Andhra Pradesh BIEAP AP Inter 2nd Year Economics Study Material 5th Lesson Industrial Sector Textbook Questions and Answers.

AP Inter 2nd Year Economics Study Material 5th Lesson Industrial Sector

Essay Questions

Question 1.

Explain the importance of Industrial Sector in India.

Answer:

Industrialisation is a pre-requisite for any country, in a particular underdeveloped country like India. The major sectors like Agriculture and tertiary sectors depend upon the available production of equipment and machinery at reasonable prices by the industrial sector.

1) Raising Income: The first important role is that industrial development provides a secure basis for rapid growth of income. In industrially developed countries, for example, the percapita income is very high where, as for the industrially backward countries is very low. Percapita income in 2012 in Germany was $ 44,010, Japan $ 47,870, U.K. $ 38,250, USA $ 50,120 and India only at $ 1530 per annum.

2) Changing the structure of the Economy: Secondly, in order to develop the economy underdeveloped countries need structural change through industrialization. The benefits of industrialization will ‘trickle down’ to the other sectors of the economy in the form of development of agricultural and service sectors leading to the rise in employment, output and income. In India sectoral contribution to gross domestic product is 13.9 percent from Agriculture, 26.2 percent from Industry and 59.9 percent from Service sector during the year 2013-14. (provisional)

3) Meeting High – Income Demands: Demands of the people are usually for industrial products alone. After having met the needs of food, income of the people is spent mostly on manufactured goods. To meet these demands and increase the economy’s output,’ underdeveloped countries need industialization.

4) Overcoming Deterioration in the terms of India : India need industrialization to free themselves from the adverse effects of fluctuations in the prices of primary products and deterioration in their terms of trade. Such countries mainly export primary products and import manufactured goods. For economic development such countries must shake off dependence on primary products. They should adopt import substituting and export oriented industrialization strategy.

5) Absorption of Surplus labour in Industries: The next advantage is underdeveloped countries like India are characterised by surplus labour and rapidly growing population. To absorb all the surplus labour it is essential to industrialise the country rapidly. It is the establishment of industries alone that can generate employment opportunities on an accelerated rate.

6) Bringing Technological Progress: Another advantage is research and development is associated with the process of industrialization. This results in bringing about an industrial civilization (or) environment for rapid progress which is necessary for any healthy economy.

7) Strengthening the Economy: Finally industrialization of the country can provide the necessary elements for strengthening the economy.

![]()

Question 2.

Briefly review the 1948 Industrial Policy Resolution of India.

Answer:

After independence, Government of India issued the first important industrial policy statement on April 6, 1948. This resolution laid the foundation of mixed economy in India. Objectives:

- Establishment of a society where equal opportunities and justice to all.

- Increase in the standards of living of people.

- Removal of inequalities in income and wealth. In order to reach the objectives • mentioned above, the resolution divided the industries into four broad categories.

- Industries – where state (Government) had a monopoly.

- Mixed sector – Industries in the private sector and Government controls them.

- Those industries under the control of Government are the key industries. They are established by the Government. The existing private undertakings were allowed to continue for 10 years. After which Government will think of their Nationalisation.

- All over industries which are not included in the above were left open to the private sector. However, the state will have its control over these units. The important features noticed in the 1948 industrial policy resolution are :

a) Industries are classified into four categories.

b) The resolution accepted the importance of both private and public sectors in the speedy industrial development of Indian economy.

c) The 1948 resolution also accepted the importance of small and cottage industries.

d) The resolution also recognized the role of foreign capital and importance of regularization of its use.

e) The resolution also mentioned about the Nationlisation of private undertakings in case of unsatisfactory progress.

Question 3.

Discuss the 1956 industrial policy resolution of India.

Answer:

1956 Industrial Policy Resolution: Agriculture sector achieved the desired progress during the first five year plan. Therefore, Government of India shifted the stress to the development of industry in the second five year plan. In the light of the socio-economic changes that took place during the 1st plan and all this necessitated a fresh statement of Industrial policy. As a result the second industrial policy resolutions were adopted in April 30, 1956.

Objectives : Following are the objectives of the 1956 industrial policy resolutions.

- Acclerating the rate of growth by speeding up the industrialisation process.

- Mutual co-operation between the public and private sectors.

- To develop heavy industries and machine making industries by expanding the public sector.

- Establishment of the socialistic pattern of society.

- To prevent private monopolies and the concentration of wealth and income.

- Reducing the regional imbalances.

- Encouragement to cottage and small scale industries.

- To build up a large and growing co-operative sector.

