Andhra Pradesh BIEAP AP Inter 2nd Year Economics Study Material 3rd Lesson National Income Textbook Questions and Answers.

AP Inter 2nd Year Economics Study Material 3rd Lesson National Income

Essay Questions

Question 1.

Explain the National income trends in India.

Answer:

National income means the total amount of goods and services produced in a country in a year. In order to understand in impact of planning in India, a study of trends in national income necessary. Therefore better if the trend in national income and changes in the structure of national product are analysed over the last 60 years of planning.

a) The increase in the production of real goods and services.

b) The rise in price.

If the increase in National income is due to the first factor. It is an indicator of real growth because it implies that more goods and services became available to the people. If it is due to the second factor, it represent and unreal inflation of National income in terms of money. National income figure is deflated at constant prices, therefore, it becomes comparable but it conceals the population effect. To eliminate the effect of growth of population or percapita income is calculated.

C.S.O. has provided a series of National income data of 1999-2000 prices from 195051 to 2013-14. Although this indicates slightly different growth rates for different periods, this was inevitable because of the coverage and change in procedure.

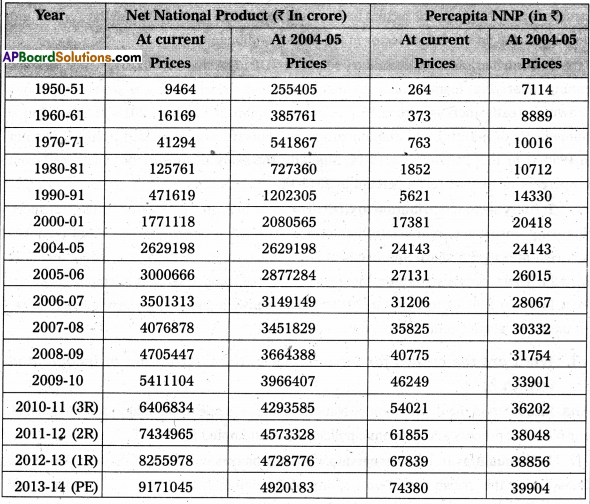

Net National Product at Factor Cost and Per capita NNP

The growth rates of both Net National Product and Per capita NNP at factor cost from 1950-51 to 2013-14 for a period of more than 6 decades. Per capita NNP at current prices in 1950-51 is ₹ 264, which rose to ₹ 5,621 and in the same period the per capita NNP at 2004-05 prices increased from ₹ 7,114 to ₹ 14,330.

Net National Product at current prices increased to ₹ 91,71,045 crore in 2013-14 from ₹ 4,71,619 crore in 1990-91 & at 2004-05 prices it was 49,20,183 crore and ₹ 12,02,305 crore respectively. Per capita NNP at 2004-05 prices rose to ₹ 74,380 in 2013-14 from ₹ 17,381 in 2000-2001.

![]()

Question 2.

Briefly explain the sectoral contribution to the National income.

Answer:

Avery important aspect of the national income of a country is its sectoral composition i.e., the contribution made to it by the different sectors of the economy. The development mainly depends upon sectoral contribution. If the contributional from agricultural sector is high, generally a country is said to be underdeveloped one.

1) Contribution of the primary sector to GDP: The share of the primary sector in the Gross Domestic Product has varied from the maximum of 55.4% in 1950-51 to the minimum of 13.9% in 2013-14. The main cause of the decline is a rapid fall in the share of agriculture alone. There is a decline in the share of forestry to GDP. Transport and trade, banking and insurance and other service sectors have grown faster than agriculture still the agricultural’ sector remains an important sector in the Indian economy.

2) Contribution of the secondary sector to GDP: The share of industry which includes mining, quarrying, manufacturing, construction and electricity, gas & water supply has shown a steady increase from 15 percent in 1950-51 to 26.2 in 2013-14. Two major components of industry and manufacturing and construction increased from 8.9 percent in 1950-51 to 14.9 percent in 2013-14. Similarly, the sharerof construction increased from 4.4 percent in 1950-51 to 7.4 percent in 2013-14.

