Andhra Pradesh BIEAP AP Inter 1st Year Accountancy Study Material 13th Lesson Final Accounts with Adjustments Textbook Questions and Answers.

AP Inter 1st Year Accountancy Study Material 13th Lesson Final Accounts with Adjustments

Essay Type Questions

Question 1.

Describe the various types of adjustments with examples.

Answer:

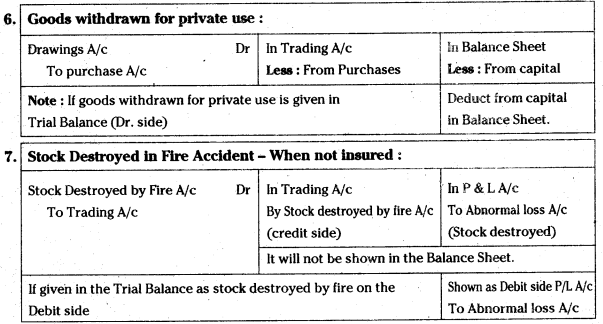

Types of Adjustments:

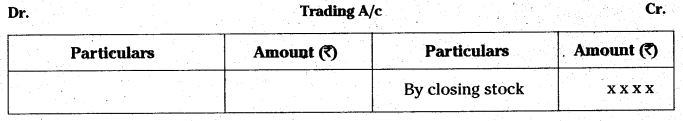

1. Adjustments relating to closing stock: Closing stock means, the stock of goods unsold at the end of the accounting year.

Adjustment entry:

(Being the closing stock transfer to the trading account)

Accounting treatment in final accounts:

1) Show on the credit side of trading A/c

2) Show on the assets side of balance sheet.

Note : If closing stock is given in Trial Balance, show it on the Assets side of Balance sheet.

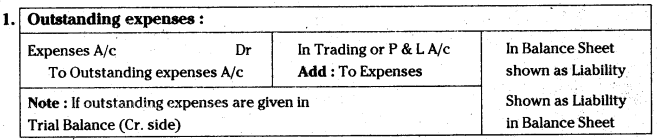

2. Adjustments relating to expenses:

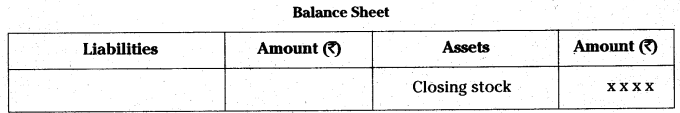

a) Outstanding expenses : Expenses relating to the current accounting year but not yet paid and are to be paid in the next year e.g: Salary for the month of December is due but not paid.

Adjustment entry:

![]()

(Being the expenses due)

Accounting treatment in final accounts:

1) Add either in trading A/c or in profit & loss A/c to the concerned expenditure item.

Trading A/c

2) Show it as a liability on the liabilities side of Balance sheet.

Note : If outstanding expenses are given in trial balance show as liability in Balance sheet.

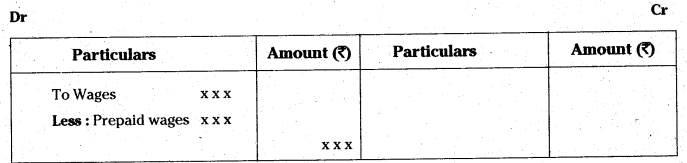

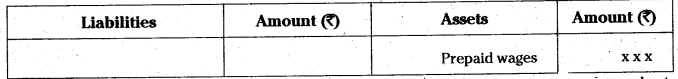

b) Prepaid expenses : Expenses relating to the next accounting year but paid in the current accounting period are called prepaid expenses. (May. ’17 – A.P.)

Adjustment entry:

![]()

(Being expenses paid in advance)

Accounting treatment in final accounts: If prepaid expenses are given as an adjustment.

- Deduct it from the concerned expenditure either in trading A/c or in Profit & Loss A/c for the first instance and

- Record as asset on assets side of the balance sheet as second time.

1) Add either in trading A/c or in profite & loss A/c to the concerned expenditures item.

Trading A/c

Balance Sheet

Note: If prepaid expenditure is given only in Trial balance, show it as asset in Balance sheet.

3. Income:

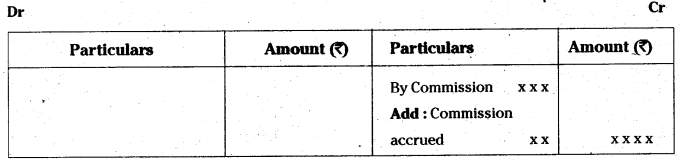

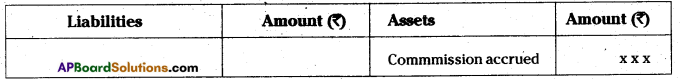

a) Accrued Income: Income relating to current year which is not received during the current year but to be received in the next year is called Accured income or income receivable.

Adjustment entry:

![]()

(Being the income receivable)

Accounting treatment in final accounts: If accrued income is given as adjustment –

- For the first instance add to the concerned income in profit and loss a/c on credit side and then.

- Show it as an asset in balance sheet on assets side.

Profit & Loss A/c

Balance Sheet

Note : If accrued income is given in trial balance, show it on assets side of Balance sheet.

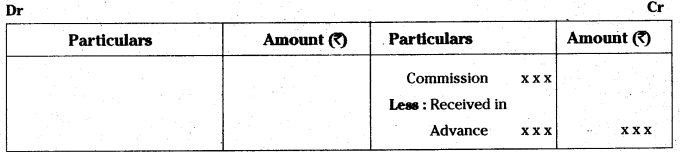

b) Income Received in Advance : The income relating to the next year but received in the current year is called income received in advances.

Adjustment entry:

![]()

(Being the income received in advance)

Accounting treatment in final accounts: When income received in advance is given adjustment

- Deduct it from the concerned income in Profit & Loss a/c on credit side and

- Record it as a liability on the liabilities side in the balance sheet.

Profit & Loss A/c

Balance Sheet

Note: If Income received in advance is given in the trial balance show it on liabilities side in the balance sheet.

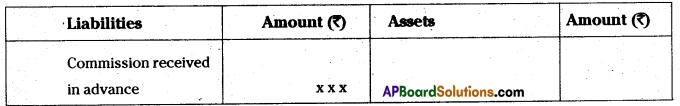

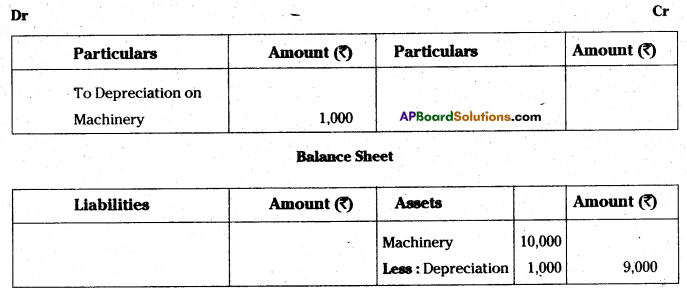

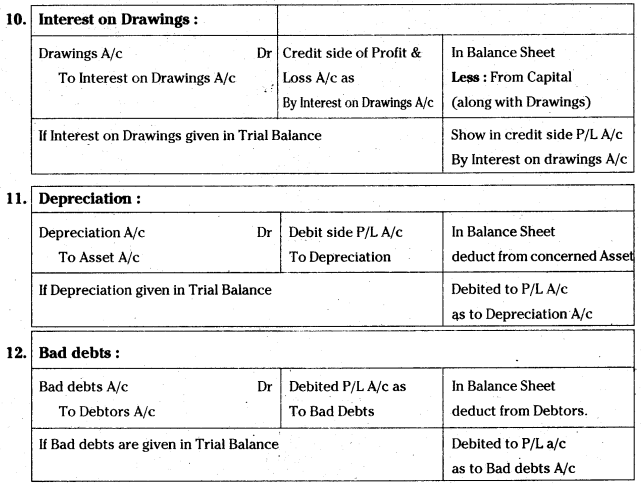

4. Depreciation: Decline in the value of fixed assets is called “Depreciation”.

Adjustment entry:

![]()

(Being the depreciation provided on asset)

Accounting treatment in final accounts: When depreciation is given as an adjustment:

- Debit it to profit & loss A/c.

- Deduct it from the value of concerned asset in balance sheet on assets side.

Trial Balance

Adj : Provide depreciation on machinery 10%

Profit & Loss A/c

Note : If depreciation is given in trial balance, it should be shown on debit side in P & L A/c only.

5. Debtors : In final accounts bad debts, provision for bad debts may be given as adjustments relating to debtors.

A) Bad debts: To debts which are not collected or irrecoverable are known as bad debts.

Adjustment entry:

![]()

(Being bad debts written off)

Accounting treatment in final accounts:

a) When bad debts are given, only in the adjustments –

- Debit to profit & loss A/c and

- Deduct from debtors in the balance sheet on assets side.

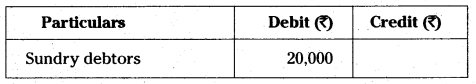

Trial Balance

Adjustment: Bad debts : 500

Note : If the bad debts are given in trial balance only, it should be shown on debit side in Profit & Loss A/c.

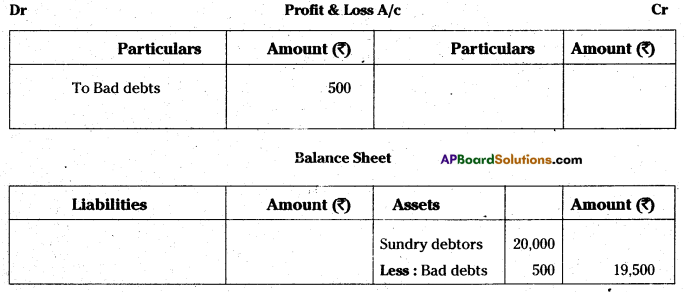

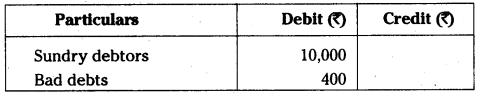

b) When Bad debts are given in both Trial Balance and adjustments:

- In Profit & Loss A/c, both the bad debts (Bad debts given in Trial balance and given in adjustment) are to be shown on debit side.