1956 Industrial policy resolutions gave importance to the establishment of socialistic pattern of society in India with an expanded public sector. In a nut-shall, we can say that this policy modernized the concept of mixed economy.

Important Provisions : The important provisions of the 1956 Industrial Policy Resolutions are :

1) New classification of Industries: The resolutions laid down three categories which bear a close resemblance of the 1948 resolutions.

a) Category A has 17 Industries : Arms of ammunition atomic energy iron and steel, heavy machinery for mining, machine tool manufacturers, heavy electrical, coal, mineral oils, aircrafts, air transports, railways, ship building, telephone, telegraph, wireless equipment, generation and distribution of electricity.

b) Category B includes : 12 Indusries mining industries, aluminium and other non ferrous metals not mentioned in category “A” chemical industry, antibiotics and other essential drugs fertilizers synthetic rubbur, chemicals, road and sea transport, carbonization of coal.

c) Category C includes : Industries which consisted of the rest. These industries and their future development would in general be left to the initiative and enterprise of the private sector.

2) Public and private sectors : This resolution also laid down the importance on the mutual co-operation between the public and private sectors.

The private sector was allowed to operate freely or its help could be obtained if the Government cleaned fit. However, the private sector was to remain subject to various regulations and controls of Government.

3) Cottage and Small scale Industries : The 1956 resolutions recognized the importance of small – scale and cottage industries as the 1948 resolutions.

4) Removing regional disparities ’: It also called for the reduction in regional imbalances and .income inequalities.

5) Role of labour : To provide the technical and training facilities for efficient management that helps for speedy industrialisation.

This resolutions also recognized the importance of industrial peace for the economic growth of the economy.

![]()

Question 4.

Critically evaluate the 1991 New Industrial’Policy Resolution of India. [A.P. Mar. 16]

Answer:

Industrial policy statement 1991 brought rapid structural changes in the economy of India. Most of the State owned units were running with huge losses. Government was not interested to run the state owned units. So as part of economic reforms generally known as liberalization, privatization, globalization and a new industrial policy became inevitable.

Objectives :

a) To build on the going already made in the industrial sector.

b) To correct the distortions or weakness that may creep in the pattern of industrial growth.

c) To maintain a sustained growth in productivity and gainful employment and

d) To attain technological dynamism and international competitiveness.

Main features: In order to explore and exploit the industrial potential of the country the following decisions.

a) Delicensing:

i) Industrial licensing will be abolished for all projects except for these which are important for security, strategic, social and envirorimental reasons and items of elite’s consumption. License is not necessary for the items produced in small scale sector. License is required to establish the following industries viz, coal, petroleum, motor cars, alcoholic drugs, cigars, industrial explosives, hazardous chemicals.

ii) Reservation for the public sector: Establishment of key and strategic industries reserved for public sector are arms and ammunition, defense equipment, atomic energy, mineral oils, railway transport.

iii) Automatic clearance of capital goods: The Government permits imports of capital goods like machinery, without any conditions if the foreign exchange needed for the imports is met from foreign equity capital.

iv) Location policy : In locations other than cities of more than one million population, there will be no requirement of obtaining industrial approvals from the Central Government except for industries specified in Annexure II originally. In cities with a population of more than 1 million, industry other than those of a non-polluting in nature, were required to be located outside 25 kilometers of the periphery.

v) Abolition of convertibility clause : The mandatory convertibility clause will no longer be applicable for term loans from the financial institutions for new projects. This has provided them an option of converting part of their loans into equity, if felt, necessary by their management.

b) Foreign investment policy : According to the new industrial policy approval will be given for direct foreign investment up to 51 percent foreign equity in high priority industries. FDI is prohibited only in the following sectors in 1991 industrial resolution.

They are :

- Retail trading

- Atomic energy

- Lottery business

- Gambling and betting

c) Foreign technology agreement: Automatic approval for technology agreements in high priority industries should be given. No permission will be necessary for hiring of foreign technicians and foreign testing of indigenously developed technologies.

d) Public sector policy : Public sector will not be barred from entering areas are not specifically reserved for it. Board for Industrial and Financial Reconstruction (BIFR) is constituted to undertake the revival of rick public units and to protect the interest of workers affected by rehabilitation.

e) MRTP ACT: The conditions in the Monopoly Restrictive Grade Practices (MRTP) Act that monoploies should get prior approval of the Government for expansion, for establishment of new undertakings merger, amalgamation, take over and appointment of directors will be removed. The Act will concentrate more on controlling unfair or restrictive trade practices.

![]()

Question 5.