Tertiary sector contribution to GDP: The share of the tertiary sector (trade, transport, financing, insurance, real-estate, banking, social and personal services and business services) indicated a sharp improvement from 29.6 percent in 1950-51 to about 59.9% in 2013-14. There was a significant increase in share of trade, transport & communications from 11.3% in 1950-51 to 26.4% in 2013-14. This shows a good sign which is essential for an under developed country like India.

Question 3.

What are the causes for inequalities in the distribution of income and wealth ?

Answer:

Inequality in the distribution of National Income is one of the major problems which our planning process and economic policies have attempted to tackle. .

1) Inequalities in land ownership : There was concentration of landed property in India during the British period on account of Zamindari system. Minhas, Dandekar and Rath and Bardhan have clearly stated that all agricultural workers and marginal and small farmers with less than 2 hectare holdings are poor. Big and large farmers not only have capacity to save, they also have an access to institutional finance. Naturally, they are attempting to improve the farm techniques. This causes income inequalities.

2) Inflation : Since the mid -1950’s prices have been rising continuously eroding the real income of the working class, while the industrialists, traders and farmers with large marketable surplus have benefited a great deal from this inflationary process. In India, very little has been done to offset this redistributive effect of inflation and as a result, it has greatly accentuated income inequalities.

3) Inequality in credit facilities : In India, there is inequity in credit facilities which accentuates the inequalities arising from an unequal distribution of wealth. Business firms and individuals having an access to the formal capital markets manage to obtain finance on very favourable terms, while vast mass of small and marginal farmer agricultural labourers and artisans depend heavily on money lenders who charge an exorbitant rate of interest and also exploit these poor people in a number of ways.

4) Urban Bias in Private Investment: While 70 percent of the population in India lives in rural areas, about 70 percent of the private investment goes to industries in urban areas. Therefore, there is a distinct “urban bias” in the pattern of Private investment. This urban bias taken the form of highly mechanized projects in which the share of wages in value added is relatively low. This naturally leads to inequality in income distribution.

5) The Role of the Government: The public investment essentially plays a supportive role to private investment. The Govenment is no longer serious about reducing income inequalities.

![]()

Question 4.

Briefly explain the measures to reduce income inequalities in India.

Answer:

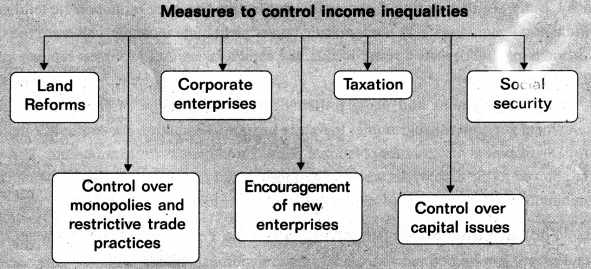

The main objective economic planning is to reduce income inequalities and to maintain social justice. To achieve this the government of India initiated the following measures.

i) Land reforms: Agricultural land was not property distributed among farmers. Thus, legislative measures were undertaken to abolish landlords and their intermediaries and ceiling on holdings were fixed. The implementation of land reforms in West Bengal states causes 18 percent increase in agricultural output and also reduced the income inequalities.

ii) Control over monopolies and restrictive trade practices : The monopolies and restrictive trade practices Act was passed in December 1969, which came into force on June 1st, 1970. The Act provides for the control of monopolies and for the prohibition of monopolistic and restrictive trade practices.

iii) Cooperative enterprises: Another instrument to balance the undue growth of big business in private sector is the decentralised sector in the farm of cooperative enterprises. This sector works for common good rather than for private and personal gain. Profits earned by cooperative sector are shared by very large number of members. This leads to reduce income inequalities.

iv) Encouragement of new enterprises: Special concessions and incentives provided to the new entrants in an industry can restrict the Concentration of economic power. If the government strictly implements the rule not to give licenses to start industries by the already existing farms, it would definitely reduce concentration of economic power.

v) Social security: The government has repeatedly declared that it aimed at “Growth with social justice”. The government undertook so many social security measures such as workmen’s compensations and maturity benefits, fixation of minimum wages, the employees Provident Fund, security for the old and disabled and family pension scheme for industrial workers and workers in mines and plantations.

