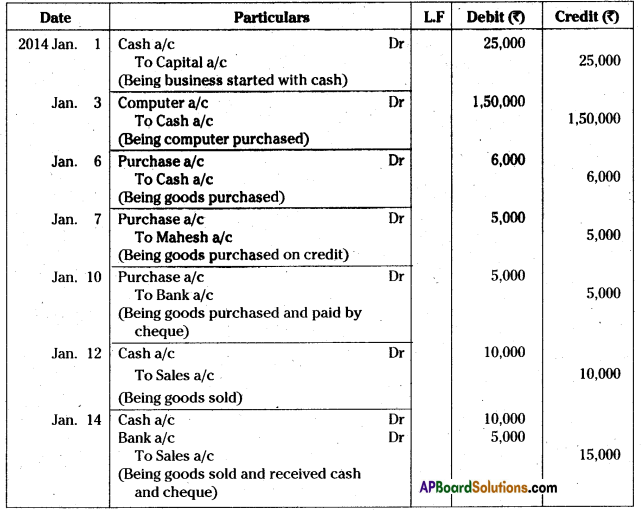

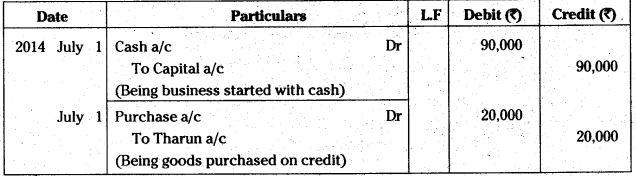

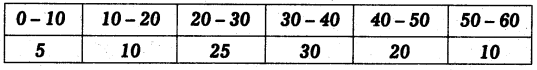

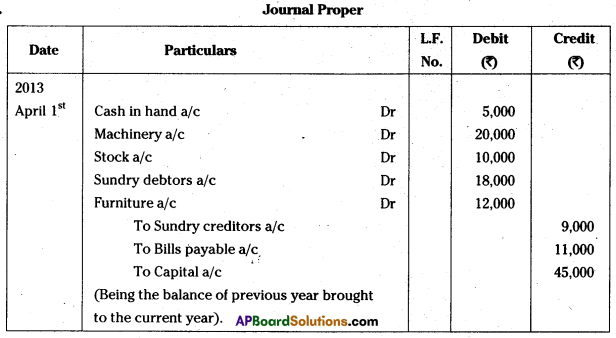

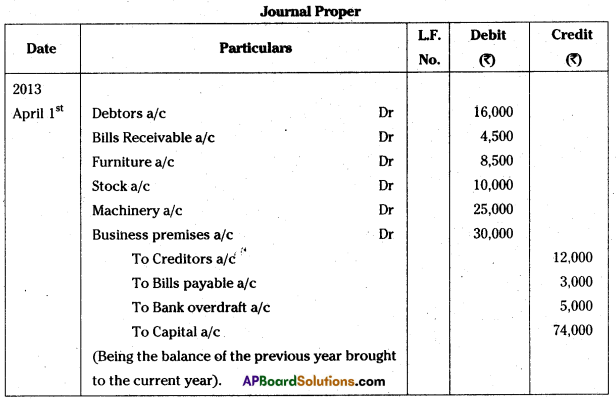

Question 1.

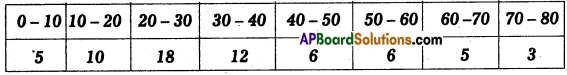

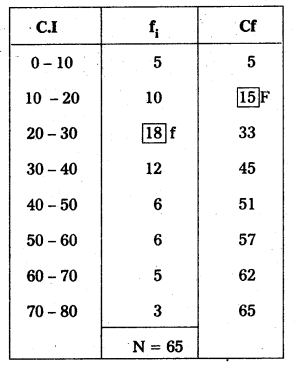

Record the Opening entry from the following particulars on 1st April 2013: (Mar. 2019 – T.S.) (Mar. 2018 : May 17 – A.P.)

Answer:

![]()