- Bad debts given only in the adjustments are to be deducted from debtors in the balance sheet.

Trial Balance

Adjustments: 1) Bad debts : 400

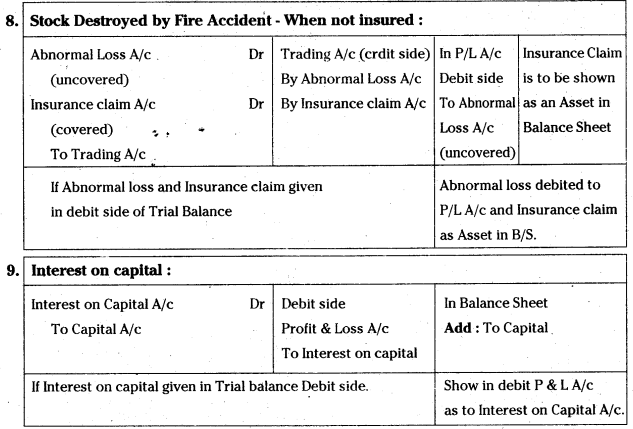

B) Provision for bad and doubtful debts: Some debts of a particular year may or may not be recovered in the next year. These debts are known as doubtful debts. So traders create same amount on current year debtors and keep the same to meet the doubtful bad debts of the next year, which is called provision for bad and doubtful debts.

a) When provision for doubtful debts is given as adjustment:

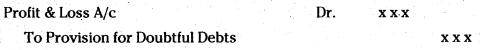

Adjustment entry:

(Being provision created on debtors)

Accounting treatment in final accounts:

- Show it on debit side in profit & Loss A/c and

- Deduct it from debtors in Balance sheet,

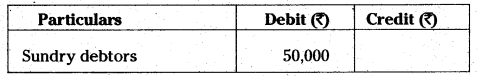

e.g.:

Trial Balance

Adjustment: Create provision for bad and doubtful debts 5%.

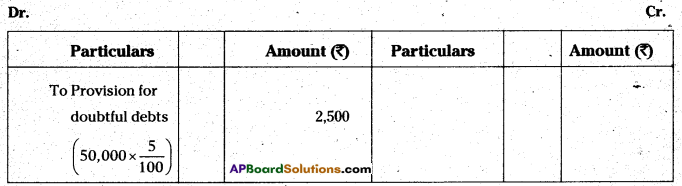

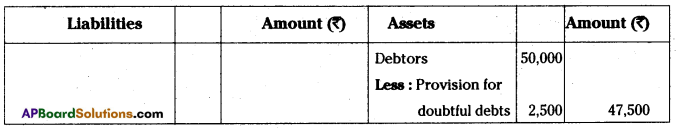

Profit & Loss A/c

Balance Sheet

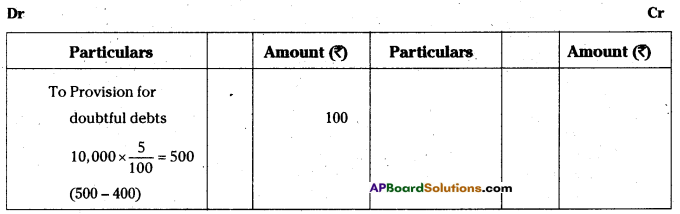

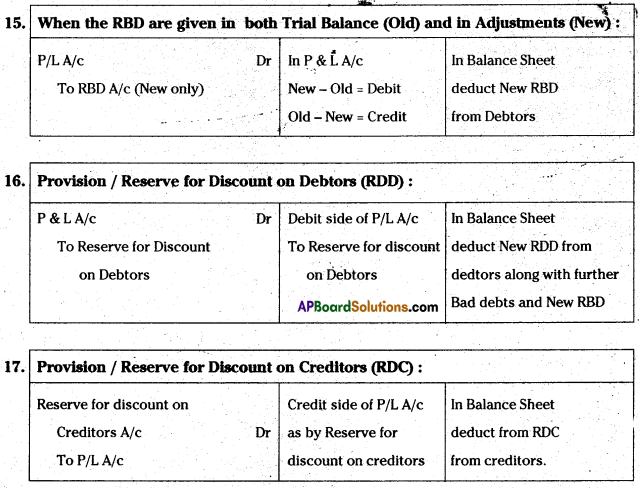

b) When provision for doubtful debts is given in Trial Balance and also in adjustments: Accounting treatment in final accounts:

1. Compare the old provision (given in trial balance) with new provision (given in the adjustments), if the new provision is more than the old provision, the difference amount (New provision – old provision) should be debited to the Profit & Loss A/c.

On the other hand, new provision is less than the old provision, the difference amount (old provision – new provision) should be recorded on the credit side of Profit & Loss A/c.

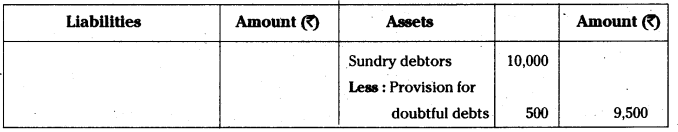

2. In balance sheet, deduct the amount of new provision of bad and doubtful debts from sundry debtors.

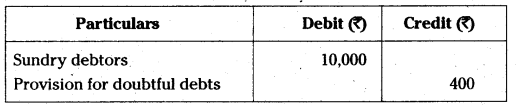

Trial Balance

Adjustments : Create 5% provision for doubtful debts.

Profit & Loss A/c

Balance Sheet

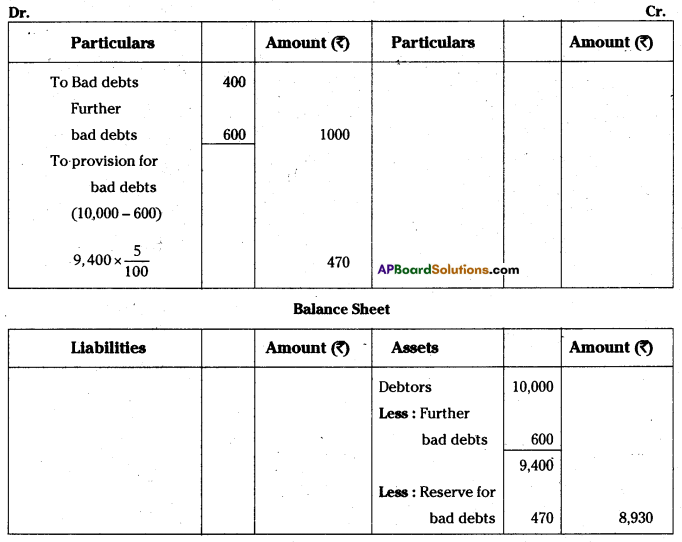

c) If the bad debts are given both in trial balance and in adjustments, and also provision for bad debts given in adjustments.

Accounting treatment in final accounts:

- Don’t calculate the provision directly on sundry debtors.

- Calculate the provision after deducting the further bad debts.

Trial Balance

Adjustments:

- Further bad debts : Rs. 600

- Provision for bad debts : 5%

Profit & Loss A/c

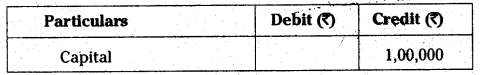

6. Interest on capital : It is the amount of interest payable on owner’s capital by the business organisation.

Adjustment entry:

(Being the interest payable on capital)

Accounting treatment in final A/cs:

- Debit in profit & Loss A/c and

- It should be added to the capital in balance sheet.

Trial Balance

Adjustment: Interest on capital: 12%

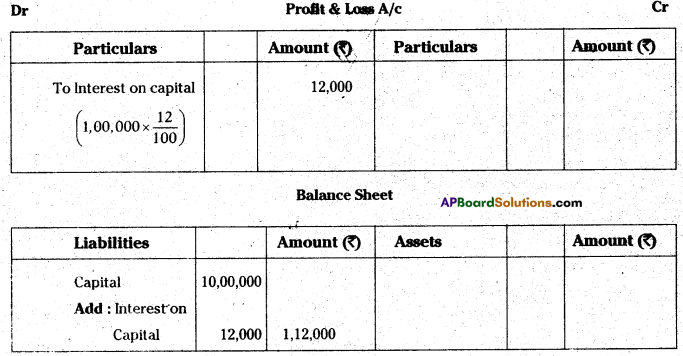

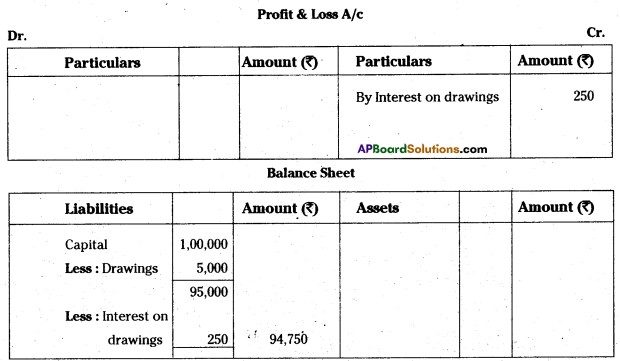

7. Interest on Drawings : Drawings mean the amount of cash or goods taken by the trader for personal use. The amount of interest payable by the owner to the business is called interest on drawings.

Adjustment entry:

(Being the interest on drawings)

Accounting treatment in final A/cs:

- It is to be recorded on credit side of P & L a/c and

- It should be deducted from capital in balance sheet.