Write about National Manufacturing Policy of India.

Answer:

After a long gap there was a major industrial policy initiated by the UPA Government in 2011. India’s manufacturing sector is only about 13% of that of China’s. Government of India brings back industrial policy into focus in the form of National Manufacturing Policy (NMP) on November 4, 2011.

National Manufacturing Polity : This policy envisages simplification of business requlations without diluting their purpose. Recognizing the importance of Small and Medium Enterprises (SMEs) in the country’s economy. These interventions relate primarily to technological up gradation, adoption of environment, friendly technology and equity investments. This policy has been given high priority in the policy through fiscal incentives for private sector and Government schemes. It also provided for on – lands which are degraded and uncultivable.

Objectives:

- Increase manufacturing sector growth 12 – 14% over the medium term.

- Increase the share of manufacturing in gross domestic product from the present level of about 16.0% to 25% by 2022.

- Create 1000 million additional jobs in the manufacturing sector by 2012.

- Create appropriate skills among the rural migrant and urban pour for their easy absorption.

- Increase domestic value addition and technological depth in manufacturing.

- Enchance global competitiveness of Indian manufacturing.

In India 60% of its population in the working age group. The manufacturing sector will have to create gainful employment opportunities for at least half this number.

Features:

- The State Government would be responsible for the selection of suitable land having an area of 50Q0 hectares in size.

- A Special Purpose Vehicle (SPV) will be constituted to discharge the affairs of NIMZs

- The State Government would facilitate the provision of water, power connectivity and other infrastructure and utilities linkages.

- The Central Government will bear the cost of master planning.

![]()

Question 6.

Explain the disinvestment policy of India.

Answer:

The Government of India in July 1991 initiated the disinvestment progress in India. “In order to raise resources and encourage wide public participation, a part of the Government share holding in the public sector would be offered to mutual funds, financial institutions, general public and employees”. This is a process for disinvestment in the public enterprises.

Salient features of the disinvestment policy are :

- Citizens have every right to own part of the shares of public sector undertakings.

- Public sector undertakings are the wealth of the Nation and this wealth should rest in the hands of the people.

- While pursuing disinvestment, Government has to retain majority shareholding; i.e, at least 51 percent and management control of the public sector undertakings.

Development regarding Disinvestment:

On 5th November 2009, Government approved the following action plan for disinvestment in profit making Government companies.

i) Already listed profitable Central Public Sector Enterprises (CPSEs) (not meeting mandatory shareholding of 10 percent are to.be made compliant by offer for sale by Government (or) by the CPSEs through issue of fresh shares or a combination of both.

ii) Unlisted Central Public Sector Enterprises (CPSEs) with no accumulated losses and having earned net profit in three preceding consecuive years are to be listed.

iii) Follow on public offers would be considered taking into consideration the needs for capital investment of CPSE, on a case by case basis, and Government could simultaneously or independently offer a portion of its equity shareholding.

iv) In all cases of disinvestment, the Government would retain at least 51 percent equity and the managment control.

v) All cases of disinvestment are to be decided on a case by case basis.

Major disinvestment receipts, since 2004 – 05 have come from sale of equity shares of National of Thermal Power Corporation Limited. (NTPC) ? 2684.07 crore, Maruti Udyog Limited (MUL) (Not a CPSU) ₹ 2277.62 crore, Power Grid Corporation of India (PGCI) ₹ 994.82 crore, Oil India limited ₹ 2247.05 crore NMDC limited ₹ 9930.40 crore, Coal India limited ₹ 15,199 crore and Power Finance Corporation (PFQ) ₹ 1144.55 crore upto 30-1-15, the Government of India got ₹ 1,79,625.25 crores through disinvestment process that should be utilized to provide social infrastructure and to undertake other development activities in the country.

Question 7.

Explain the role of foreign Direct Investment in economic development of India.

Answer:

Foreign direct investment is a major source of non financial resources for the economic development of India. Foreign companies invest in India to take advantage of cheaper wages, special investment privileges like tax exemptions etc. The Government has taken many initiatives in recent years such as relaxing FDI norms across sectors such as defense, PSU oil refineries, telecom, power exchange, stock exchange, Auto mobile industries etc.

According to a recent report by global credit rating agency Moody’s, FDI inflows have increased significantly in India in the current fiscal. Net FDI inflow to take of US $ 14.1 billion in the 1st five months of 2014 – 15. Total FDI inflows into India in the period April 2000 – November 2014 touched US $ 350,963 millions.