vi) Taxation : Indian tax system is progressive and has been designed to prevent concentration of wealth in a few hands.

vii) Control over capital issues: Already the new capital issues are under government control. But it seems the control has not been effective checking monopolistic tendencies. In India many industries with monopolistic power yield huge incomes which are the cause for. income inequalities. As a result of this, the capital Issues Act 1956 was replead in May 1992.

viii) Employment and wage policies : The Government of India started many employment generation programmes to reduce income inequalities. For example, Integrated Rural Development Programme, National Rural Employment Programme etc. The wage rates allowed to the employees working in unorganized sector is very low. Implementation of minimum wages act leads to reduce income inequalities.

![]()

Question 5.

What are the causes for poverty in India ? [A.P. Mar. 18, 17]

Answer:

Poverty can be defined as a social phenomenon in which a section of the society is unable to fulfill even its basic necessities of life.

There are two types of poverty.

- Absolute poverty

- Relative poverty

1) Absolute poverty : Absolute poverty of a person means that his income or consumption expenditure is so meager that he lives below the minimum subsistence level.

2) Relative poverty : Relative poverty merely indicates the large inequalities of income. Those who are in the lower income groups receive less than those in the higher income groups.

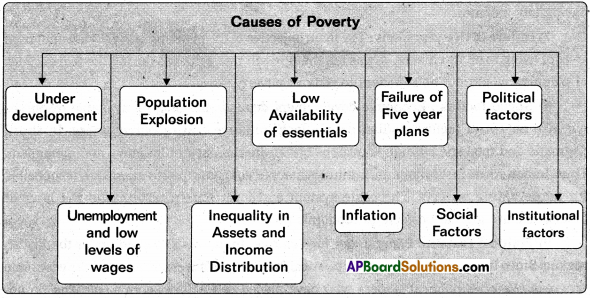

Causes of poverty: Poverty cannot be attributed to any one single set of causes. It is a complex phenomenon and as such is the outcome of interaction of diverse factors, economic and non-economic.

1) Underdevelopment: The root cause of poverty is the underdevelopment of Indian economy. Dandekar and Rath have argued that unviable and unprofitable farms with little capacity for capital accumulation have been responsible for rural poverty in India. Small and scattered holdings, lack of adequate inputs, lack of credit facilities and insecure tenancy system are all responsible for backwardness of Indian agriculture which causes rural poverty. Industrial development has failed to make any dent on poverty.

2) Unemployment and low levels of wages: Poverty is caused by under-employment or unemployment coupled with low rates of wages. This is because supply of labour is more than that of demand for labour. Due to shortage of capital, the industrial sector is not in a position to absorb more number of people. This causes poverty.

3) Population explosion : In India population has increased from 361.09 millions in 1951 to 1210.19 millions in 2011. Due to scarce capital and low level of technology, it is not possible to provide sufficient goods services to the fast growing population. Rapid growth of population is another important cause for the prevailing poverty in the country.

4) Inequality in Assets and Income Distribution : The relative poverty is to be attributed to inequality in the distribution of National Income. Most of the agricultural labourers are in a states of poverty because; they have less than one hectares land to cultivate. Likewise, inequality in the ownership of industrial and commercial capital is one of the reasons of urban poverty in India.

5) Low availability of essentials : Another important cause for poverty in India is the low availability of essential commodities. The country is not able to produce sufficient goods and services as needed by the rapid growing population. The consumer goods shortage is responsible for low level of standard of living. There is a wide disparity in the consumption levels of the top rich and the bottom poor.

6) Inflation : Continuous rise in prices is another cause of poverty. When the prices rise, the purchasing power of money falls and it leads to improverishment of the lower middle and poorer sections of the society. Inflation affects the living standards of the people having low incomes.

7) Failure of five year plans: The main objective of the planning is to provide minimum level of living to all its citizens. It was felt that growth rate achieved during the five decades of planning would not be sufficient to remove poverty.

8) Social factors : Economic development depends not only on available resources but also on social factors. Indian people lack initiative and resourcefulness. In short, dogmatic and fatalistic attitude is responsible for inertia, lack of initiative and dynamism. Thus, Indian social institutions and attitudes hamper economic progress and are responsible for perpetuating poverty. The caste system and joint family system and the laws of inheritance are a great obstacle to economic progress.