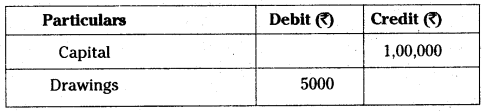

Trial Balance

Adjustment: Interest on drawings : 5%

Note: When interest on drawings is given in trial balance, it should be shown on credit side in Profit & Loss A/c only.

Short Answer Questions

Question 1.

Write the following:

a) Interest on Capital:

Answer:

The amount of interest payable on owner’s capital by the business organisation is called interest on capital.

Adjustment entry:

![]()

(Being the interest payable on capital)

Accounting treatment in final accounts:

When interest on capital is given as an adjustment.

1. Debit in P & L A/c and

2. It should be added to the capital in balance sheet.

Note : When it is given in trial balance, debit it in P & L A/c only.

b) Interest on Drawings :

Answer:

Drawings mean the amount of cash or goods taken by the trader for personal use.

The amount of interest payable by the owner to the business is called Interest on drawings.

Adjustment entry:

![]()

(Being the interest on drawings)

Accounting treatment In final accounts:

When interest on drawings given as adjustment.

- It is to be recorded on credit side of P & L A/c and

- Deduct the amount from capital in Balance sheet.

Note: When interest on drawings is given in trial balance, it should be shown on credit side in Profit & Loss A/c.

Very Short Answer Questions

Question 1.

What is the meaning of adjustment ?

Answer:

To find out net profit and true financial position, all expenses relating to current year whether actually paid or not, all incomes received or yet to be received should be taken into account. Some of the incomes and expenses relating to next year, but received and paid in the current year should not be included in the accounts of current year. The amount to be adjusted to the concerned items is called adjustment. e.g: Outstanding salaries, prepaid insurance, etc.

![]()

Question 2.

Explain the importance of adjustment:

Answer:

- Expenses or incomes relating to the accounting period can be known accurately.

- Profit or loss can be ascertained accurately.

- Real value of assets and liabilities can be ascertained easily.

Question 3.

Give the meaning of bad debts. (Mar. 2018 T.S.)

Answer:

The debts which are not collected or Irrecoverable are known as bad debts.

Adjuštment entry:

![]()

(Being bad debts written off)

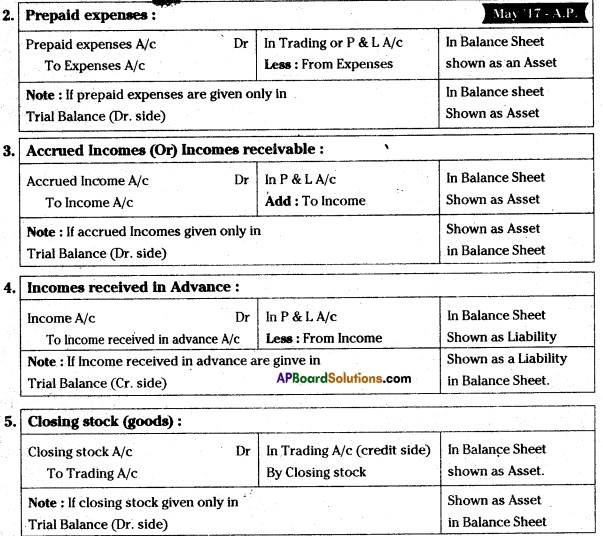

Adjustments Summary

Problems

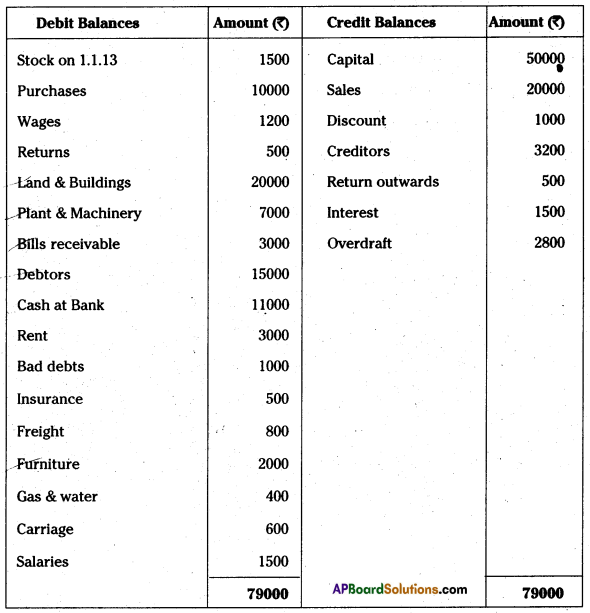

Question 1.

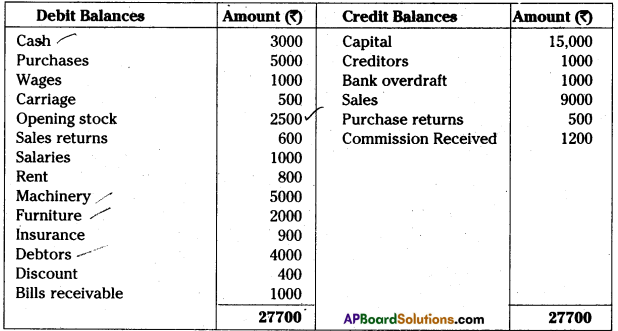

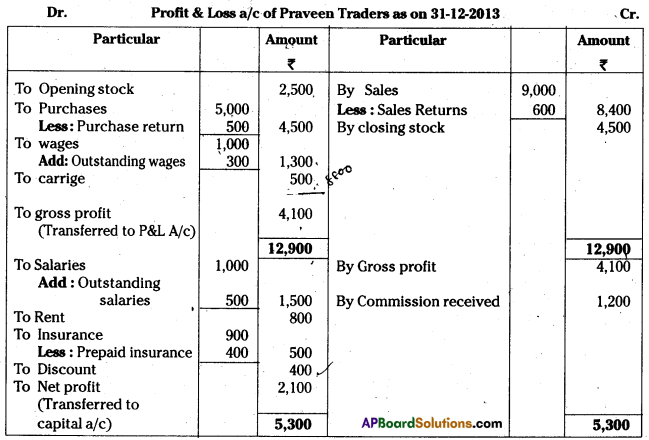

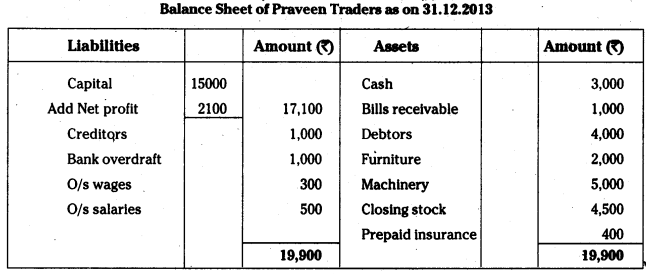

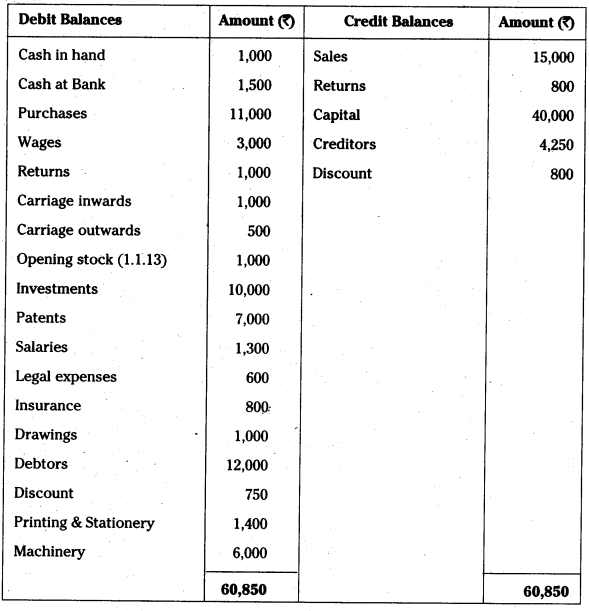

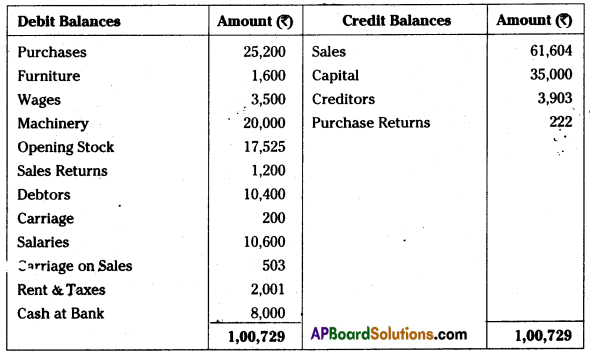

From the following trial balance, prepare final accounts of Praveen Traders as on 31.12.2013:

Adjustments:

- Closing stock: 4500;

- Outstanding wages : 390;

- Outstanding salaries : 500

- Prepaid Insurance: 400

Answer:

![]()

Question 2.