Government initiatives towards (FDIs): India’s cabinet has cleared a proposal which allows 100% FDI in railway, infrastructure, excluding operations. The Government has notified easier FDI rules for construction sector, where 100% overseas investment is permitted, which will allow overeas investors to exist a project even before its completion.

With the objective of encouraging foreign firms to transfer state of the art technology in defence production, the Government increase the FDI cap for the sector to 74% from 49% at present. The Union Cabinet has cleared a bill to raise the foreign investement ceiling in private insurance companies from 26% to 49%.

The RBI has allowed a number of foreign investors to invest on repatriation basis, in non – convertible preference shares or debentures which are issued by Indian companies. The RBI has established a frame work for investments, which allows foreign port folio investors to take part in open offers, buyback of securities and disinvestment of shares by Central or State Governments.

India will require around US $ 1 trillion in 12th Five Year Plan to fund infrastructure growth covering sectors such as highways, ports and airways. This requires support in terms of FDI. During the year 2013 FDI was dumped into the automobiles, computer software, hardware, power and telecommunications.

![]()

Question 8.

Critically examinethe role of Special Economic Zones in Indian economic development.

Anwer:

The Government of India announced Special Economic Zones policy in April 2000. This policy aims at rapid economic growth supported by quality infrastructure complemented by an attractive fiscal package, both at the-Central and State level, with the minimum possible regulations. In India, while passing the SEZ Act in May 2005 and came into effect from February 2006, the following objectives were laid down.

- Generation of additional economic activity.

- Promotion of exports of goods and services.

- Promotion of investment from domestic and foreign sources.

- Creation of employment opportunities; and

- Development of infrastructure facilities.

Special Economic Zones in India : Upto 2013 number of formal approval Special Economic zones were 577. Number of SEZ notified and functioning are 389 and 170 respectively. The total units approved are 3589 and these units provide employment to 10,74,904 persons (as on March 31,2013). The Special Economic Zones exports are ₹ 4,76,159 crore during the year 2012 – 13. As per the provision of the SEZ Act 2005, 100% Foregin Direct Investment is allowed.

Government Incentives to Special Economic Zones: Government of India offers the following fiscal and incentive packages to Special Economic Zones.

- Exemption from custom duties, central excise duties, service tax, central sales tax and securities transactions tax to both the developers and the units.

- Tax holidays for 15 years i.e, 100 percent tax exemption for 5 years, 50 percent for the next 5 years and 50 percent of the ploughed back export profits for the next 5 years

- 100 percent income tax exemption for 10 years in a block period of 15 years for SEZ devleopers.

- Provision of standard factories at low rents with extended lease period.

- Provision of infrastructure and utilities.

- Single window clearance and simplified procedures.

Advantages of Special Economic Zones : Special Economic Zones are expected to give a big push to exports, employment and investment. In fact, the Government of India has been systematically projecting SEZs as “Carriers of Economic Properity”. The advantages of SEZs are as follows.

- Boost economic growth at an extremely fast rate.

- Usher in affluence in rural areas.

- Provide large number of jobs in manufacturing and other services.

- Attract global manufacturing and technological skills. ‘

- Bring in private and public sector investment from both home and abroad.

- Made Indian firms more competitive and

- Help to slow down rural – urban migration.

To conclude, it may be stated that the standing committee report on SEZ in June 2007 is a path breaking document which indicates the direction in which the country must move if it wants to pursue industrialization with a human face.

![]()

Question 9.

Mention the various causes for Industrial backwardness in India.

Answer:

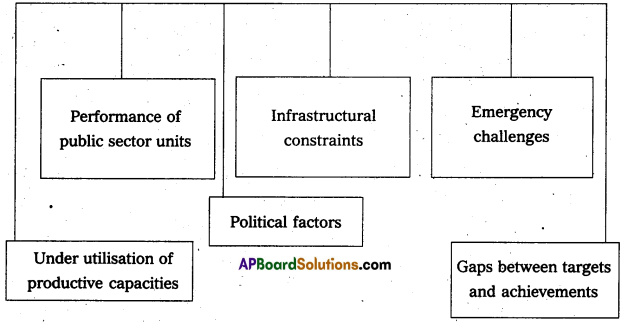

India could not achieve the desired growth rate in the industrial sector even though it is rich in natural resources and has huge working population. Even after completion of eleven Five Year Plans, there is wide gap between targets fixed targets achieved. Rakesh Mohan opines that there is a gap of 20 percent on an average between the targets fixed and targets realized in each plan annually. The reasons for this are as follows.