9) Political Factors : Being under foreign rule, India was exploited under the British regime. Since Independence, the other political factors have adversely affected the economic progress. We have political leaders who have placed self before service and who do not hesitate to enrich themselves at the cost of the country. The Indian administration is known to be corrupt and inefficient. The legislators would not pass laws which may help the poor. Some times they may hit their interest.

10) Institutional factors : There are certain institutional factors operative in rural areas as well as urban area having a strong bearing on ownership, management and work. Semi-feudalism is an institutional factor responsible for rural poverty. The social and political institutions in rural areas have not allowed the land reforms and technological reforms to make a dent on rural poverty. The government is providing agricultural inputs like electricity seeds fertilizers and credit facilities at subsidized prices to be farmers. But these facilities are not catering the needs of poor farmers having small holdings and also the tenants. The institutional rigidities have not allowed equitable sharing of public goods such as education and health.

![]()

Question 6.

Write about the remedial measures to reduce poverty in India.

Answer:

In recent years, a two-pronged strategy was introduced by the government toward a solution to the problem of poverty in India.

- The expansion of sectors which promise higher level absorption and

- Empowering the poor with education, skill formation and health, so that they can enter sectors which require higher competence and provide better remuneration which enable the poor to cross the poverty line. The problem solving strategies are :

i) Adoption of a strategy of proper growth instead of emphasizing liberalization and GDP growth : Former Prime Minister Atal Bihari Vajpayee in his Independence Day Message (15th August 2001) stated “The fruits of liberalization have not adequately reached the poor and the people living in rural areas, inequalities have increased. “The government has to pay attention to improve the economic conditions of 92 percent work force employed in unorganised sector. Government should give priority to the removal of unemployment in urorganised sector. “Right to work” should be made a basic human right. In this model emphasise should be laid on development of irrigation and watershed development with peoples participation. Agricultural cooperative should be strengthened.

ii) Stimulation Agricultural Growth: The growth rate of agriculture was 2.7% in the 9th plan and only 1.7% in the 10th plan. To overcome this type of slow growth rate, the Government of India appointed a high power commission under the chairmanship of Dr.M.S.Swaminathan which suggested the following 5 point action plan for the fanners.

- To undertake enhancement of soil health programmes.

- To promote water-harvesting, conservation and equitable use by empowering panchayats.

- To reduce the crop loan interest to 4 percent.

- To set up Krishi Vigyan Kendras for training the farmers.

- To reduce the gap between what the rural producer gets and the urban consumer pays should be reduced.

iii) Increasing the productivity and job quality of unorganized sector: The National Democratic Alliance Government appointed special group on targeting 10 million employment opportunities under the chairmanship of S.P. Gupta in 2002 to emphasize the growth of unorganized sector as surest method to reduce unemployment and poverty.

iv) Empowerment of the poor through education and skill formation : The development of a huge educational structure of 378 universities and 18,064 colleges, 152 lakh secondary and higher schools and 10.43 lakhs of primary and upper primary schools helps to enrich the human resources that leads to reduce the poverty.

v) Empowerment through provision of Better health : The strong link between poverty and health needs to be recognized. Long term illness and expensive illness can drive even the non-poor into poverty. National Rural Health Mission (NRHM) and National Urban Health Mission (NUHM) are the two major initiatives to help the poor in the availability of health facilities. There is a need to extend health insurance for workers in the unorganized sector, in order to overcome from poverty trap.

vi) Empowering the poor through provision of housing : House is the basic needs for both rural and urban poor. The country must launch a massive programme to provide housing in the form of Indira Aawas Yojana and basic civic amenities in a period of 20 years.

vii) Empowerment through skill formation for expanding IT sector : The development of Information and Technology sector provides number of employment opportunities which enable to reduce the poverty. This will be possible through the following measures.

a) Governments should provide subsidized higher education and vocational training to the poor.

b) Sanction a large number of merit scholarships for the poor.

c) Government should help the educational institutions both financially and infrastructure-wise to provide education to the poor.

viii) National Rural Employment Guarantee scheme : The National Rural Employment Guarantee Act came into force in 2006 in India. For removal of poverty, we need two sets of measures

a) We must accelerate economic growth by increasing substantially our National income.

b) Our efforts of re-distributing National Income in favour of the poor should be more pronounced. Thus, accelerated economic growth and reduction of inequalities are both indispensable for a successful attack on mass poverty.

