Andhra Pradesh BIEAP AP Inter 1st Year Commerce Study Material 6th Lesson Joint Stock Company – Formation Textbook Questions and Answers.

AP Inter 1st Year Commerce Study Material 6th Lesson Joint Stock Company – Formation

Essay Answer Questions

Question 1.

What is a joint stock company? What are its features of it?

Answer:

Business units may be classified into two types. They are :

1) Non-corporate business units

2) Corporate business units.

The basic demerits of non-corporate business units (i.e., sole proprietorship concerns, partnership firm, joint Hindu undivided family concerns) are limited sources, unlimited liability. To overcome these demerits new business units i.e. corporate business units came into existence.

Joint Stock Company is one of the kind of corporate business units. A joint stock company is a voluntary association of persons formed for undertaking some big business activity. It is established by law and can be dissolved by law. The company has a separate legal entity, so that even if its members die, the company remains in existence. The money so contributed constitutes capital of the company. The capital of the company is divided into small units called shares. Since members invest their money by purchasing the shares of the company they are known as shareholders and the capital of the company is known as share capital.

Company – Definition :

“A company is an artificial person created by law, having a separate legal entity with a perpetual succession and a common seal.” – Section 566 of the Companies Act, 1956

“A Joint Stock Company is a voluntary association of individuals for profit, having a capital divided into transferable shares, the ownership of which is the condition of membership.

Features:

1) An artificial person created by law :

A company is an aritficial person created by law and existing only in contemplation of law. It is intangible and invisible legal person having no body and soul. .

2) Seperate legal entity :

A company has an independent existence a part from its members. Its assets and liabilities belong to the company and not to its members. It can own property, have a bank account, take a loan, sue (file a case in court) and be sued in its own name.

3) Formation :

A company comes into existence through the operation of law. So, registration must be under the Companies Act.

4) Common seal as a substitute for signature:

A company cannot sign the documents as it is not a natural person. So, each company has a common seal which is like its signature. When any authorised person puts the seal on any paper or document, it is a legal evidence of an act done by the company.

5) Perpetual existence :

A company is an artificial person created by a process of law. Hence, it enjoys perpetual succession (permanent existences) i.e. it never dies. It is said that “members may come and members may go but the company goes on forever”. A company is not affected by death of a member or a new member coming in place of an old member. A company is wound up by law only. It has to act through its directors and employees.

6) Limited liability of members:

The liability of every shareholder is limited to issue price of the shares allotted to him. If the shares are fully paid up-, he is not subject to any further liability.

7) Transferability of shares:

The members of the company (public company) are free to transfer or dispose the shares held by them to any person as and when they like. They do not need the consent of other shareholders to transfer their shares. But in case of private company some restrictions are imposed for transfering shares.

8) Membership :

To form a joint stock company, a minimum of two members are required in case of private limited company and seven members in case to public limited company. The maximum limit is fifty in case of private limited company. There is no maximum limit on the number of members in case of a public limited company.

9) Democratic management:

Since the number share holders are very large and may be distributed at different geographical locations, it becomes difficult for them to carry on operational management of the company on day-to-day board. This gives rise to the need of separation of the management and ownership.

10) Statutory regulations are to be followed :

A company has to comply with and abide by a number of statutory requirements. A company is governed by the Companies Act and it has to invariably follow the various provisions of the Act. For ‘ instance, such companies should submit a number of returns to the government and also its accounts have to be audited by a Chartered Accountant.

Question 2.

Explain the advantages and disadvantages of a joint stock company.

Answer:

A joint stock company is an artificial person created by law with a fixed capital, divisible into transferable shares, with perpetual succession and common seal. The company has a separate legal entity. It must be compulsorily registered. The capital of a company is divided into small units called shares. Any one who holds or buys share in a company is called shareholder.

Joint Stock Company – Advantages:

1) Limited liability :

The liability of shareholders is limited. The risk of loss is limited to the issue price of theshares.