Reasons for Industrial Backwardness in India

1) Under – utilisation of productive capacities: Many of the industrial units failed to utilize the existing productive capacities fully. There are many reasons for this. Among them is raw material scarcity, low technical know-how etc. For example during 2005 – 2006, out of 203 public sector enterprises, the capacity utilization was below 50 percent by nearly 67 percent of the units.

2) Performance of public sector units: Prior to liberalization, there was a phenomenal growth of the public sector. Many of the public sector units were under losses. The number of loss making units decreased from 105 in 1999 – 00 to only 63 in 2011. However, the losses increased from ₹ 10,302 crores in 1999 – 00 to ₹ 27,602 crores in 2011-12.

3) Political factorsIn many situations, political factors influence decision about location of projects not considering feasibility. This approach leads to a considerable wastage of capital resources.

4) Infrastructural constraints: One of the major constraints in industrial development is poor quality and high cost of infrastructure particularly power and transport network. All such infrastructural constraints not only showed adverse effect on industrial growth but also reduced the competitiveness of Indian industries that were, fast emerging in the new global economic environment.

5) Gaps between targets and achievements : In the earlier period of planning achievements were below the targets. Rakesh Mohan has observed. “The average industrial growth rate achieved over thirty – five to forty years has been about 6.2 percent rate to the average of about 8 percent projected”.

6) Emergency challenges : As a founder member of the World Trade Orginization, India has withdrawn all quantitative restrictions on imports. This resulted into the closure of a nuclear of industrial units. Thus, the industrial sector facing so many problems.

Question 10.

What are the merits and demerits of small scale enterprises in Indian economy. [A.P. Mar. 18, 17]

Answer:

The small scale and cottage industries play apvital role in the Indian economy. As ancillary industries, they are contributing to the growth of the agriculture and industrial sectors in a developing country like India.

The recommendations of Abid Hussian Committee, the Government raised the investment limit on plant and machinery for small units and ancillaries to 3 crores and that for tiny units to ₹ 25 lakhs.

Merits:

- Expansion of small scale industrial sector and its share in industrial production: The rapid growth of small scale units from 2006 – 07 onwards contributing much to India’s gross domestic product.

- Employment opportunities : The small industries are labour intensive they could generate employment opportunities to the tune of 191.4 lakh persons in 1994 – 95, 249.3 lakh persons in 2001 – 02 and it increased to 1012.6 lakh persons in 2011 – 12.

- Capital formation: The spreading of industry over the country side would encourage the habits of thrift and investment in the rural areas.

- Low capital: The small scale units are best suited to the developing countries like India, which are labour intensive and capital scarce economics. It does not require much capital for the establishment Of these units.

- Skill formation : A small scale enterprise does not require any sophisticate skill. But it provide, industrial experience for large number of small scale managers.

- Low import intensity: Low import intensity in the capital structure of small scale .enterprises reduces the need for foreign capital.

- Decentralized industrial development : Development of small scale industries will bring about decentralization of industries. It will promote the object of balanced regional development.

- Equitable distribution : The profits earned by small scale enterprises distributed among large number of enterpreneurs leads to decentralization of income and wealth.

- Exports : The contribution of small scale enterprises to earn foreign exchange is very high. The share of exports from the small scale sector represents about 31.1% of total exports in 2006 – 07.

![]()

Demerits:

- Inefficent human factor: Most of the rural people are illiterates and lack technical know-how in the areas of production, finance, accounting and marketing management.

- Lack of credit facilities : The small industrialists are generally poor and there are no facilities of cheap credit either. Thus, they are caught up in the vicious circle of debt trap.

- Problem of raw materials : The quantity, quality and regularity of the supply of raw materials are all highly unsatisfactory. According to an estimate, about 40 percent of such units have become sick owing to non – availability of raw materials regularly.

- Absence of organized marketing: Since marketing is not properly organized, the helpless artisans are completly at the mercy of middlemen. The small scale units cannot afford to spend lavishly on advertisement to promote their sales.

- Lack of machinery and equipment: Small scale untis are facing inadequate modem machines and equipment. This leads to low productivity in small scale units.

- Power shortage : In recent years power shortage and frequent power cuts played havoc with small scale industries. More hours of power cut are there in rural areas which affect the growth of small scale units.

- Lack of technological up – gradation : It is found that the levels of productivity and technology used by the small scale sector are not globally competitive. Without technological upgradation these units may not serve in a globally integrated economy.

- Heavy taxation : Cottage and small scale industries have also to bear a heavy burden of taxation both on raw materials and also on finished goods.

Question 11.

Briefly explain the Indian industrial growth rate during the Five Year Plans.