![]()

Question 7.

What is the role of Micro Finance in reducing the poverty in India ?

Answer:

Micro Finance institutions in India exist as non-governmental organizations. A section of 25 companies and Non-Banking Financial Companies (NBFC’s) and Commercial banks, Regional Rural banks, Co-operative societies and other large lenders have played an important role in providing refinance facility to Micro Finance Institutions.

“Micro Finance is the provision of Financial services to low income clients or solidarity lending groups including consumers and self-employed, who rationally lack access to banking and related services”. It covers a wide range of services like credit, savings, insurance, remittance and also non-financial services like training and counciling.

Micro Finance and Poverty reduction :

1) As an intervention to allieviate poverty, micro finance is viewed as the practice of extending small loans and other financial services such as savings and insurance to the poor for empowering them to protect themselves from economic setbocks.

2) Poverty can also be understood as vulnerability to downward in income. Such fluctuations may results from unexpected shocks such as crop failure, illness, funeral expenses or loss of assets such as livestock through theft or death. Micro Finance are the promise to reduce such vulnerable and protect livelihoods also reduce poverty.

3) An important dimension of poverty is powerlessness. Powerlessness can be experienced in a variety of situations, within the households, as a result of differences in gender and age and within the community, between socio economic groups, as a result of cost, electricity and wealth. Intervention with micro finance can influence the power relations of the society by fastering salidarity among the vulnerable through its group-based mechanism.

4) In most parts of the country micro finance services are being provided through group based systems that are advantageous of using peer pressure as social collateral.

5) These group-based systems can be broadly classified into two systems. They are Grameen, Group system, pioneered in Bangladesh and Self Help Group (SHG) system, Nurtured in India. Both these systems are widely replicated all over the world.

6) With the globalization and liberalization of the economy, opportunities for the unskilled and illiterate are not increasing fast enough, as compared to the first of the economy. This leeds to a lopsided growth in the economy thus increasing the gap between the rich and poor. It is in this context, the institutions involved in microfinance have a significant role to play to reduce this disparity and poverty.

![]()

Question 8.

Explain the causes for unemployment and remedial measures to reduce unemployment. [A.P. Mar. 16]

Answer:

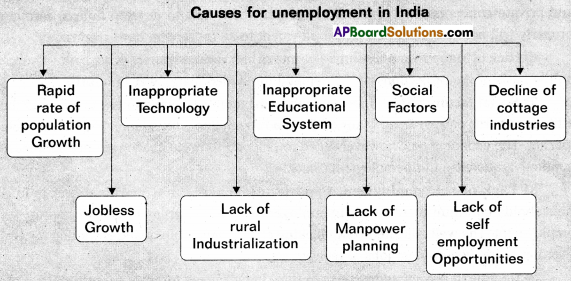

A man is willing to work but he is not getting work. Therefore he is called unemployed. Unemployment is too serious an evil to be ignored. Widespread and growing unemployment is not due to any single factor.

1) Rapid rate of population growth :The most fundamental cause of widespread unemployment in India is the rapid rate of population growth which leads to increase in labour force. The rate of population growth rose to 2.2 percent per annum during the 1960s. As the population increased from 718.2 millions in 1983 to 1227.4 millions in 2011-12, corresponding the labour force also increased from 261.33 millions to 440.4 millions respectively. This is too big a number to be provided gainful employment at the present rate of growth of the economy.

2) Jobless growth : During the first three decades of economic planning, the GDP growth rate was as low as 3.5 percent per annum. In this period, employment increased at a moderate rate of 2 percent per annum. The rate of growth of employment picked up considerably to 2.90 percent per annum during the five year period 1990-00 to 2004-05 but again declined to almost zero present over the next five years i.e., from 2004-05 to 2009-10. Thus, the country could create only one million jobs during 2004-05 to 2009-10.