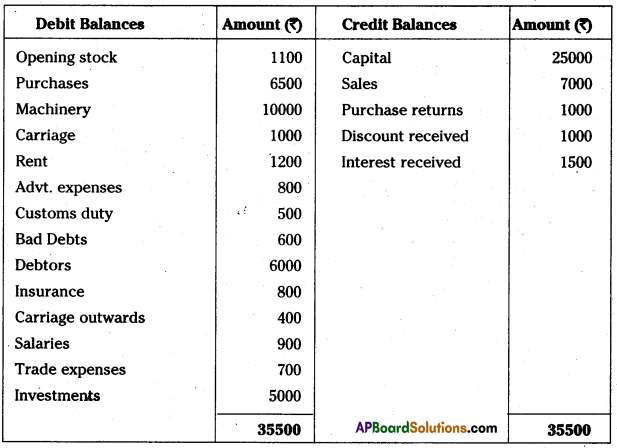

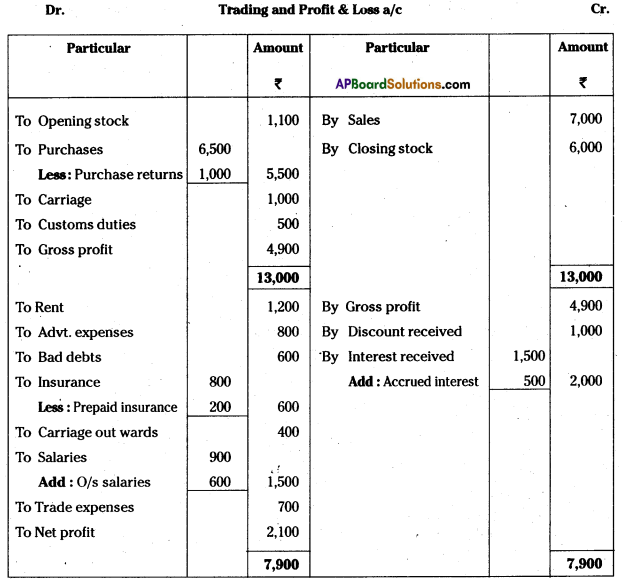

From the following particulars, prepare final accounts : (May ’17 – T.S.)

Adjustments:

- Closing stock: 6000

- Prepaid Insurance: 200

- Outstanding salaries :600

- Accrued interest : 500

Answer:

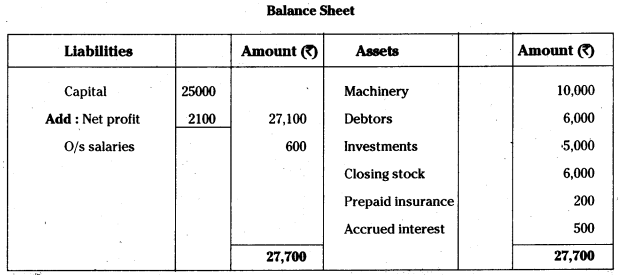

Question 3.

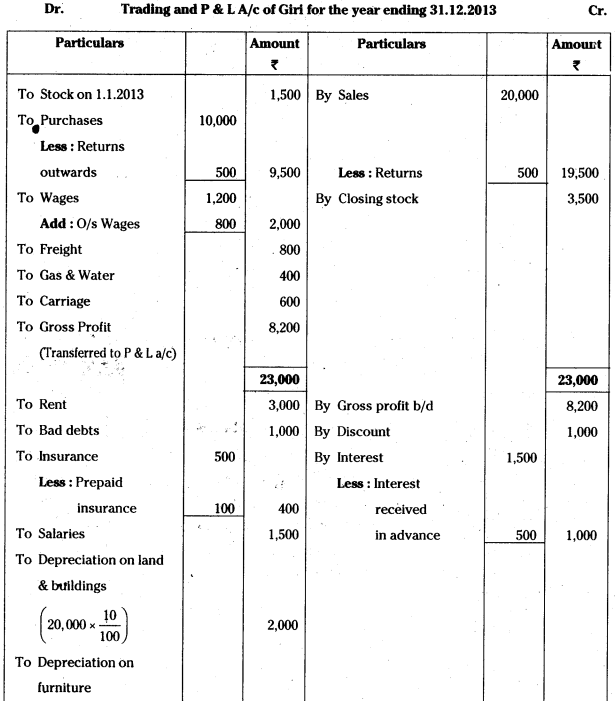

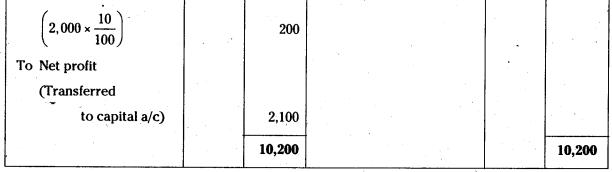

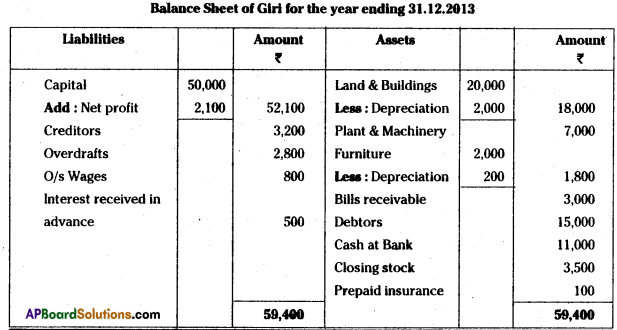

From the following particulars, prepare final accounts of Giri for the year ending 31.12.2013.

Adjustments:

- Closing stock value: 3500

- Outstanding wages : 860

- Prepaid insurance: 100

- Provide depreciation on furniture: 10% and on land & buildings : 10%

- Interest received in advance : 500

Answer:

![]()

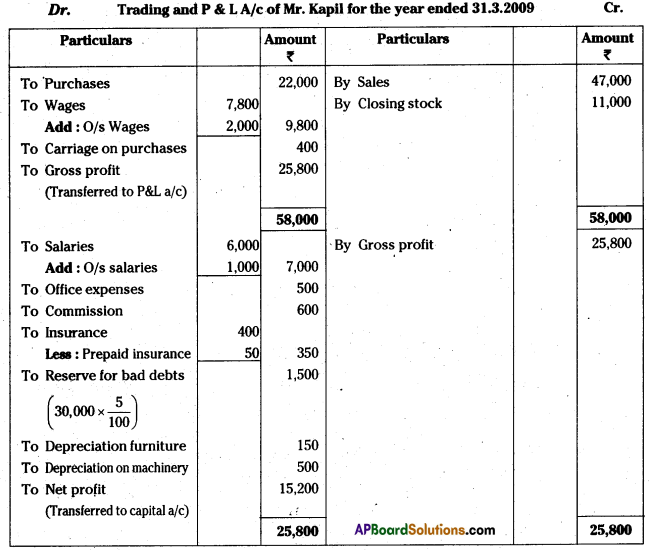

Question 4.

From the following Trialbalance o1 Mr.kapil, prepare Trading P & L A/c and Balance Sheet or the year ended (Mar. 2018 – A.P.)

Trial Balance

Adjustments:

- Outstanding wages: 2000;

- Outstanding salaries: 1000;

- Prepaid insurance: 50;

- Create 5% reserve for bad debts on debtors;

- Depreciation on furniture: 150, Dep. on machinery: 500;

- Closing stock: 11,000.

Answer:

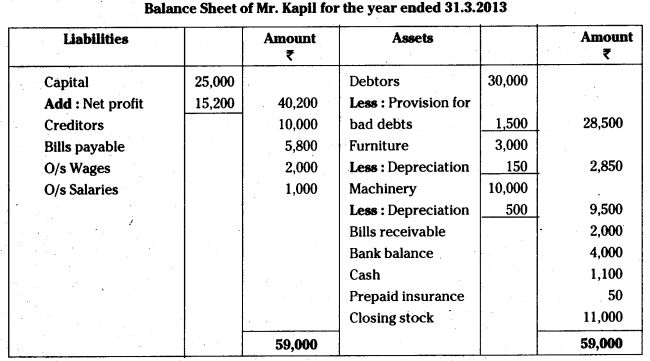

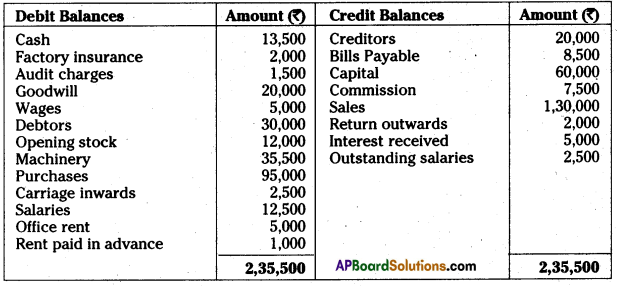

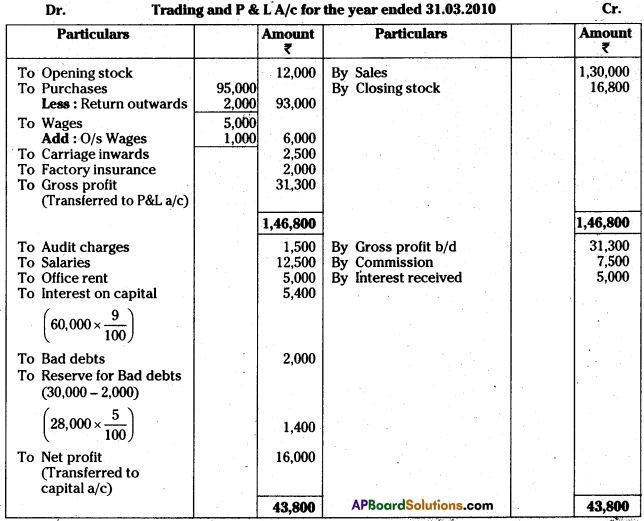

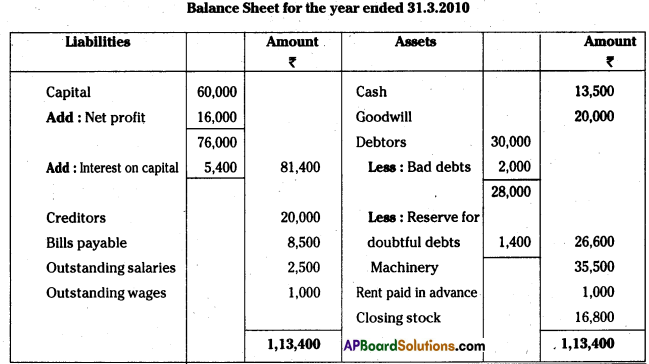

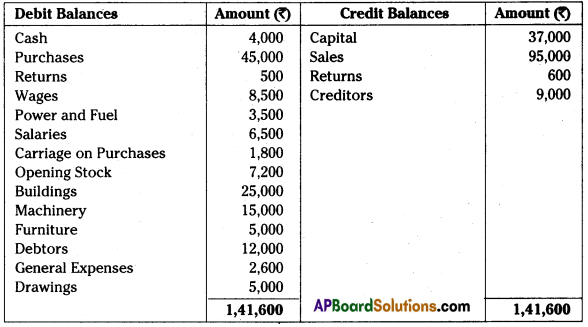

Question 5.