Answer:

The industrial pattern in India has undergone a marked change as a result of Five Year Pains, especially since the beginning of the Second Five Year Plan (1956 – 61). The number of bigger industrial establishments has multiplied and the proportion of producer goods in the composition of manufacturers has registered a striking is increase. Heavy and basic industries have come to occupy an important place in the industrial structure of India.

I. First Plan (1951 – 56): Owing to the small size of the First Plan, insufficiency of funds and greater urgency or agricultural development, the First Plan did not make any big provision for industrial development. The overall industrial production increased by 39 percent i.e about 8 percent per year.

II. Second Plan (1956 – 61) : The actual investment in the public sector on organized industry was ₹870 crores in the second plan. In comprised 27 percent in the Second Five Year Plan’s total outlay.

III. Third Plan (1961 – 66) : The overall financial outlay in industrial sector during the Thrid Plan was ₹ 3,000 crores, out of which the outlay in the public sector was about 1,700 crores and the private sector was ₹ 1,300 crores. An overall target of 7 per cent increase in industrial production was envisaged in the plan.

IV. Fourth Plan (1969 – 74): During the Fourth Plan on the actual out lay organized industry was ₹ 2,700 crores in the public sector. The private sector investment was around ₹ 2,250 crores. The actual performance during the Fourth Plan in the industrial sector was very disappointing. Its average annual growth rate was hardly 5 per cent as against the plan target of 8 per cent.

V. Fifth Plan (1974 – 79) : The Fifth Plan assigned a very important place to the development of industries with a view to achieving self – reliance and social justice. The public sector outlay on industrial development was around ₹ 9,700 crores. The average rate of industrial growth during the plan was targeted at 8.1 per cent per annum.

VI. Sixth Plan (1980 – 85): The public sector outlay of ₹ 23,000 crores was envisaged during the Sixth Plan period, during the sixth plan reveals that a growth rate of 5.45 percent as against 7 percent was achieved.

VII. Seventh Plan (1985 – 90) : The total investment in the industrial sector was ₹ 22,460 crores or 12.5 percent of the total plan outlay. The Seventh Plan achieved the targeted industrial growth rate of 8.5 per cent. It has been made possible because of adequate infrastructure and liberalization policy of the Government.

VIII. Eighth Plan (1992 – 97) : The Eighth Plan was formulated under a new environment when a number of reforms in industrial, fiscal, trade and foreign investment policies were introduced in the economy.

IX. Ninth Plan (1997 – 2002) : Ninth Plan allocated ₹ 69,972 crores for industry at 1996 – 97 prices. Ninth plan targeted a growth rate of 8% for industry. But it achieved only 5%.

X. Tenth Plan (2002 – 07): In the Tenth Plan public sector outlay was ₹ 44,695 crores at 2001 – 02 prices. Industrial performance in the Tenth plan period improved to 8.9% from very low level of growth rate of 4.3% in ninth plan.

XII. Eleventh Plan (2007 – 12): The total outlay in the Eleventh Plan is estimated at ₹ 36,44,718 crores. During this plan, the targeted growth rate is 10 – 11%. The target rate of growth achived more or less in case of industry.

XII. Twelfth Plan (2012 – 2017) : Twelfth Plan envisages an investment of 50 lakh crores in 5 years. The private sector is expected to provide 25 lakh crores. To achieve industrial growth rate to the tune of 9.5% it would require much faster growth in the manufacturing as well as in electricity, gas and water supply sectors.

![]()

Question 12.

Discuss major sources of Industrial Finance in India.

Answer:

Industry needs capital expenditure for the purchase of land, construction of building, installation of machinery etc. Besides this, funds are also required for the purchase of raw materials, for stores, for marketing and for meeting day – to – day requirements of the industry.

The following are the main sources from which the Indian Industry draws finance:

a) Shares

b) Debentures

c) Public deposits

d) Commercial banks

e) Industrial financial institutions

Rapid industrialization needs adequate medium and long term loans. Industrilalization requires lot of funds to start up new units and to modernize existing units. Some of the industrial financial institutions are:

a) Industrial Finance Corporation of India (IFCI)

b) State Financial Corporations (SFC’s)

c) Industrial Credit and Investment Corporation of India (ICICI).

d) The Industrial Development Bank of India (IDBI)

e) Small Industries Devlopment Bank of India (SIDBI)

f) Industrial Investment Bank of India (IIB1)

g) Venture Capital Funds (VCF)

h) UC and GIC.

Short Answer Questions

Question 1.

Industrial Finance Corporation of India.