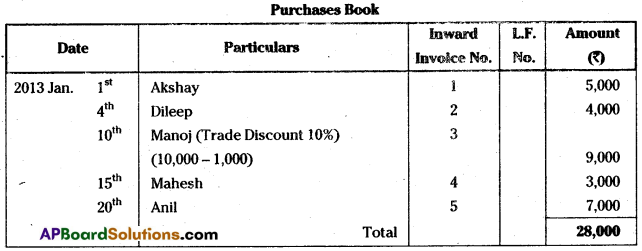

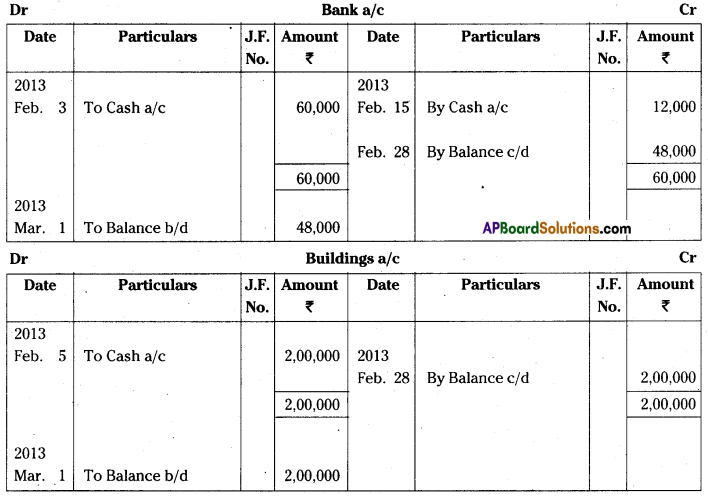

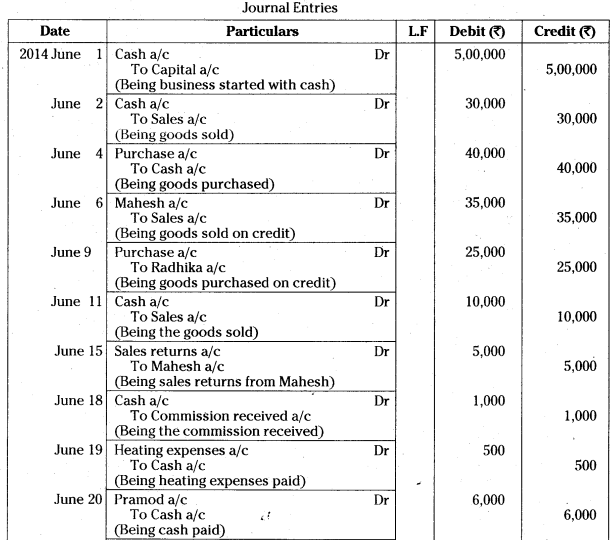

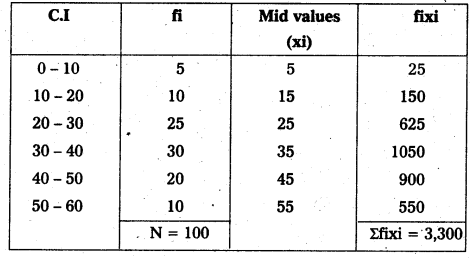

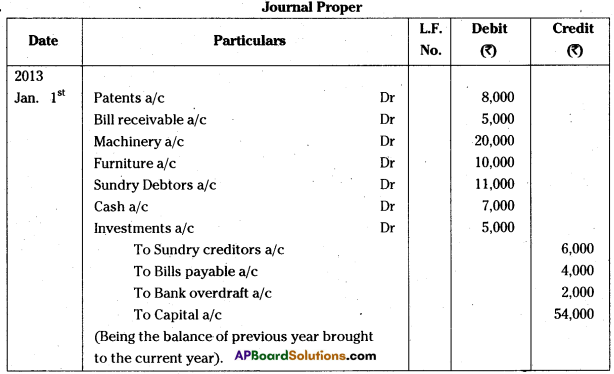

Question 2.

Write the Opening entry on 1st Jan. 2013 in the books of Ram from the following:

Answer:

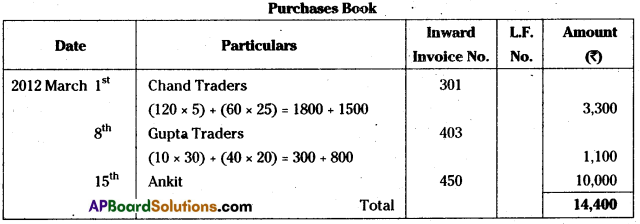

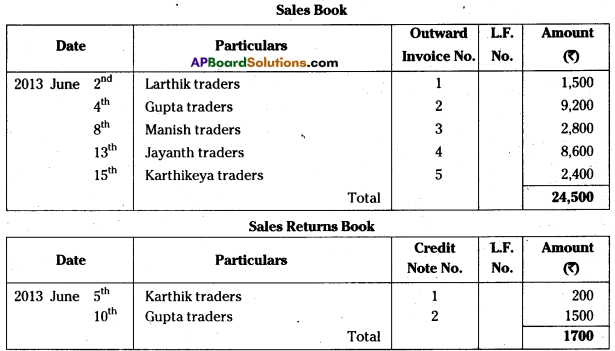

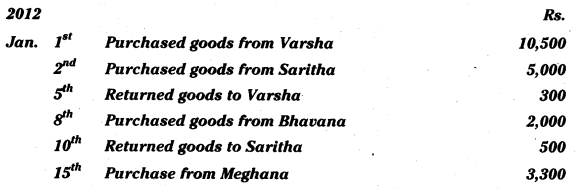

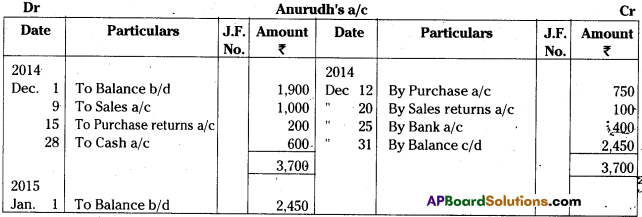

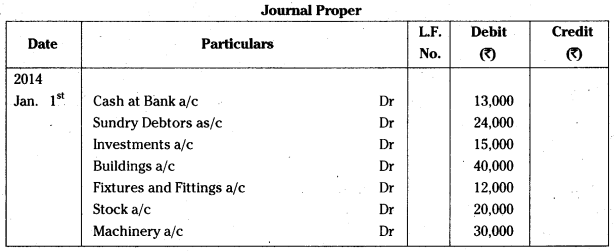

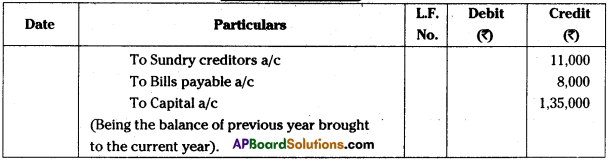

Question 3.

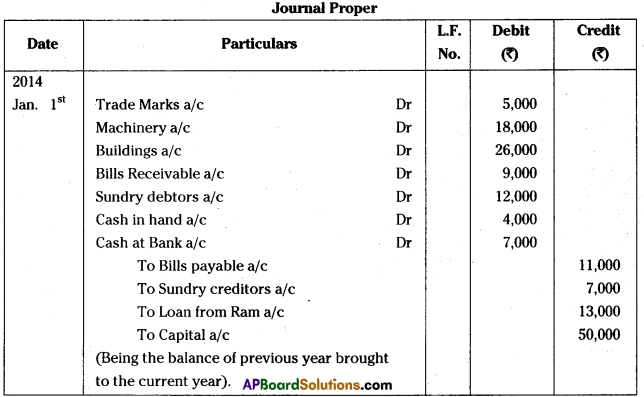

Record the Opening entry from the following assets and liabilities as on Jan. 1st, 2014:

Answer:

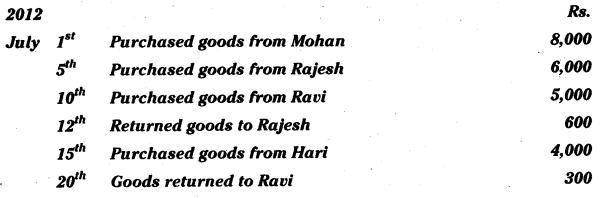

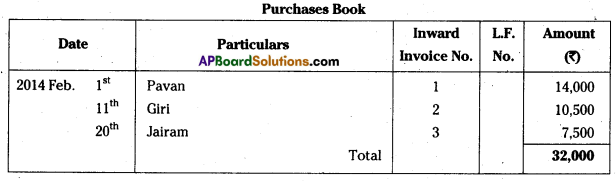

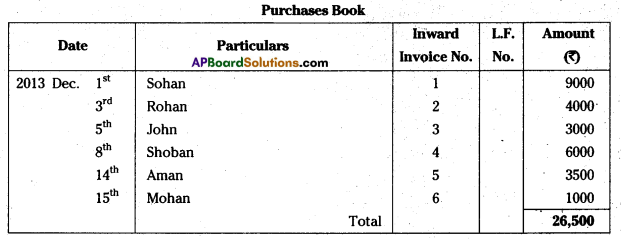

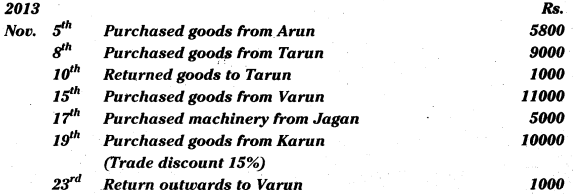

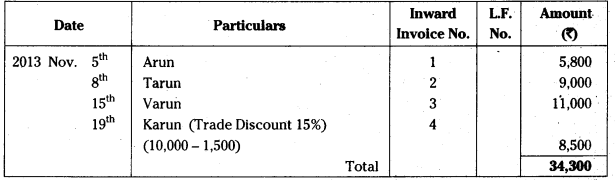

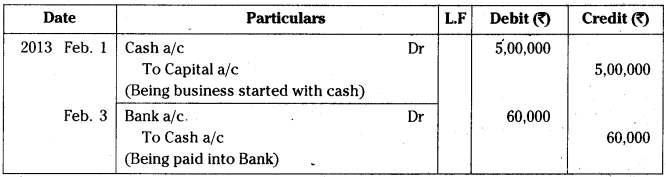

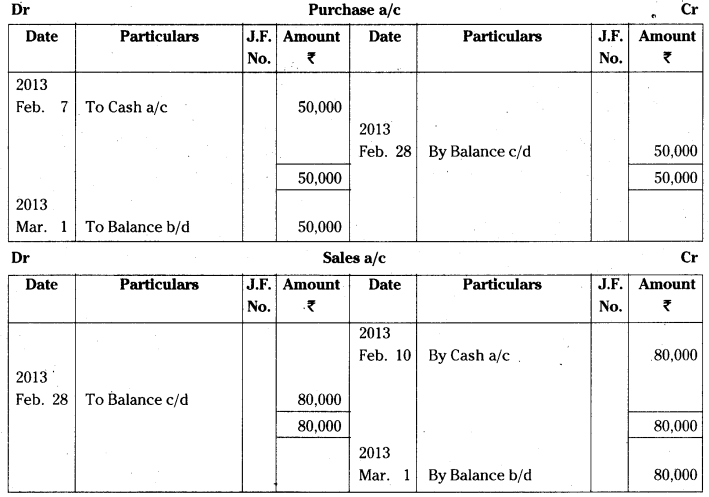

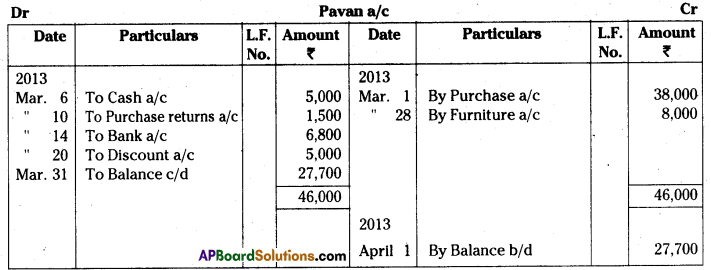

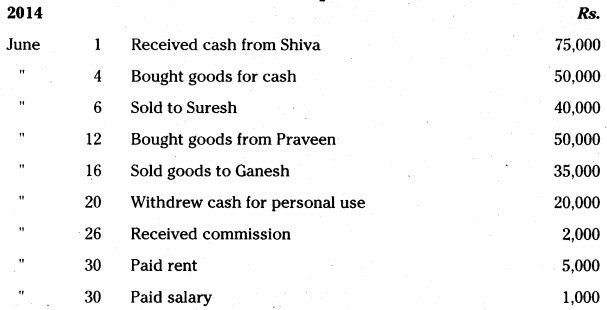

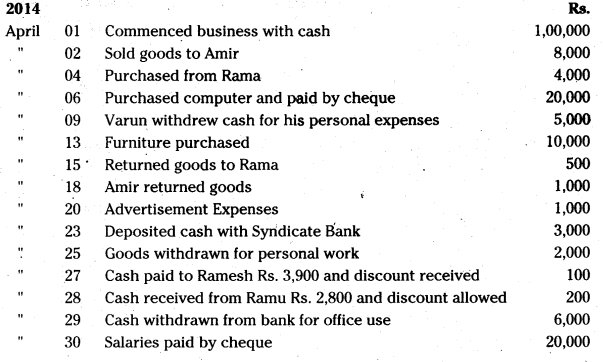

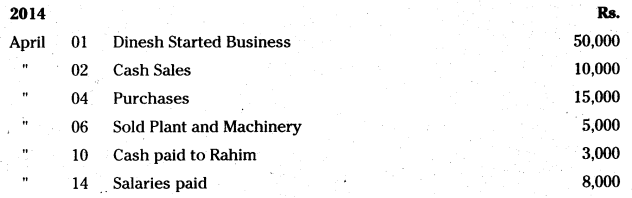

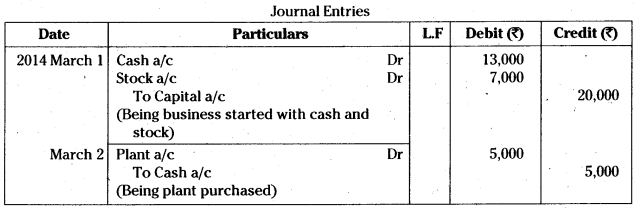