From the following particulars, prepare final accounts for the year ended 31.3.2010.

Trial Balance

Adjustments:

- Closing stock: 16,800;

- Interest on capital :9%;

- Write off : 2,000 as bad debt and provide 5% reserve for doubtful debts;

- Outstanding wages: 1,000.

Answer:

![]()

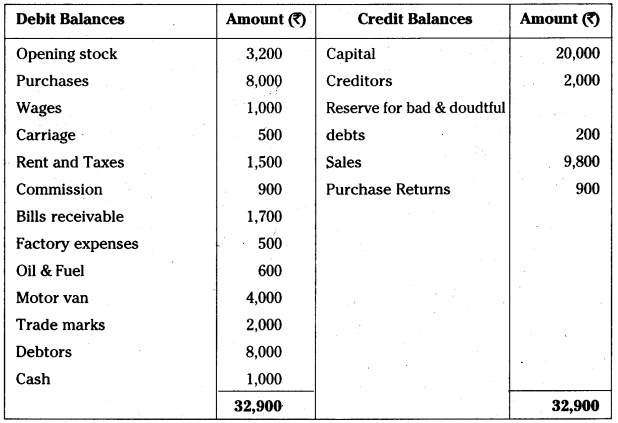

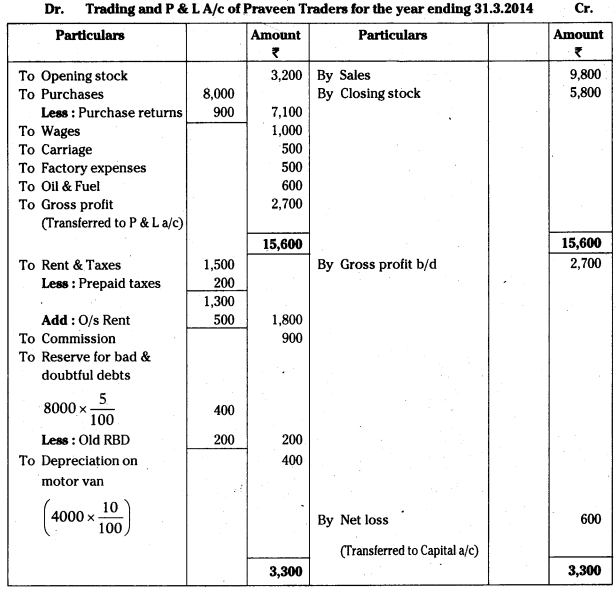

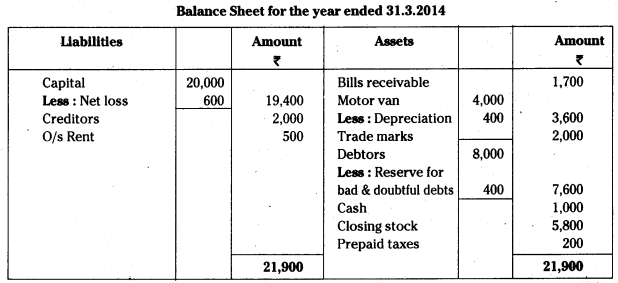

Question 6.

Prepare final accounts of Praveen Traders for the year ending 31.03.2014.

Trial Balance

Adjustments:

- Closing stock : 5,800;

- Depreciation on motor van: 10%;

- Reserve for bad & doubtful debts : 5%;

- Outstanding rent Rs. 500;

- Prepaid taxes: Rs. 200/-.

Answer:

Question 7.

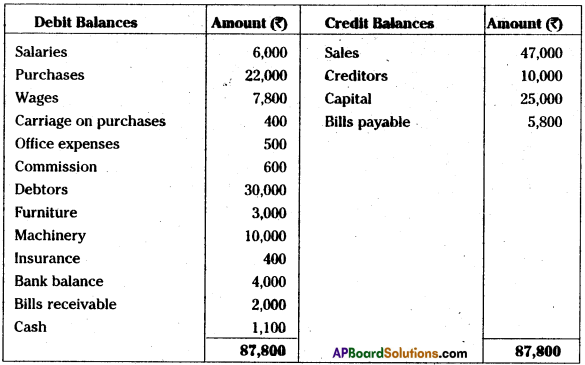

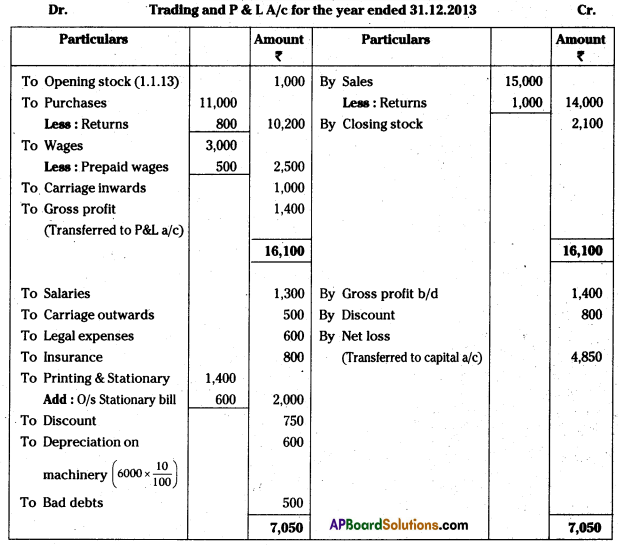

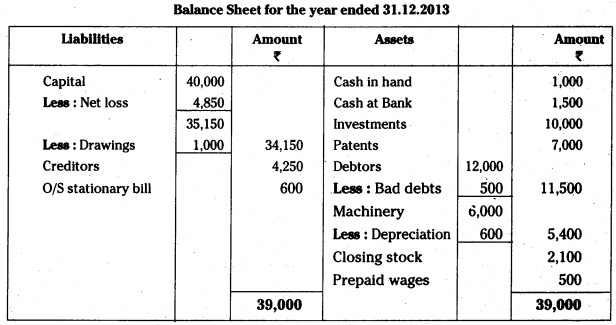

Prepare final accounts from the following trial balance for the year ended 31.12.2013.

Trial Balance

Adjustments:

- Closing stock: 2,100

- Outstanding stationery bill : 600

- Depreciation on machinery: 10%

- Bad Debts : 500

- Prepaid wages :500

Answer:

![]()

Question 8.

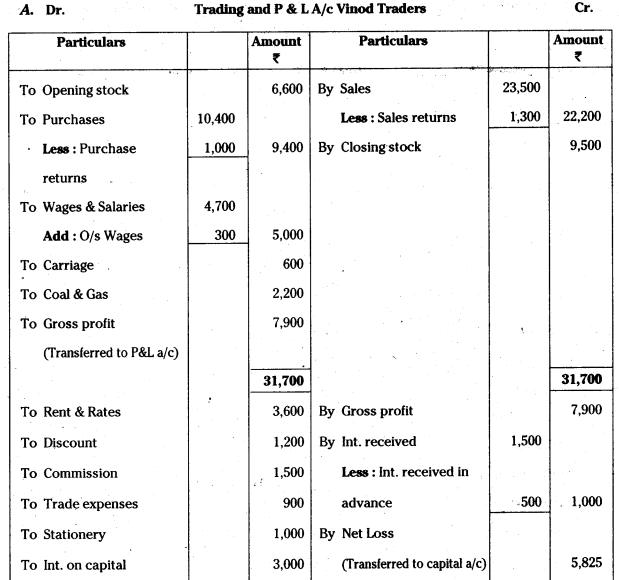

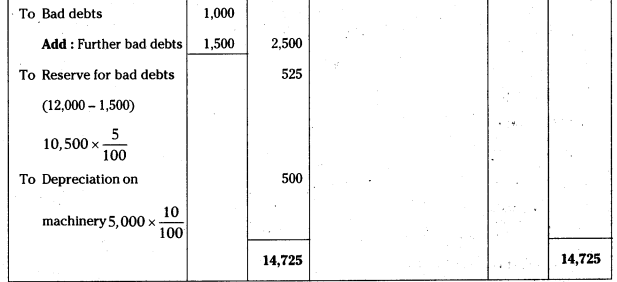

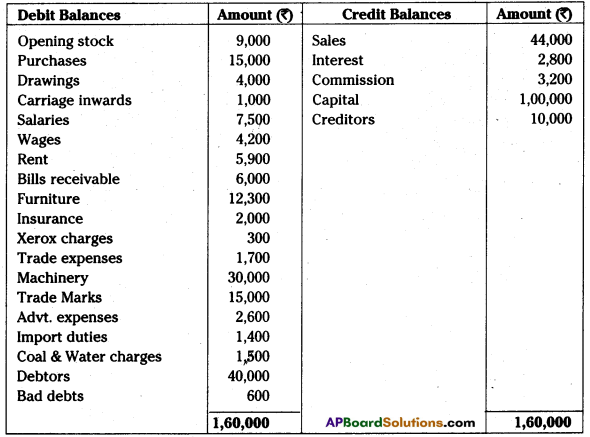

From the following Trial balance of Vinod Traders, prepare final accounts:

Trial Balance

Adjustments:

- Closing stock: 9,500

- Bad debts : 1,500

- Provide reserve for bad debts : 5%

- Outstanding wages : 300

- Depreciation on machinery: 10%

- Interest received in advance : 500.