2) Large financial resources :

Company form of organisation enables to mobilise huge financial resources because of principles of limited liabilities and diffusion of ownership. It collects funds in the form of shares of small denominations so that people with small means can also buy them. Benefits of limited liability and transferability of shares attract investors.

3) Continuity of existence :

A company has perpetual or continuous existence. Members may go or new members may come in, but the company goes on for ever.

4) Benefits of large scale operation :

A joint stock company can undertake business on large scale. As a result it can derive all the advantages of large scale production.

5) Liquidity :

The transferability of shares act as an added incentive to investors. The shares of a public company can be traded easily in the stock exchange. The public can buy shares when they have money. The prospective investors can invest and convert shares into cash whenever they need money.

6) Professional management :

Companies, because of their complex nature of activities and large volume of business, require professional managers at every level of their operation. This leads to efficiency in management of their business affairs.

7) Research and development :

A company generally invests a lot of money on research and development for improved processes of production, designing and innovating new products, improving quality of product, new ways of training its staff, etc.

8) Tax benefits :

Although the companies are required to pay tax at a high rate, in effect, their tax burden is low as they enjoy many tax exemptions under Income Tax Act.

Joint Stock Company – Disadvantages :

1) Too many legal formalities:

Formation of a company is a time – consuming process and also expensive. Many legal formalities have to be observed and several legal documents have to be prepared and filed. Delay in formation may deprive the business the momemtum of an early start.

2) Lack of motivation :

The directors and other officers of a company have little personal involvement in the efficient management of a company. Separation between ownership and control and absence of a direct link between effort and reward may lead to lack of personal interest and incentive. It is difficult to keep peronal touch with all the customers and employees. As a result, efficiency of business operations may be low.

3) Delay in decisions :

Redtapism and bureaucratic hurdles do not permit quick decisions and prompt action in company form of organisation. There is little scope for personal initiative and a sense of responsibility. Paid employees like to play safe and tend to shift responsibility. There is lack of flexibility of operations in a company.

4) Economic oligarchy :

The management of company is supposed to be carried on according to the collective will of its members. But in practice, there is rule by a few (Oligarchy). Often directors try to mislead the members and manipulate voting power to maintain and continue their control.

5) Corrupt management:

In a company, there is often danger of fraud and misuse of property by dishonest management. Fake companies may be formed to deprive the investors of their hard-earned money. Unscrupulous people may manipulate annual accounts to show artificial profits or losses for their personal gain.

6) Excessive government control :

A company has to submit many statements and returns to the government. Excessive government control leads to waste of time for the company.

7) Unhealthy speculation :

A few individuals may corner the shares to gain control over the company.

8) Conflict of interests :

Company is the only form of business wherein a permanent conflict of interests may exist. In a company conflicts may continue between shareholders and board of directors or between shareholders and creditors or between management and workers.

9) Lack of secrecy :

Under the Companies Act, a company is required to disclose and publish a variety of information on its working. Widespread publicity of affairs makes it almost impossible for the company to retain its business secrets. The accounts of a public company are open for inspection to public.

![]()

Question 3.

Distinguish between a private company and a public company. [Mar. 2019 – A.P. & T.S. – Mar. 2018 – T.S.]

Answer:

On the basis of number of members or public interest companies may be classified into

- Public company

- Private company

1) Public company :

According to Companies Act, Public company means a company which (a) is not a private company; (b) has a minimum paid-up capital of ₹ 5 lakhs or such higher paid-up capital and (c) is a private company which is a subsidiary of a company which is not a private company.

2) Private company:

According to Companies Act, Private company means a company which has a minimum paid up capital of one lakh rupees or such higher paid up capital as may be prescribed and by its articles. Restricts the right of members to transfer its shares. Limits the number of its members to 50. Prohibits any invitation to the public to subscribe to any shares in, or debentures of the company. Prohibits any invitation or acceptance of deposits from persons other than its members, directors, and relatives.