Answer:

The Government of India set up the Industrial Finance Corporation of India in July 1948 under a special Act. The corporation was authorized to issue bonds and debentures in the open market, accept deposits from the public and also borrow from the R.B.I.

Functions:

- It guaranteed loans raised by the industrial concerns in the capital market.

- It granted loans and advances to industrial concerns and subscribed to the debentures floated by them.

- If under wrote the issues of stocks, shares, bonds and debentures of industrial concerns. The loans sanctioned by IFCI increased from ₹ 210 crores in 1980 – 81 to ₹ 1,860 crores in 2000 – 01.

Question 2.

Industrial credit and Investment corporation of India.

Answer:

It played a role in consolidation in various sectors of the Indian Industry, by financing, mergers and acquisitions. The ICICI, groups financing and banking operations both wholesale and retail.

Functions :

- Guaranteed loans from other private Government source.

- Provided financial services such as deffered credit, leasing credit, installment sale, asset, credit and venture capital.

- It offered long term and medium – term loans, both indian currency arid foreign currency loan.

- Participated in equity capital and in debentures and under wrote new issues of shares and debentures.

![]()

Question 3.

Industrial Estates.

Answer:

Industrial estates are very useful in the development of small scale industries. An industrial estates refers to an area in which a number of small industries are concentrated. As a number of manufacturing units are located with in the same area, they can have common advantages like good site, electricity, water, communication etc. The production costs of the industrial units decrease as they get all facilities at one place for lesser cost.

Advantages:

- It providing and opportunity both rural and semi-urban areas to develop industrially.

- Giving scope to use the available local resources.

- More scope for regional development.

- It makes possible for small industrial units to realise the benefits of economics of scale.

- They can become the best ancillary units, when they are situated nearby the large scale industries.

- The small scale industrial units can make their production profitable by using the available facilities at one place for a lower cost.

Question 4.

Special Economic zones.

Answer:

Special Economic Zones policy was announced by Government of India in April 2000. This policy aims at rapid economic growth by quality infrastructure complemented by an attractive fiscal package, both at the Central and State level. In India, while passing the SEZ Act in May 2005. It came into effect from February 2006.

Objectives:

- Development of infrastructure facilities.

- Generation of additional economic activity.

- Promotion of exports of goods and services.

- Promotion of investment from domestic and foreign sources.

- Creation of employment opportunities etc.

Question 5.

Explain the need of Foreign Direct Investment in India.

Answer:

Foreign Direct Investment is a major source of non – debt financial resource for the economic development of India. Foreign companies invest in India to take advantage of cheaperwages, special investment privileges like tax exemption.

- Encouraging foreign firms to transfer state – of – the art technology in defence production.

- For a country where foreign investments are being made, it also achieving technical know-how and generation of employment.

- The continuous inflow of FDI in India, which is allowed across several industries.

![]()

Question 6.

National Investment Fund.

Answer:

The Government of India constituted the National Investment Rind (NIF) on 3rd November, 2005. The amount received in the form of Disinvestment will go into the National Investment Rind. The fund was to be maintained outside the consolidated fund of India. The NIF was initialized with the disinvestment proceeds of two CPSE. 1. Power Grid Corporation of India Limited (PGCIL) and Rural Electrification Corporation (REQ amounting to ₹ 1814.45.

Features:

- The corpus of the National Investment Rind will be of a permanent nature.

- The proceeds from disinvestment of CPSEs will be channelized into the national investment fund, which is to be maintained outside the consolidated fund of India.

- The Rind will be professionally managed to provide sustainable returns to the Government.

- 75% of annual income of the fund will be used to finance selected social sector schemes, which promote education, health and employment. Ex: Jawaharlal Nehru National Urban Renewal Mission (JNNURM), Rajiv Gandhi Gramin Vidyutikaran Yojana (RGGVY) etc.

Question 7.

Objectives of National Manufacturing Policy. [A.P. Mar. 18]

Answer:

Government of India brings back industrial policy into focus in the form of National manufacturing policy on November 4th 2011.

Objects:

- Increase manufacturing sector growth to 12-14% over the medium term.

- Create 100 million additional jobs in the manufacturing sector by 2012.

- Increase the share of. manufacturing in gross domestic product from 16% to 25% by 2022.

- Create appropriate skills among the rural and urban migrant.

- Increase domestic value addition and technological depth in manufacturing.

- Enhance global competitiveness of Indian manufacturing.

Question 8.

National Investment and Manufacturing Zones.

Answer:

- The State Government would be responsible for the selection of suitable land having an area of 5000 hectares in size.