Answer:

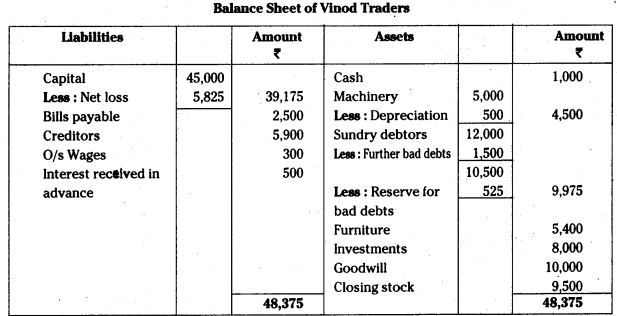

Question 9.

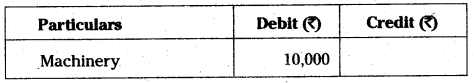

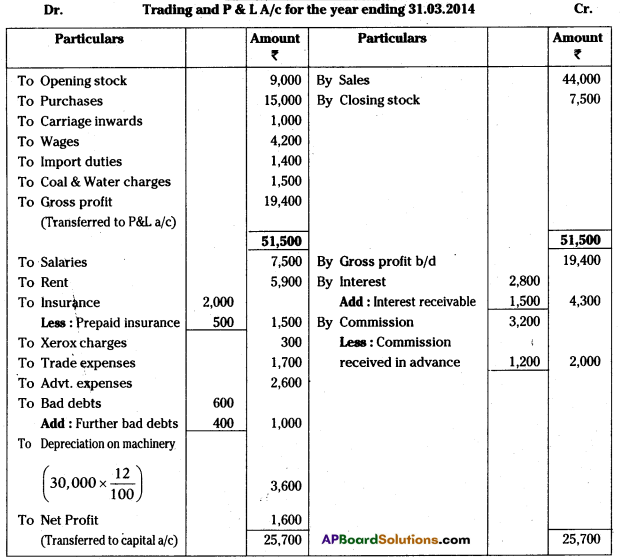

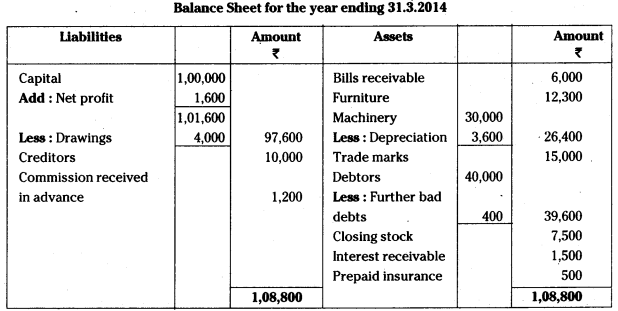

Prepare sole traders final accounts for the year ending 31.03.2014.

Trial Balance

Adjustments:

- Closing stock value : 7,500;

- Depreciation on machinery : 12%;

- Commission received in advance : 1,200;

- Interest receivable : 1,500;

- Further bad debts : 400;

- Prepaid insurance: 500.

Answer:

![]()

Question 10.

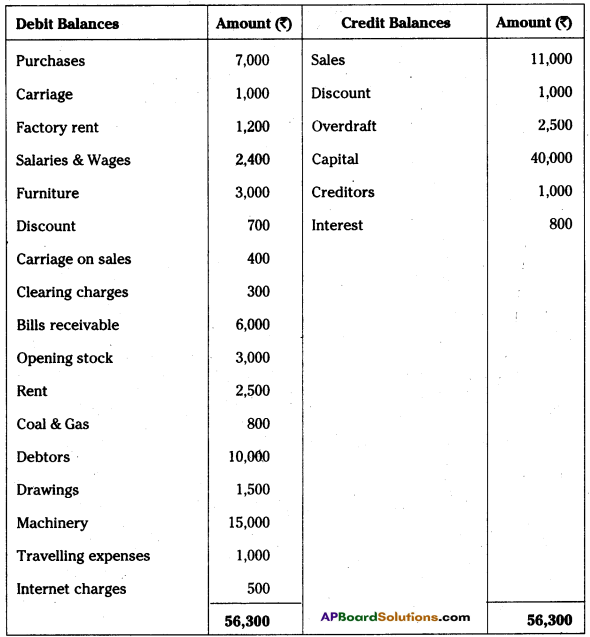

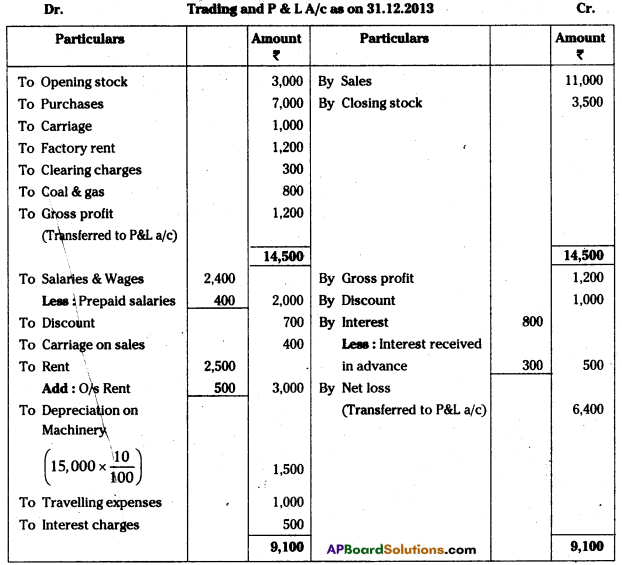

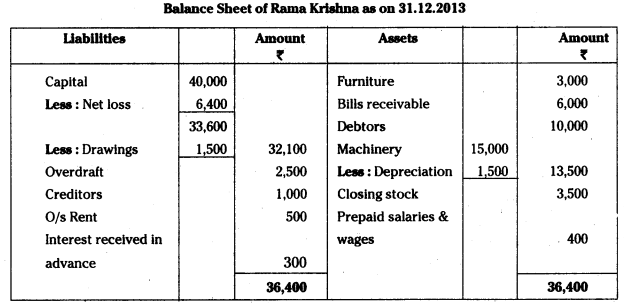

Prepare Final Accounts of Ramakrishna Traders as on 31.12.2013:

Adjustments:

- Closing stock: 3,500

- Outstanding rent: 500

- Prepaid salaries & wages : 400

- Interest received in advance: 300

- Depreciation on machinery: 10%

Answer:

Question 11.

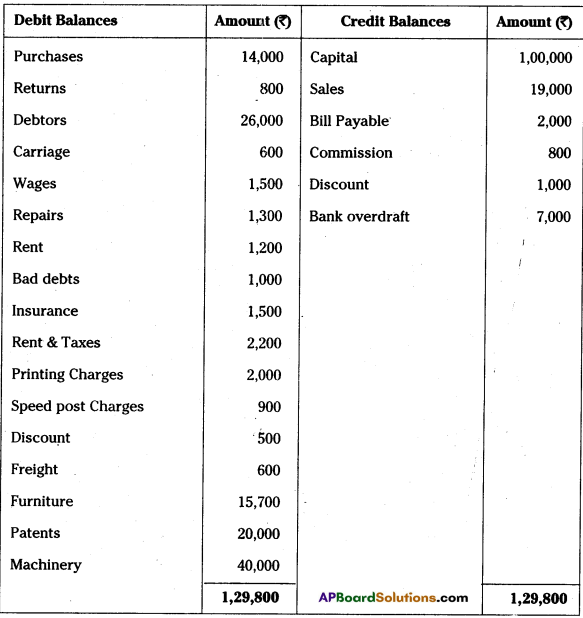

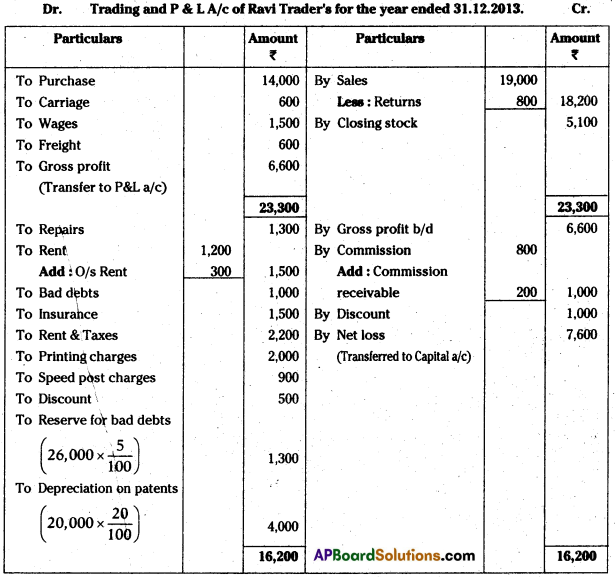

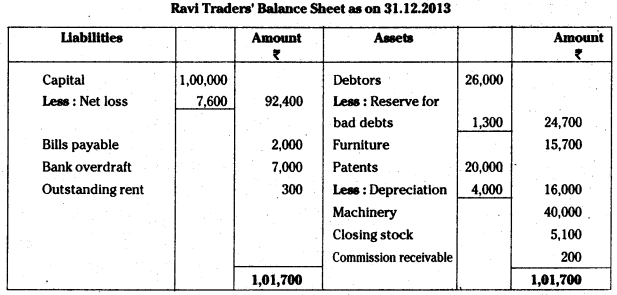

Prepare Ravi Traders’ Final Accounts for the fear ended 31.12.2013:

Trial Balance

Adjustments:

- Closing Stock Value : 5,100

- Reserve for Bad Debts : 5%

- Depreciation on patents : 20%

- Outstanding Rent :300

- Commission Receivable : 200

Answer:

Question 12.