Differences between Private company and Public company

| Basis of Comparison | Private Company | Public Company |

| 1) Minimum number of persons | Two members | Seven members |

| 2) Maximum number of members | 50 members | No limit |

| 3) Minimum paid up capital | ₹ One lakh | ₹ Five lakh |

| 4) Identification | Must suffix ‘Private Limited’ to its name | Must suffix ‘Public Limited’ to its name |

| 5) Transfer of shares | It cannot transfer their shares. | It can freely sell their shares to others. |

| 6) Public issue of capital | It cannot secure capital irom the public. | It can secure capital from the public. |

| 7) Commencement | It can start its business immediately upon its incorporation. | It cannot start its business immediately alter its incorporation. It has to obtain a certificate for starting. |

| 8) Board of directors | Minimum: Two Maximum: No limit |

Minimum: Three Maximum: 20 |

| 9) Appointment and Retirement of Directors | Single resolution is enough to appoint or retire the directors. | Separate resolution is required. |

| 10) Managerial remuneration | There are no restrictions on the remuneration of Directors and Managing Directors. | There are restrictions. |

Short Answer Questions

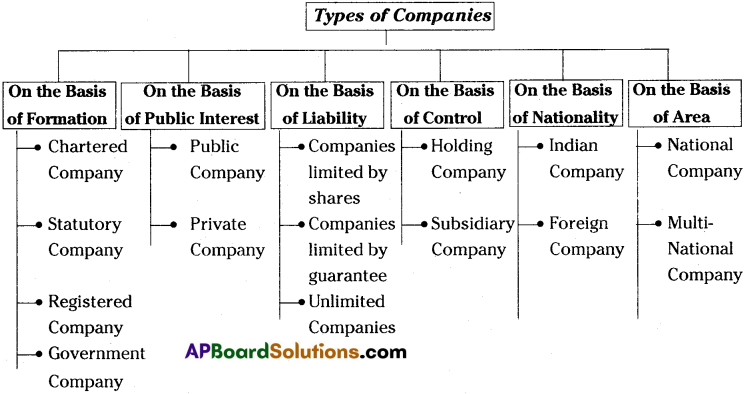

Question 1.

List out and briefly explain different types of companies.

Answer:

1) Chartered Companies:

The companies which are established by the Royal charter or special sanction of the Royal Head of the State are called chartered companies. Such companies are granted special privileges and powers to achieve the defined objectives.

E.g.: East India Company.

2) Statutory Company :

These companies are formed by the enactment of special Act by Parliament or State Assembly. The Reserve Bank of India, the State Bank of India, Life Insurance Corporation of India, etc. are the examples of Statutory Companies.

3) Registered Company:

All those companies that are registered under the Companies Act 2013 are called Registered Companies.

4) Government Company :

Government company means any company in which not less than 51% of the paid up capital is held by the Central Government or by any State Government or Governments or partly by the Central Government and partly by one or more State Governments and includes a company which is a subsidiary of a government company.

5) Private Company :

A private company is a very suitable form for carrying on the business of family and small concerns. It is registered under the Companies Act 2013.

6) Public Company :

According to the section 2 (71) of the Companies Act of 2013 a company is a said to be public company (a) It is not a private company (b) It has a minimum paid up capital of ₹ 5,00,000 and above (c) It is a private company which is subsidiary of any public company.

7) Companies limited by shares :

In these compaines the liability of the members is limited to the extent of the value of shares held by them.

8) Companies limited by guarantee :

In these companies the members’ liability is not only up to the face value of the shares but also extended to the amount guaranteed by them.

9) Unlimited Companies:

In these companies the liability of the members is unlimited. The members are fully liable for all the debts of the company.

10) Holding Company :

Where one company controls the management of another company, the controlling company is called ‘Holding Company’.

E.g.: If.company A holds more than 5,1% of paid1 up share capital of company B, the company A is called holding company.