- NIMZ’s will be utilised for location of manufacturing units at least 30% of total area proposed.

- The State Government would facilitate the provision of water power, connectivity and other infrastructure.

- The Central Government will provide financial support in the form of viability gap finding not exceeding J20% of project costs.

- The Central Government will bear the cost of master planning and will improve physicial infrastructures like rail, road, airports and telecommunications.

![]()

Question 9.

Write briefly about MSMEs.

Answer:

On October 2, 2006, “Micro, Small and Medium Enterprise Development Act” came into force’ MSMEs sector in India constitutes enterprises with investment in plant and machinery less than 10 crore in manufacturing and less than 5 crore in case of service sector. In India MSMEs play a vital role in the industrial economy of the country. The major advantage of the sector is its employment potential of low capital cost.

Question 10.

The Industrial Investment Bank of India. [A.P. Mar. 16]

Answer:

To provide financial, technical and managerial assistance to sick units, Industrial Reconstruction Corporation of India was set up in 1971. The Government of India converted I the IRCI into Industrial Reconstruction Bank of India (IRBI) on March 20,1985. IRBI was reconstituted into full-fledged new financial institution called Industrial Investment Bank ; of India (TIBI) in March 1997.

The financial assistance sanctioned by IIBI in 2003 – 04 was ₹ 2,412 crore while assistance disbursed was ₹ 2,252 crore. As the IIBI was suffering operating losses and also poor financial position. IIBI is in the process of voluntary winding up.

Very Short Answer Questions

Question 1.

SIDBI. [A.P. Mar. 18]

Answer:

Small Industries Development Bank of India with a view to ensure largest flow of financial and non financial assistance to the small scale and cottage industries. The SIDBI Act was passed by the parliment in 1989 and the bank commenced its operation from April 2nd 1990.

![]()

Question 2.

IDBI.

Answer:

The Industrial Development Bank of India. The IDBI was set up 1st 1964. The IDBI was initially set up as a wholly owned subsidiary of the R.B.I. In February 16, 1976 the IDBI was made an autonomous’ institution and its ownership passed on from the RBI to the Government of India.

Question 3.

State Finance Corporations.

Answer:

The SFC was set up to offer financial assistance to only large and medium sized undertakings. Therefore the need for separate level development banks which could cater to financial needs of small and medium sized industrial concerns was rightly felt. The 1st SFC setup in punjab in 1953. At present there are 18 SFCs in the country.

Question 4.

Disinvestment.

Answer:

The Government of India in July 1991 initiated the disinvestment process in India. The new industrial policy provides that in order to raise resources and encourage wide public participation, apart of the government share, holding in the public sector would be offered to mutual funds financial institutions, general public and employees.

Question 5.

MRTPAct.

Answer:

Monoploy Restrictive Trade Pratices Act. The Act will concentrate more on controlling unfair or restrictive trade practices.

![]()

Question 6.

Special Economic Zones. [A.P. Mar. 17]

Answer:

The Government of India announced Special Economic Zones policy in April 2000. This policy objective is at rapid economic growth supported by quality infrastructure complemented by an attractive fiscal package both at central and state level with minimum possible regulations. This act came into effect from February 2006.

Question 7.

Foreign Direct Investment.

Answer:

Foreign Direct Investment is a major source of non – debt financial resource for the economic development of India. Foreign companies invest in India to take advantage of cheaper wages, special investment privilages like tax exemptions etc.

Question 8.

Industrial Estates.

Answer:

It was established in the year 1955 by small scale industries board for the development of small scale industries. An industrial estate is a group of small scale units constructed on an economic scale in suitable sizes with facilities of water transport, electricity, banks and is provided with special arrangements for technical guidance and common service facilities.

Question 9.

MSMEs.

Answer:

Micro, Small and Medium Enterprises. MSME sector in India constitutes enterprises with investment in plant and machinery less than 10 crore in manufacturing and less than 5 crore in case of service sector. The labour intensity of the MSME sector is much higher than that of the large enterprises.

![]()

Question 10.

ICICI.

Answer:

Industrial Credit and Investment Corporation India.

It was set up in January 1955 and it commenced business in March of the same year. It was second all India development financial institution to be established in the country. It was a private sector development financial institution.

Question 11.

IFCI.

Answer:

Industrial Finance Corporation of India. It was set yp in July 1948, under a special Act. It was set up to provide medium and long term credit to industry to start new industries, expansion of old industries and for modernisation.

Question 12.

Globalization.

Answer:

It is the process of integrating various economies of the world without creating and hindrances the free flow of goods and services, technology, capital even labour or human capital.