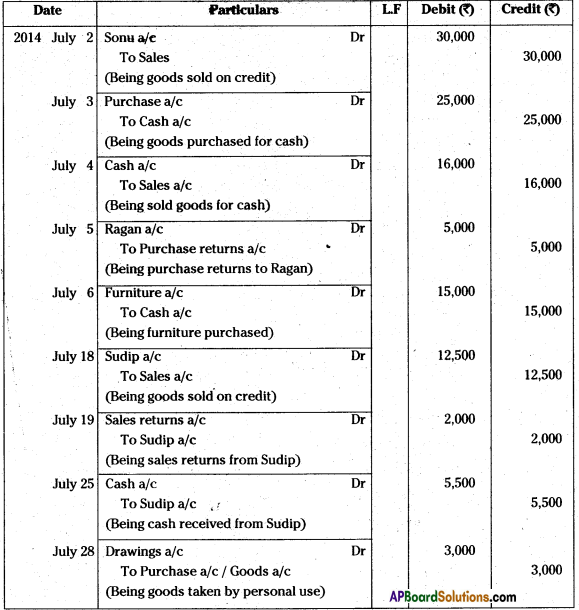

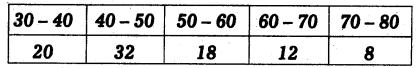

Question 4.

Pass Opening Journal Entry from the following particulars on 1st April, 2013.

![]()

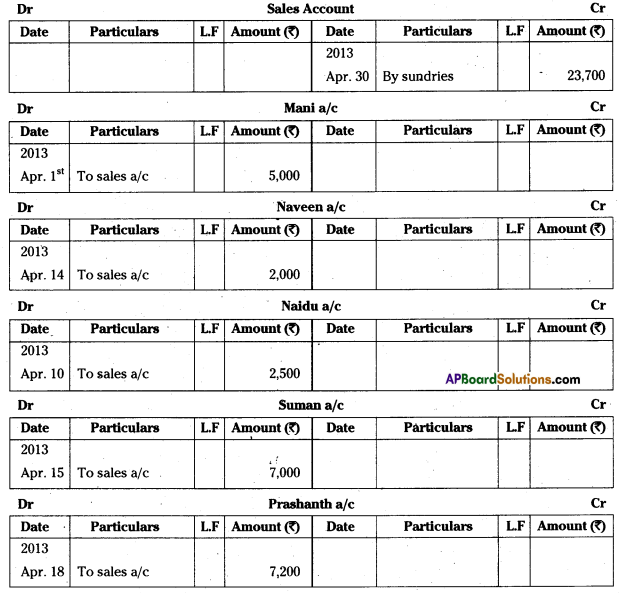

Question 5.

Record Opening entry on 1st Jan. 2014 from the following assets and liabilities:

Answer:

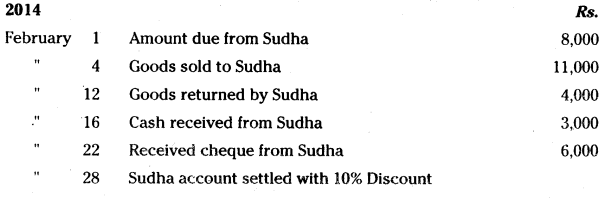

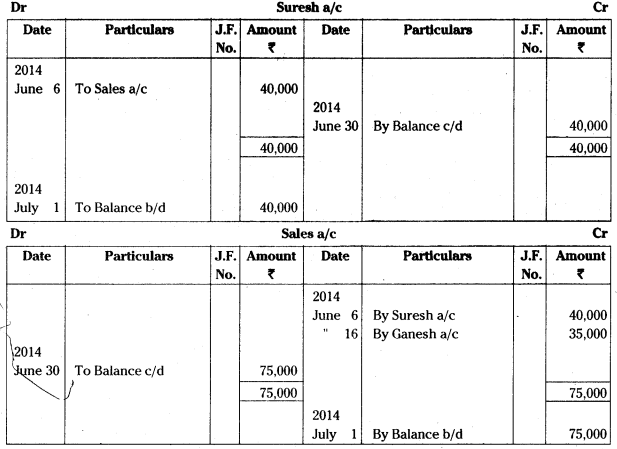

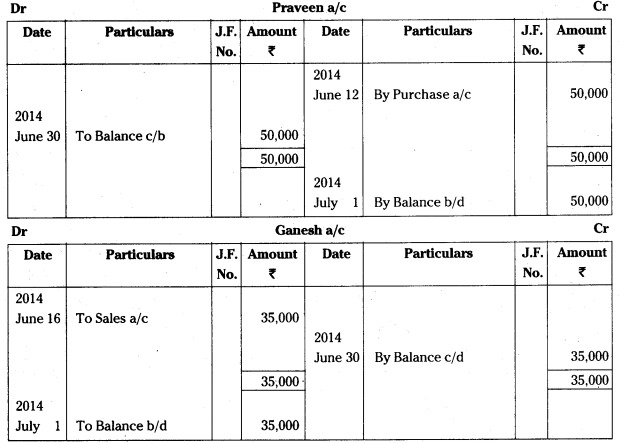

Question 6.