11) Subsidiary Company :

Where one company controls the management of another company such- company so controlled fs called subsidiary company.

E.g. : If company A holds more than 51% of paid up share capital of company B, the company B is called subsidiaiy company.

12) Indian Company:

A company registered in Indian having place of business in India called Indian company. It may be a private company or a public company.

13) Foreign Company :

A foreign company is one that is incorporated outside India but has business operations in India.

14) National Company:

Such companies confine their operations within the boundaries of the country in which they are registered.

15) Multi-national Company :

Such companies which extend the areas of their operations beyond the country in which they are registered.

![]()

Question 2.

What are the features of a public company?

Answer:

A joint stock company is an artifical person created by law with a fixed capital, divisible into transferable shares, with perpetual succession and common seal. The company has a seperate legal entry. It must be compulsorily registered. The capital of the company is divided into small units called shares. Any one who holds or buys share in a company is called shareholder. Thus a company is defined as an association of persons, having a separate legal existence, perpetual sucession and a common seal.

On the basis of public interest company may be classified into two types.

- Private Limited Company

- Public Limited Company.

Public Limited Company – Features :

It is suitable form of company for carrying on the business at large scale involving huge amount of capital. According to section 2(71), Public company is one which has the following features.

- The minimum paid up capital is ₹ 5,00,000.

- The minimum number of members is seven.

- The maximum number of members is unlimited. Such a company must use the word “Ltd” as part of its name.

A public company must write public limited or simply limited after its name. Steel Authority of India Limited, Bajaj Auto Limited, Reliance Industries Limited, and Hindustan Lever Limited are the examples of public companies.

Question 3.

What are the features of a private company?

Answer:

Sole proprietorship, Joint Hindu family and partnership form of business organisations could not meet the needs of modern industry and commerce because of their limitations like limited resources, unlimited liability, etc. The need for another form of organisation free of the above limitations was felt thus joint stock type of company came into existence as it can raise large resources with risk of unlimited liability, deploy huge capital, use modern technology, introduce specializations and run with professionalism.

On the basis of public interest company may be classified into two types

- Private limited company

- Public limited company.

Private Limited Company – Features :

According to section 2(68) of the Companies Act 2013 private company means company which has a minimum paid up capital of one lakh rupees or such higher paid – up-capital as may be prescribed and by its articles.

- Restricts the rights of members to transfer its shares.

- Limits, the number of its member to 50.

- Prohibit any invitation to the public to subscribe to any shares in, or debentures of the company.

- Prohibits any invitation or acceptance of deposits from persons other than its members, directors, and relatives.

Very Short Answer Questions

Question 1.

Define company.

Answer:

The word ‘Company’ implies a group of people who voluntarily agree to form a company and derived from the Latin word ‘com’ i.e., with or together and ’panis’ i.e., bread. It refers to an association of persons discussing matters and taking food together. However, in law company is termed as a company which is formed and registered under the Companies Act 2013.

“A Joint Stock Company is a voluntary association of individuals for profit, having a capital divided into transferable shares, the ownership of which is the condition of membership.” -L.H. Haney

Question 2.

What is a Government company? [Mar. 2019 – A.P. & T.S.Q Mar. 2018 – A.P.]

Answer:

Government company means any company in which not less than 51% of the paid up capital is held by the Central Government or by any State Government or Governments or partly by the Central Government and partly by one or more State Governments and includes a company which is a subsidiary of a government company.

Question 3.

What do you mean by a statuatory company?

Answer:

There are companies formed by the enactment of special Act by Parliament or State Assembly. The Reserve Bank of India, the State Bank of India, Life Insurance Corporation of India, etc. are the examples of Statutory Companies.

![]()

Question 4.

Chartered Company

Answer:

The companies which are established by the Royal charter or special sanction of the Royal Head of the State are called chartered companies. Such companies are granted special privileges and powers to achieve the defined objectives.

iE.g.: East India Company.