3) Inappropriate Technology.: In India, while capital is a scarce factor, labour is available in abundant quantity. Under such circumstances, if market forces operate freely and efficiently, the country would have adopted labour – intensive techniques of production.

4) Lack of Rural Industrialization : With regard to large rural unemployment and under employment, the underlying cause is the very heavy pressure of population on land and the backward nature of our farming. As a result, agriculture cannot provide employment opportunities for the far too numerous rural population.

5) Inappropriate Educational system : The educational system in India is defective. According to Gunnar Myrdal, India’s educational policy does not aim at development of human resources. It merely produces clerks and lower cadre executives for the government and private concerns. Any educational system which fails to develop human resources properly will not be able to provide employment to all those who have received it.

6) Lack of Manpower planning: The intake into various courses is not being plannned on the basis of the projections of the demand for skilled manpower in future.

7) Social factors : Since Independence, education among women has changed their attitude towards employment. Many of them now compete with men for jobs in the labour market. The economy has, however failed to respond to these challenges the net result is continuous increase in unemployment backlog.

8) Lack of self-employment opportunities : The rural marginal and landless households continue to remain unemployed (or) underemployed due to lack of self employment. The well educated youth lacking entrepreneurship qualities waiting for years together to get government jobs at meager wages.

9) Decline of cottage industries : In rural India, village (or) cottage industries are the only means of employment particularly of the landless people. They depend directly on various cottage industries for their livelihood. But, now-a-days, these are adversely affected the industrialisation process.

Short Answer Questions

Question 1.

Explain the incidence of unemployment in India.

Answer:

The size of unemployment in any country depends on the level of development. Therefore when a country makes progress and its production expands the employment opportunities grow. In India, during the past six decades production has expanded in all the sectors of the economy. Most of the developing countries face an acute problem of unemployment and underemployment.

The basic reason for this that the rural areas have failed miserably to generate adequate employment opportunities for the rapidly increasing population.

Unemployment as measured by UPs orientation declined from 4.23 percent in 1977-78 to 2.81 percent in 1999-2000, but indicated an increase to 3.06 percent in 2004-05. In 2011-12 unemployment on UPs criterion is estimated to be 2.7 percent.

Unemployment in Current Daily Status (CDS) declined from 8.18 percent in 1977-78 to 6.09 percent in 1987-88, but the declining trend reversed to 8.28 percent in 2004-05, in 2011-12, rate of unemployment on CDS basis is estimated to be 5.6 percent.

![]()

Question 2.

What are the different concepts of poverty ? [A.P. Mar. 16]

Answer:

Poverty can be defined as a social phenomenon in which a section of the society is unable to fulfill even its basic necessities of life.

When a substantial segment of a society is deprived of minimum level of living and countries at a base subsistence level, that society is said to be played with mass poverty.

Concepts of poverty:

1) Absolute poverty : The population whose level of income or expenditure is below the figure considered to be the absolute poverty or a person whose income or consumption expenditure is so meagre that he lives belows the minimum subsistance level is called absolute poverty.

2) Relative poverty : According to the relative standard, income distribution of the population in different fractile groups is estimated and a comparison of the levels of living of the top 5 to 10 percent with the bottom 5 to 10 percent of the population is called relative poverty, or those who are in the lower income groups receive less than those in the higher income groups.

3) Poverty line : According to the planning commission a person who is not having monthly percapita total expenditure of ? 49.9 in rural area and ? 56.64 in urban area at 1973-74 prices is called as a person living below the poverty line.

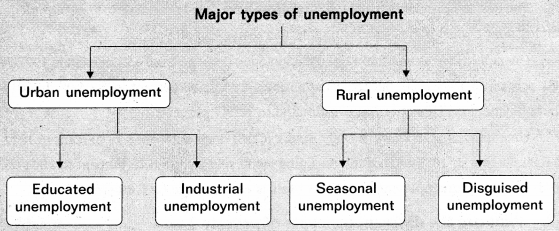

Question 3.

What are the different types of unemployment ? [A.P. Mar. 17]

Answer:

Types of unemployment: Unemployment is broadly defined into two types.