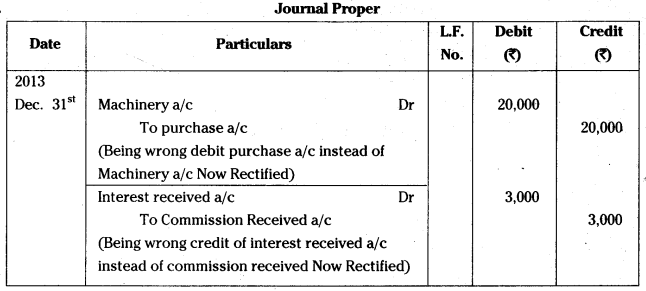

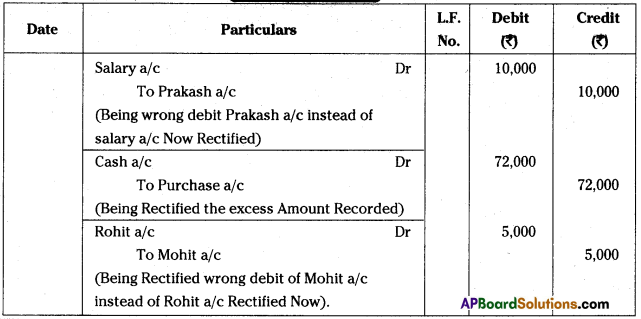

Rectify the following errors dated on Dec. 31st, 2013:

1. Machinery purchased Rs. 20,000, wrongly debited to Purchases a/c,

2. Commission received Rs. 3,000, wrongly credited to Interest received a/c,

3. Salaries paid to Accountant Prakash Rs. 10,000, debited to his personal a/c,

4. Purchased goods for Rs. 8,000, recorded as Rs. 80,000,

5. Paid cash to Rohit Rs. 5000, wrongly debited to Mohit a/c.

Answer:

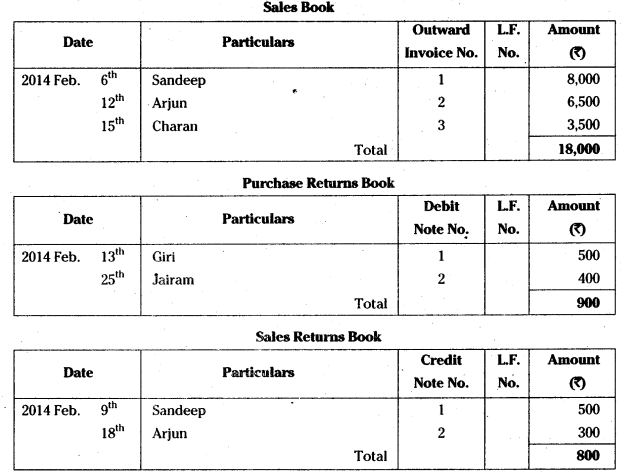

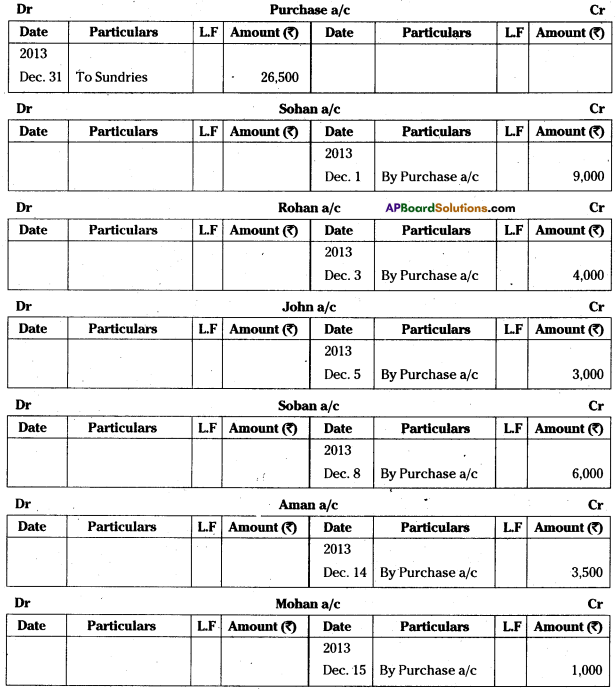

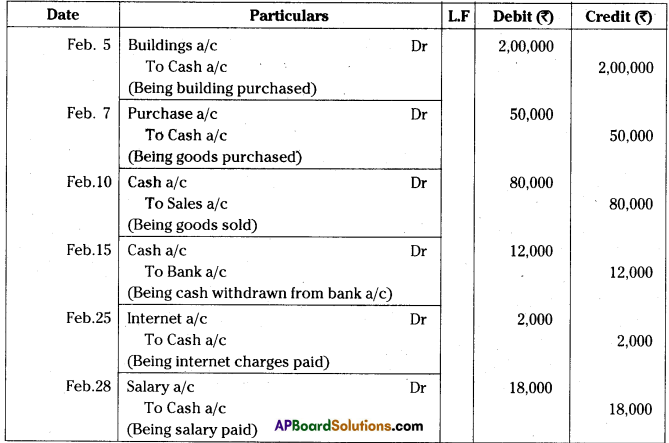

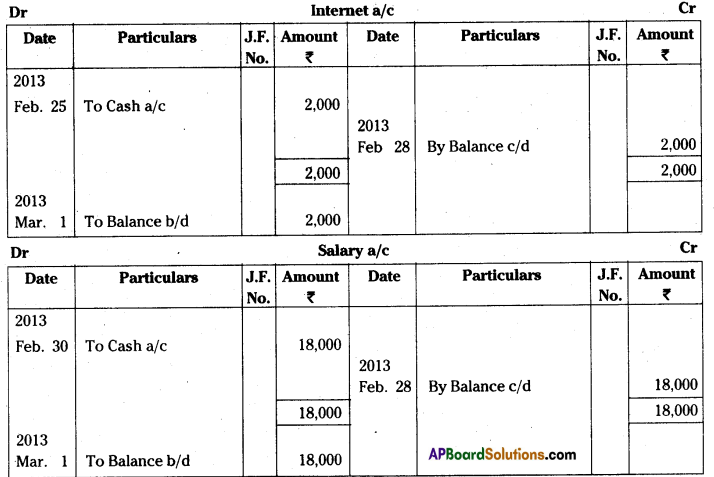

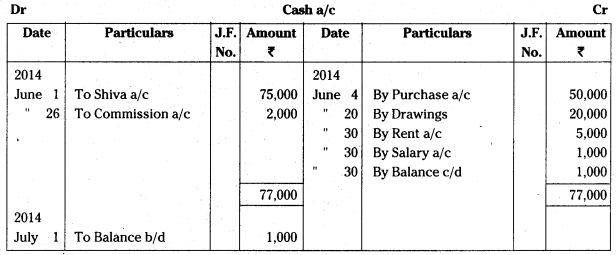

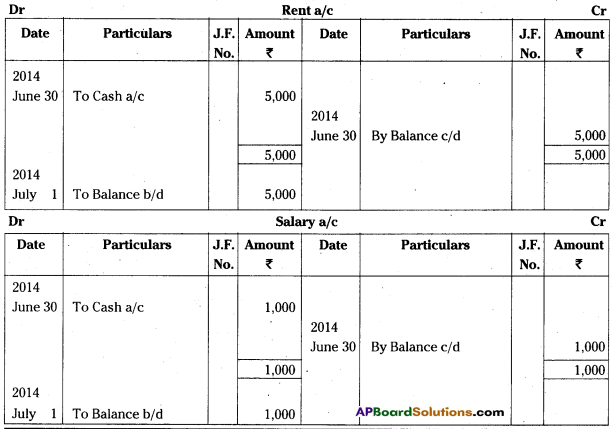

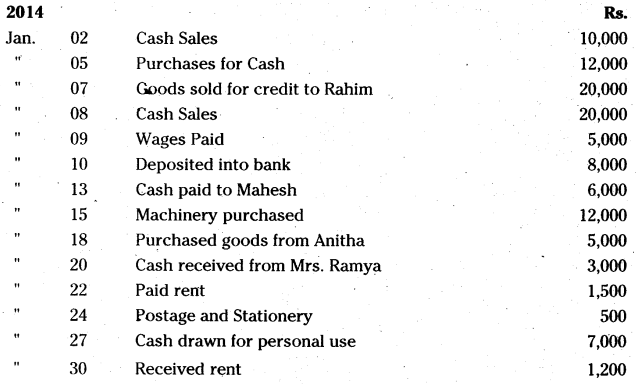

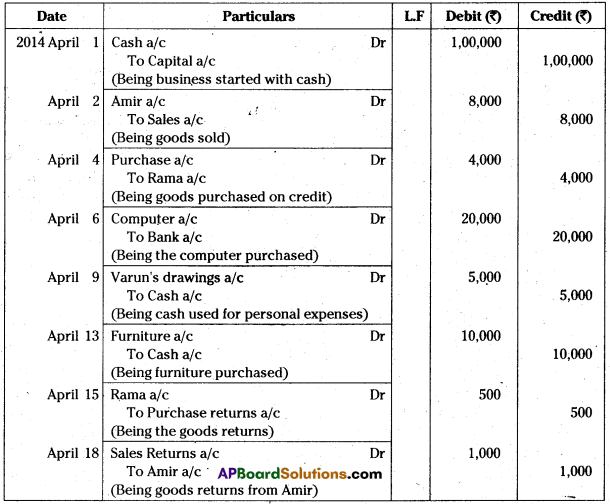

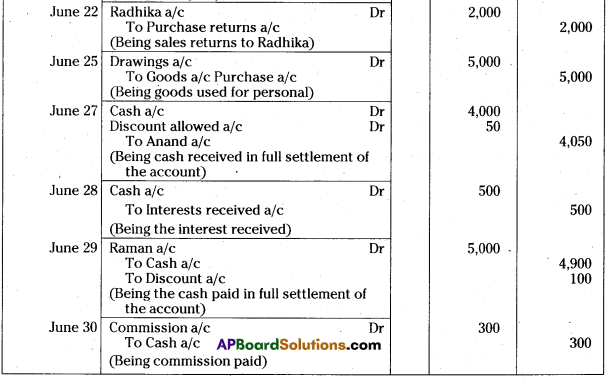

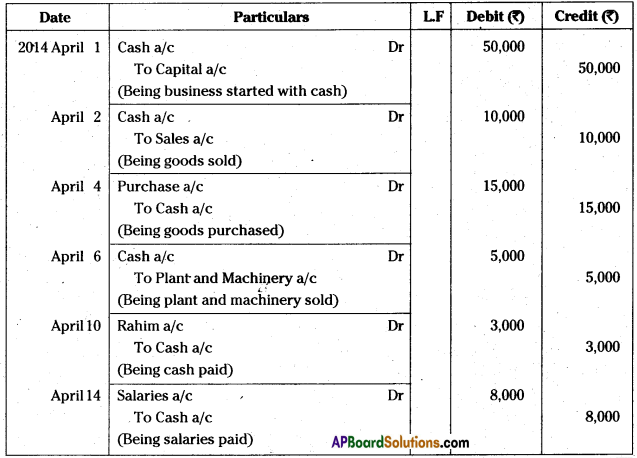

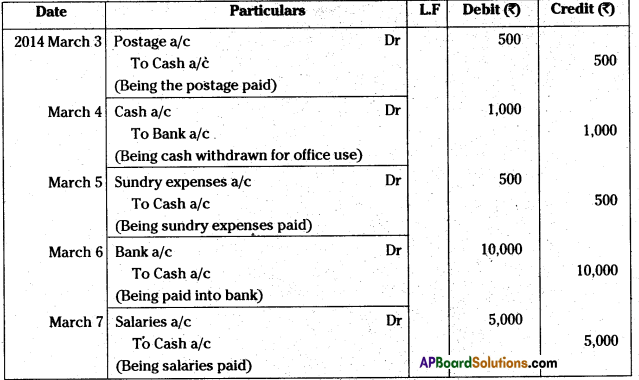

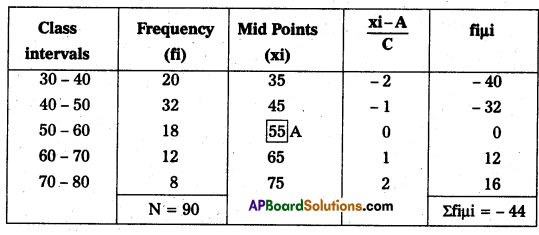

Question 7.