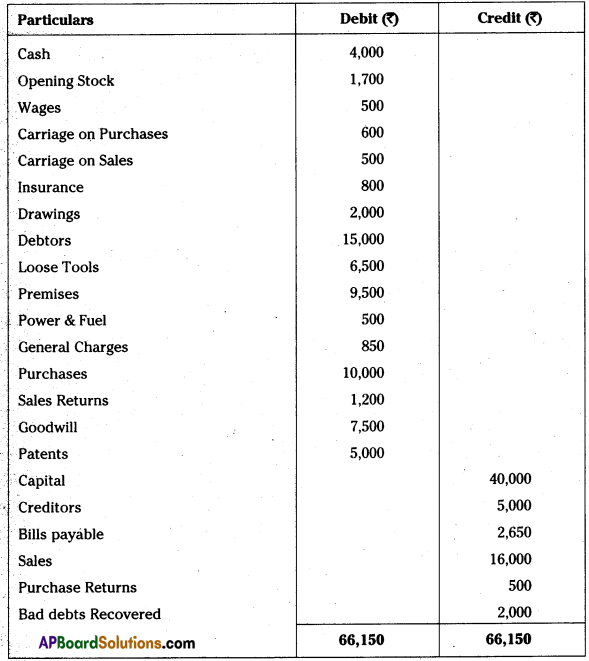

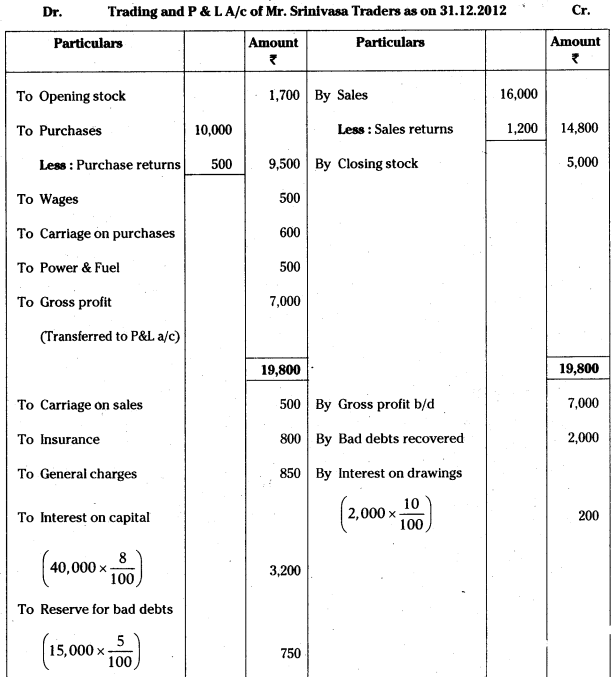

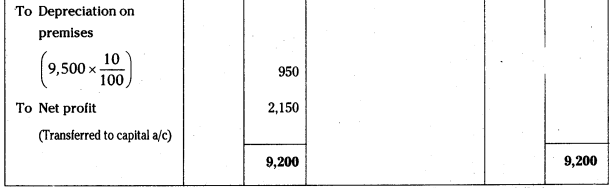

Prepare Final Accounts of Srinivasa Traders as on 31.12.2012.

Trial Balance

Adjustments:

- Closing stock value: Rs. 5,000

- Calculate Interest on Capital : 8%

- Interest on Drawings: 10%

- Provide Reserve for Debts : 5%

- Depredation on premises: 10%

Answer:

Question 13.

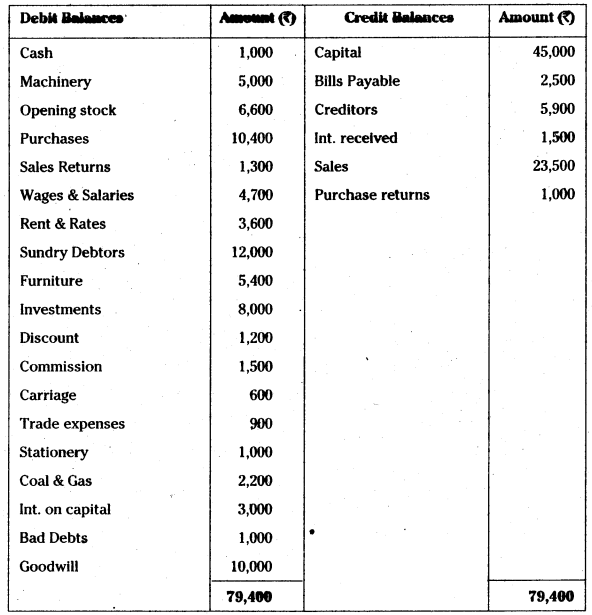

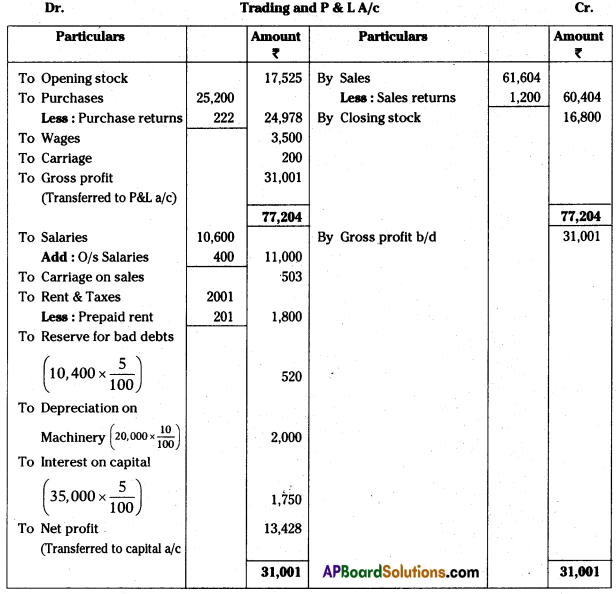

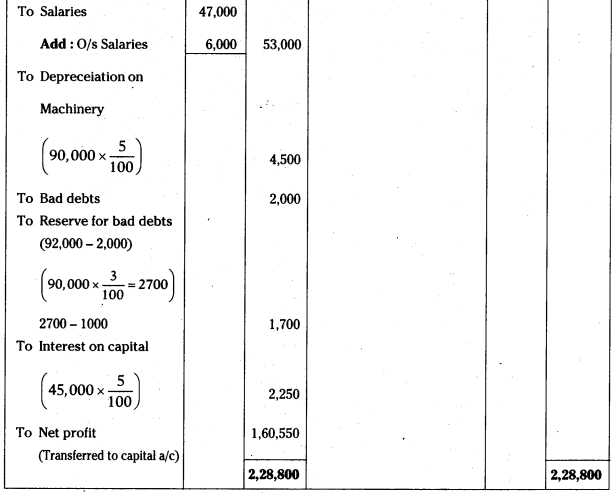

From the following Trial Balance prepare Final Accounts.

Trial Balance

Adjustments:

- Closing Stock Value : Rs. 16,800;

- Outstanding Salaries : 400

- Prepaid Rent & Taxes: 201

- Provide Reserve on Sundry Debtors : 5%

- Depreciation on Machinery: 10%

- Interest on Capital: 5%

Answer:

![]()

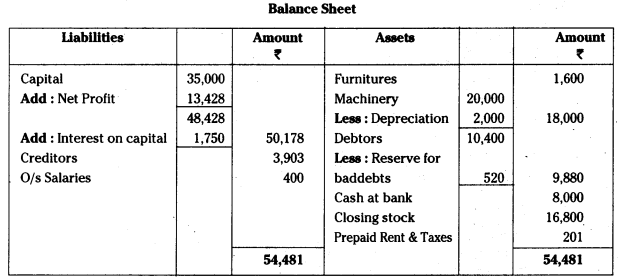

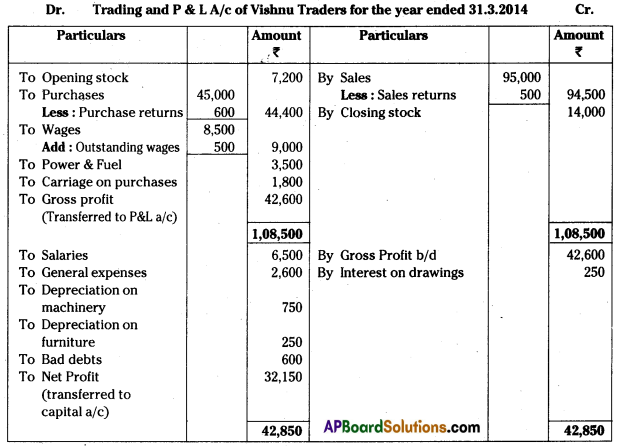

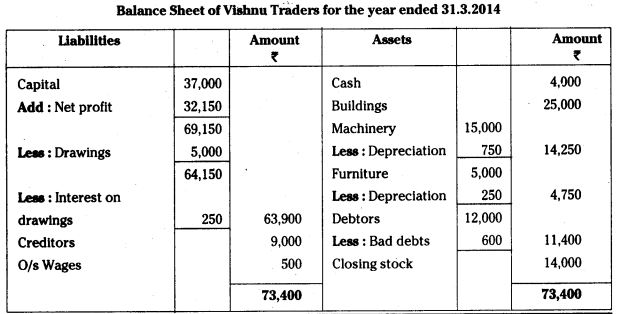

Question 14.

From the following Trial Balance of Vishnu traders prepare Final Accounts for the year ended 31.3.2014.