A) Unemployment in Urban areas and

B) Unemployment in Rural areas.

A) Unemployment in Urban areas :

i) Educated unemployment: The large number of educated unemployed shows, “a measurement between the kind of job opportunities that are needed and that are available in the job market”. The defective educational system, with its theoretical base, lack of aptitude and technical qualifications for various types of working among job-seekers and Maladjustments between demand on supply of education workers are some well-known causes of educated unemployment.

ii) Industrial unemployment: In India, the manufacturing sector has indeed expanded and employment in it has steadily increased. One of the reasons for this is the low employment elasticity in the manufacturing sector. As a result, industrial unemployment increased.

B) Unemployment in Rural areas :

i) Seasonal unemployment: If in agriculture is a normal phenomenon in India. In India farmers cultivating approximately 75 percent of their land remain involuntarily unemployed for 3 to 4 months in a year and most of them fail to find some temporary employment in this period. The main reason for its unemployment is lack of irrigation facilities.

ii) Disguised unemployment: Indian agriculture is characterized by the existence of considerable amount of surplus labour. In technological language, it is said that marginal productivity of such labour is zero. The kind of disguised unemployment is also comes underemployment.

Other types of unemployment:

1) Cyclical Unemployment: If unemployment occurs as a result of trade cycles, if it

is called cyclical unemployment. Trade cycles refers to the frequent booms and depression, up swings and low swings. Keynes said that cyclical unemployment is the result of the deficiency in efficient demand. Therefore, if effective demand increased, the level of employment can also be increased.

2) Structural Unemployment: It is one of the main type of unemployment within an economic system. If focuses on the structural unemployment within an economy and inefficiencies in labour markets. Structural unemployment occurs when a labour market is not able to provide jobs for everyone who is seeking unemployment.

3) Under employment: Labour that falls under the underdevelopment classification includes those workers that are highly skilled but working in low paying jobs.

4) Frictional Unemployment: It is another type of unemployment within an economy. It is the time period between jobs when a worker is searching for or transistioning from one job to another. Frictional unemployment is always present to some degree in an economy. It occurs when there is a mismatch between the workers and jobs.

![]()

Question 4.

Write briefly about employment Guarantee Act.

Answer:

Mahatma Gandhi National Rural Employment Guarantee scheme) This scheme was launched from 2nd October 2009, MGNREGS seeks to provide at least 100 days of guaranteed wage employment in a financial year to at least one number of every rural household whose adult members volunteer to do unskilled manual work. At least 33% of the beneficiaries are to be women under MGNREGS wage disbursement through bank and post office is mandatory. This is to help in ‘financial inclusion” of the poor. It provides a wage rate of ₹ 100/- per day to a worker. The focus of MGNREGS is an workers relating to water conservation, drought proofing, land development, flood control and rural connectivity etc. Panchayats have a key role in planning, implementation and monitoring of MGNREGS. This Act is useful for decentralization and deepening gross root democratic structure.

Question 5.

Explain briefly about Deen Dayal Upadhyaya Grameena Kaushal Yojana. [A.P. Mar. 18]

Answer:

Deen Dayal Upadhaya Grameen Kaushal Yojana was launched on 25th September 2014 in view of 98th birth anniversary of Pandit Deenadayal Upadhyaya. Earlier the Yojana was known as Aajeevika Skills Development Programme (ASDP).

The Rational launching the yojana : The Yojana was launched in light of solving huge problem of unemployment among the rual youth despite the fact that they have merits. In order to correct this match, Union Government decided to launch skill development programme scheme.

Status of skilled workers In India : In India as against 12 million people entering the work force every year during the last 10 years only 1 million youth were trained. Further out of 12 million people, only 10 percent were skilled ones, while the percentage in European Unions is 75 percent and in China 50 percent.

Main features of DDUGKY : The main features of the Deena Dayal Upadhyaya Kaushal Yojana are :

- The Yojana aims to give training 10 lakh rural youth for jobs in three years, that is by 2017.

- The minimum age for entry under the Yojana is 15 years compared to 18 years under the Aajeevika skills programme.