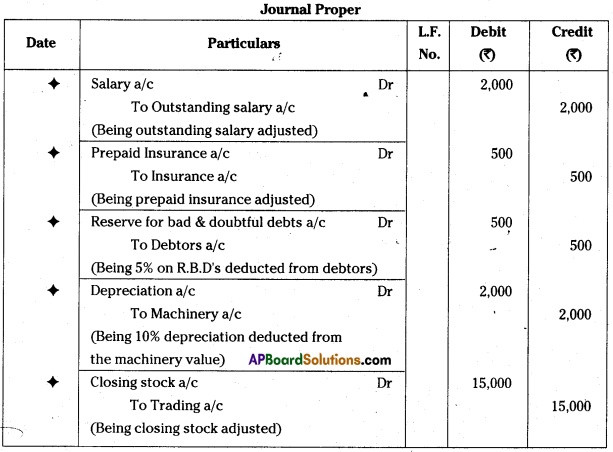

Pass adjustment journal entries for the following:

1. Salaries Outstanding Rs. 2,000,

2. Insurance Paid in Advance Rs. 500,

3. Credit 5% Reserve for Bad and Doubtful Debts on Debtors amounted to Rs. 10,000,

4. Provide 10% Depreciation on Machinery. Machinery Value Rs. 20,000,

5. Closing Stock Rs. 15,000.

Answer:

![]()

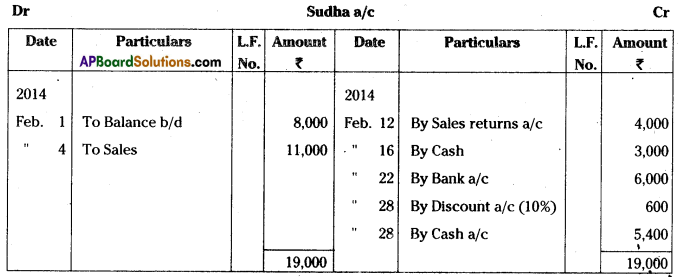

Question 8.

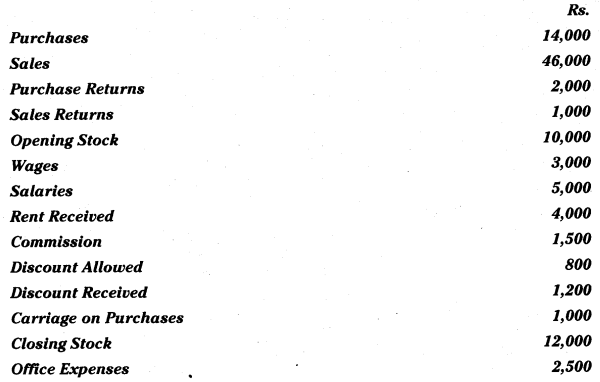

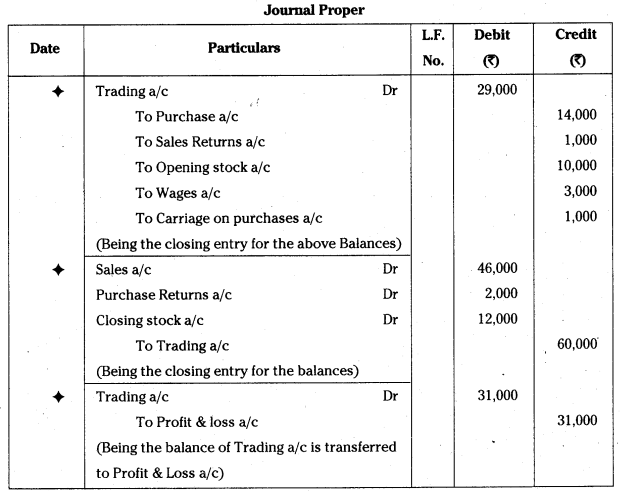

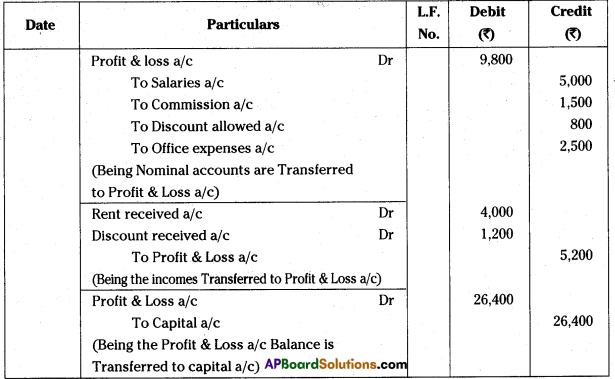

Record the Closing Entries from the following Ledger Balances ofAshrith :

Answer:

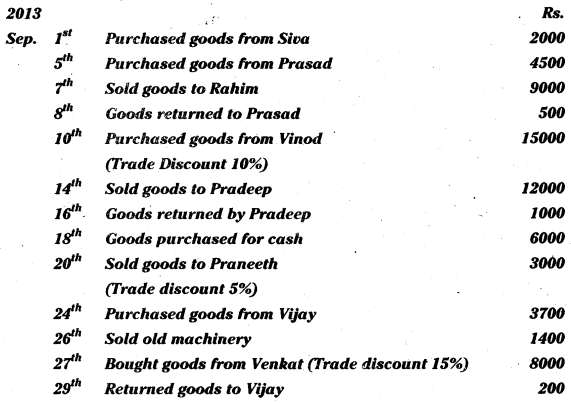

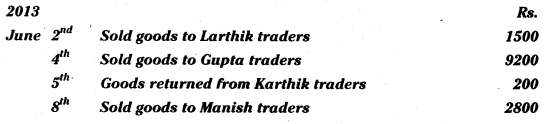

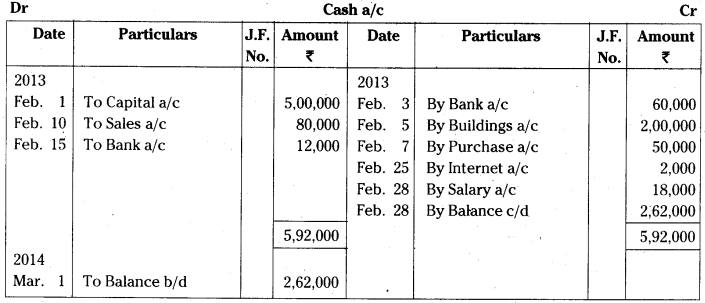

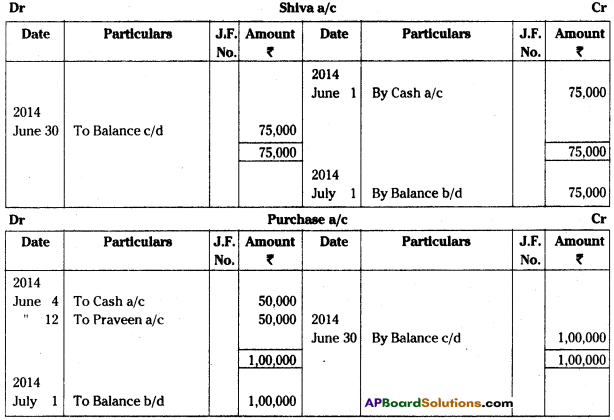

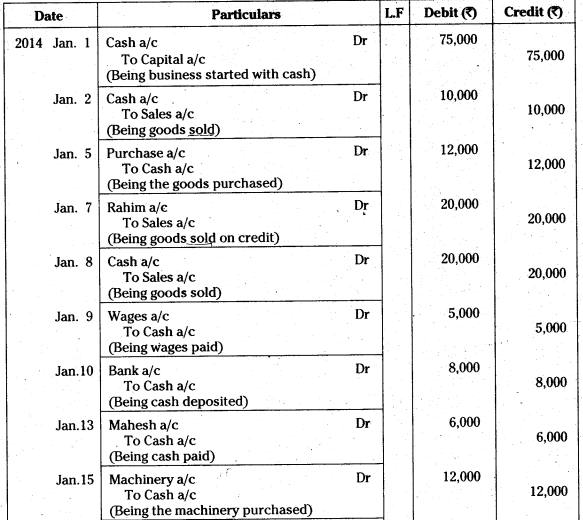

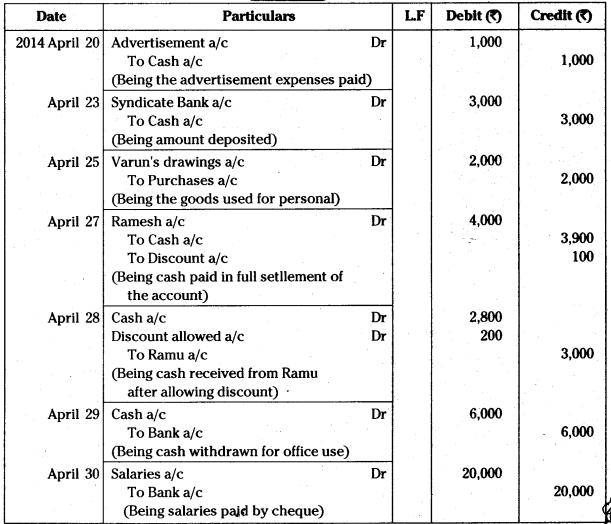

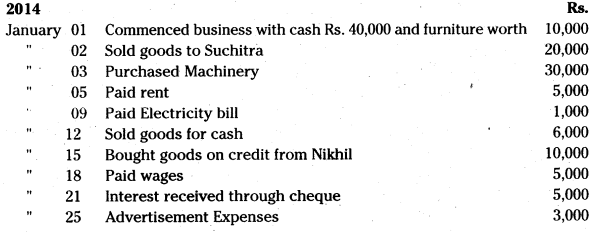

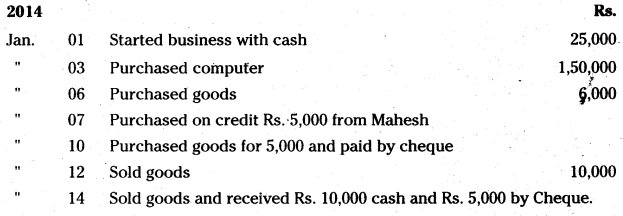

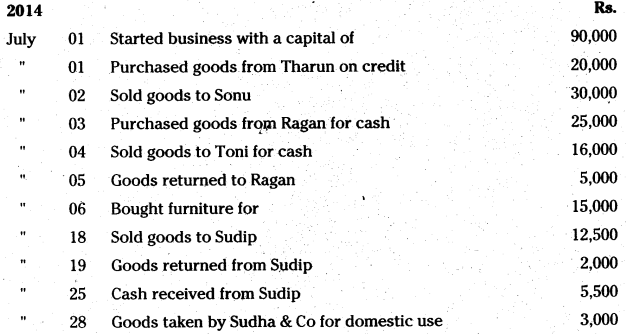

Question 9.

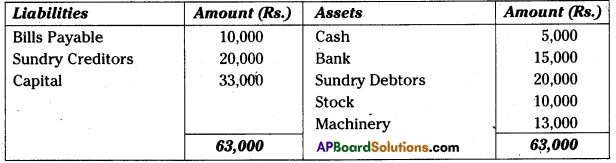

Write Opening Entry as on Jan. 1st 2014 from the following balance sheet of Venkat: Balance Sheet of Venkat as on 31st Dec. 2013

Answer:

![]()

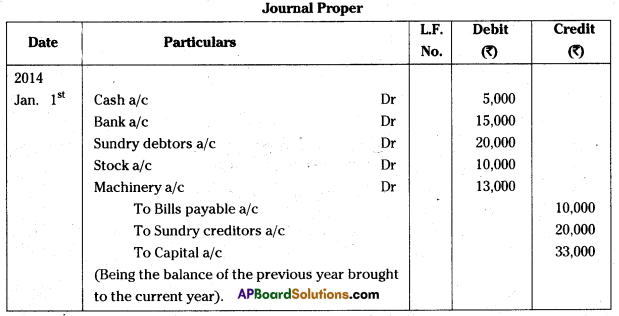

Question 10.

Write Opening Journal Entry from the following as on 1st April 2013 : (Mar. 2018-T.S.)

Answer:

Student Activity

Visit any organisation/firm and record opening, closing and other entries of Journal proper.