Trial Balance

Adjustments

- Closing Stock Value: Rs. 14,000;

- Depreciation on Furniture: 250, on Machinery: 750

- Outstanding Wages : Rs. 500;

- Bad Debts : 600;

- Interest on Drawings : 5%

Answer:

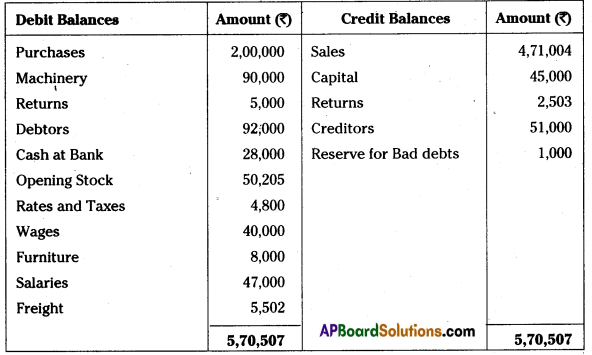

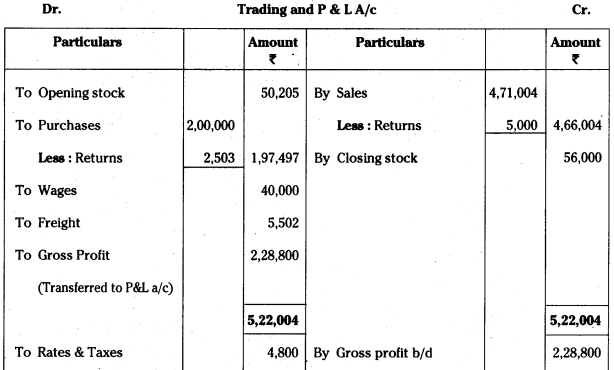

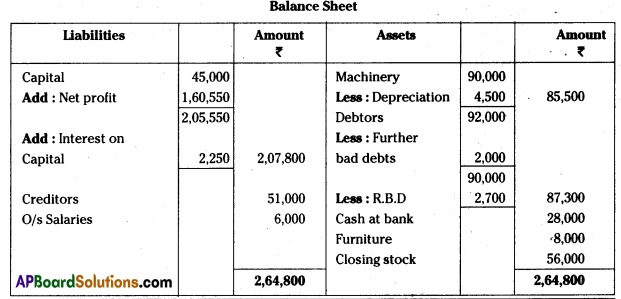

Question 15.

Prepare Final Accounts:

Trial Balance

Adjustments:

- Closing Stock Value : Rs. 56,000

- Outstanding Salaries : 6,000

- Bad Debts : 2000, and Create Reserve for Bad debts : 3%

- Depreciation on Machinery: 5%

- Interest on Capital: 5%

Answer:

Question 16.

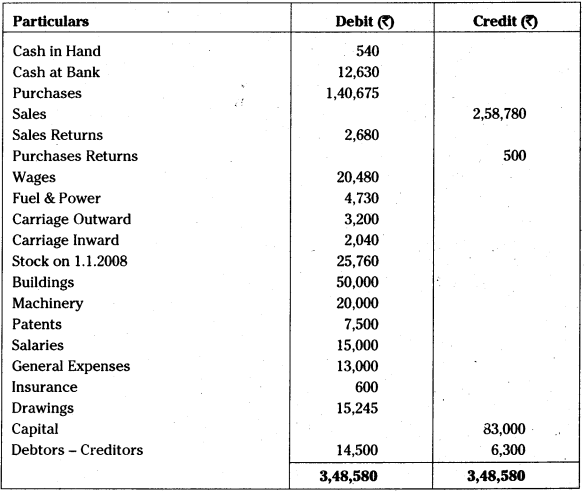

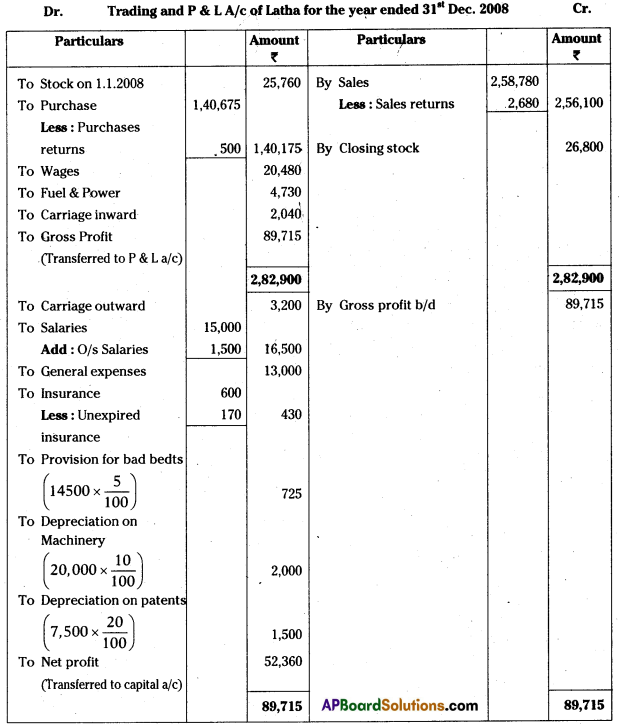

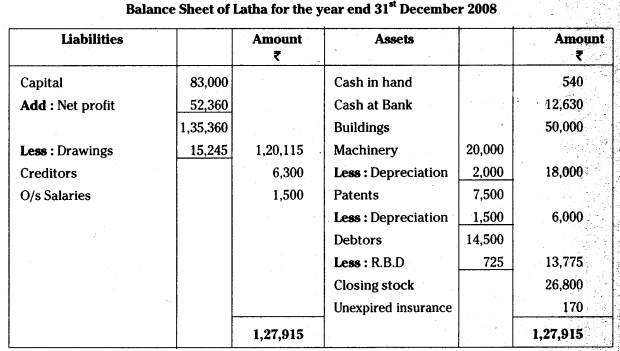

From the following Trial Balance and additional information of Latha, prepare Trading and Profit and Loss Account for the year ended 3l Dec. 2008 and Balance Sheet as on that date.

Trial Balance

Adjustments:

- Closing Stock : Rs. 26,800

- Depreciate 10% on Machinery and 20% on Patents

- Outstanding Salaries : Rs. 1,500

- Unexpired Insurance: Rs. 170

- Provide 5% provision for bad debts on Debtors

Answer:

![]()

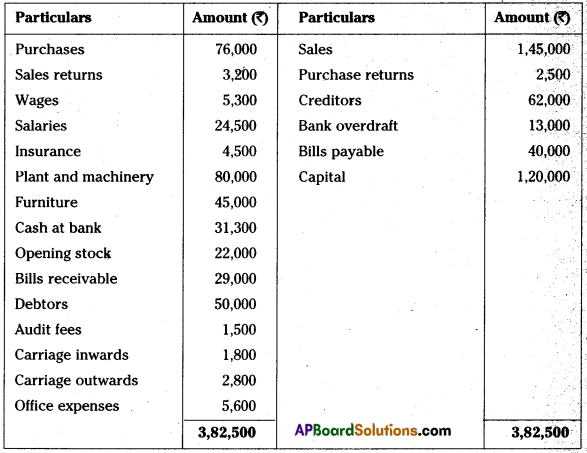

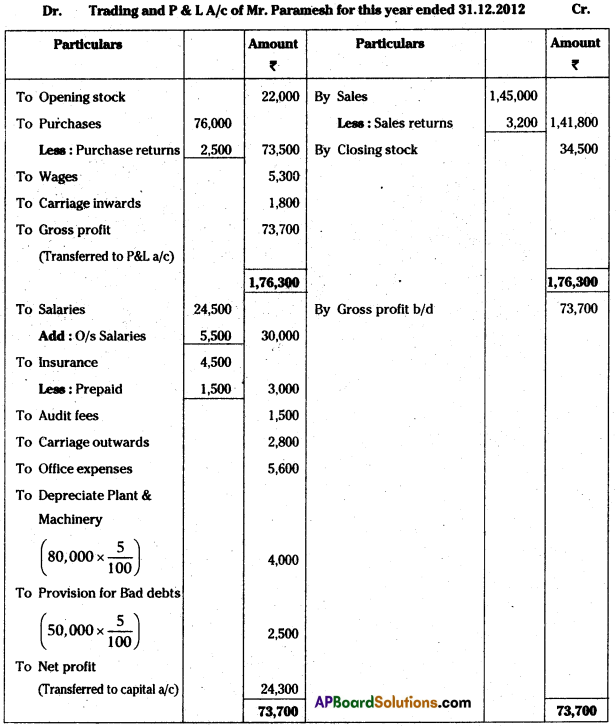

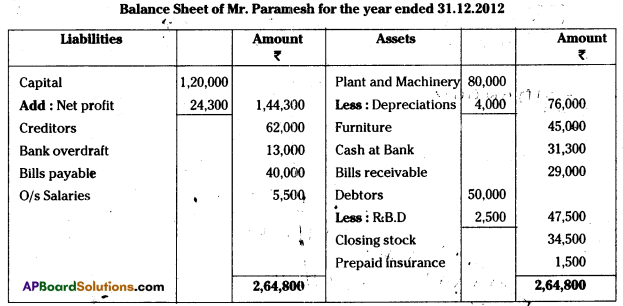

Question 17.

From the following Trial Balance of Mr. Paramesh, prepare the Trading, Profit and Loss account and Balance Sheet for the year ended 31.12.2012.

Trial Balance as on 31.12.2012

Adjustments:

- Closing Stock : Rs. 34,500

- Outstanding salaries : Rs. 5,500

- Depreciate plant and machinery by 5%

- Prepaid insurance: Rs. 1,500

- 5% provision is to be made for bad debts on debtors

Answer:

Student Activity

Visit any organisation and note the adjustments made during the last year’s final accounts.