- Skill Development training centre’s to be launched. So as to address the unemployment problem in rural area.

- The skills imparted under the Yojana will now be bench marked against international standards and will compliment the Prime Minister make in India compaign.

This scheme was launched to enhance the employability of rural youth which is the key to unlocking India’s demographic dividend. A sum of ₹ 1500 crores was allotted for this scheme in the 2015-16 budget.

![]()

Question 6.

Micro finance .

Answer:

Micro finance is the provision of Financial services to low income clients or solidarity lending groups including consumers and self employed, who rationally lack access to banking and related services”. It covers a wide range of services like credit, savings, insurance, remittance and also non-financial services like training and counseling.

Features of Micro Finance:

- Borrowers are from the low income groups.

- Loans are of small amount (Micro loans).

- Short duration loans.

- Loans are offered without collateral securities.

- High frequency of re-payments.

- Loans are generally taken for income generation purpose.

Need for Micro finance : Micro finance plays a major contributor to provide credit facilities. In the past few decades it has helped out remarkably in eradicating poverty. Reports show that people who have taken Microfinance have been able to increase their income and thereby their standard of living.

Micro finance institutions serve as a supplement to banks and in some sense better one too. These institutions not only offer micro credit but they also provide other financial services like savings, insurance, remittancé and non-financial services like individual counseling, training and support to start own business. But all this comes at a cost and the interest rates charged by these institutions higher than commercial banks and vary widely from 10 to 30 percent.

Question 7.

MGNREGS

Answer:

Mahatma Gandhi National Rural Employment Guarantee scheme) This scheme was launched from 2nd October 2009, MGNREGS seeks to provide at least 100 days of guaranteed wage employment in a financial year to at least one number of every rural household whose adult members voluntar to do unskilled manual work. At least 33% of the beneficiaries are to be women under MGNREGS wage disbursement through bank and post office is mandatory. This is to help in ‘financial inclusion” of the poor. It provides a wage rate of ₹ 100/- per day to a worker. The focus of MGNREGS is an workers relating to water conservation, drought proofing, land development, flood control and rural connectivity etc. Panchayats have a key role in planning, implementation and monitoring of MGNREGS. This Act is useful for decentralization and deepening gross root democratic structure.

Very Short Answer Questions

Question 1.

National Rural Employment Guarantee Scheme

Answer:

The National Rural Employment Guarantee Act came into force in 2006. It helps to reduce the poverty.

![]()

Question 2.

Relative poverty

Answer:

The people with lower income are relatively poor compared with higher incomes, eventhough they may be living above the minimum level of subsistance is called relative poverty.

Question 3.

Absolute poverty [A.P. Mar. 18]

Answer:

A person whose income or consumption expenditure is so mearge that he lies below the subsistance level they can called absolute poverty.

Question 4.

TRYSEM [A.P. Mar 16]

Answer:

This was initiated in 1979 with the objective of tackling unemployment problem among the rural youth. It aimed at training about 2 lakh rural youth every year to enable to become self employed. The TRYSEM was merged into Swamajayanthi Gram Swarozgar Yojana in April 1999.

Question 5.

Disguised unemployment

Answer:

A person whose marginal productivity is zero or when more people are engaged in a job than actually required.

Question 6.

Poverty Gap Index

Answer:

The poverty gap index is defined by the mean distance below the poverty line expressed as a proportion of that line. The poverty gap index is insensitive to the extent of inequality among the poor. If income is transferred from a person to someone who is poor, the poverty gap index will not change.

Question 7.

Usual status concept of unemployment.

Answer:

This concept is used to measure chronic or long-term unemployment. It measures the activity status i.e., a person who remains unemployed for most of the time in the year. Thus, it appropriately measures open unemployment.

![]()

Question 8.

Micro Finance [A.P. Mar. 17]

Answer:

The provision of thrift, credit and other financial services and products of very small quantity to the poor in rural, semi-urban and urban areas for enabling them to raise their incomes and improving living standards.

Question 9.

Percapita income

Answer:

It is estimated dividing National income by population of the country as per the formula given below.

Percapita income = \(\frac{\text { National income }}{\text { Population }}\)